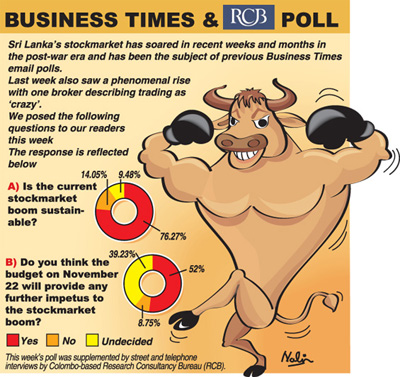

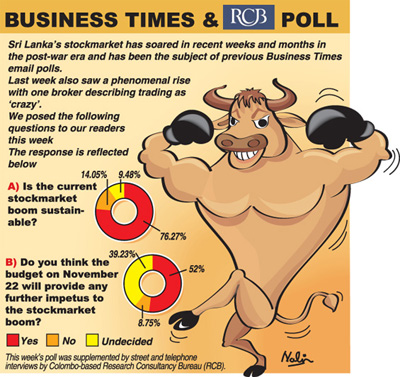

More than 75% of respondents in a Business Times (BT) poll this week said the current boom in the Colombo stockmarket is sustainable.

Responding to an email poll that was enhanced by man-on-the-street interviews and telephone interviews by Colombo-based Research Consultancy Bureau (RCB), a market and social research agency, many respondents said ‘Y (Yes)’ to the question: Is the current stockmarket boom sustainable?

The poll which drew over 600 respondents found 75.27% saying Y, 14.05% saying N (No) and 9.48% responding with U (Undecided). The second question in the poll – “Will the budget on November 22 provide any further impetus to the stockmarket boom?” – saw a more balanced response with 52% saying Y but a large percentage (39.23%) were U (Undecided). Only 8.75% responded with a N.

Interestingly in the email poll by the BT, which tapped a large percentage of CEOs and business professionals, quite a few said the market boom was not sustainable, a view that was however completely outweighed by the man-on-the street where the majority said the market will continue to ‘zoom’ at current levels. Interestingly in the email poll by the BT, which tapped a large percentage of CEOs and business professionals, quite a few said the market boom was not sustainable, a view that was however completely outweighed by the man-on-the street where the majority said the market will continue to ‘zoom’ at current levels.

Brokers polled, also quickly and firmly said the market will continue to soar.

“While professionals are able to analyse and provide a more rational and structured response, the man-on-the street provides a gut-reaction and possibly because they may be new investors seeking to make a fast buck. In the case of the brokers, most of them also want to see the market zoom for their own commercial reasons,” a veteran management professional said, analysing the poll.

The Colombo market index (ASPI) has grown by 100 % in the past year while some big-time stocks have soared by a phenomenal 600% in the last 12 months prompting many average, middle class workers to consider investing in the market – moving their little savings from banks.

Some street respondents said they believed there could be a ‘government’ hand in the booming stockmarket but were unable to provide any evidence of this. However the fact that major state and state-connected institutions like EPF, ETF, Bank of Ceylon and National Savings Bank are investing heavily in the market could also be interpreted as the state being partly responsible for the boom. Parliament was this week informed that the EPF has invested nearly Rs 30 billion (of depositors’ money) in 76 companies in the stockmarket.

This is the first time the BT poll sought man-on-the street and telephone interviews which came about after RCB joined the paper in expanding the poll which is how future BT polls would look like.

As far as the second question of the poll – relating to whether the budget will contain any stockmarket-friendly sops – is concerned, quite a few ‘street’ respondents were not sure what the budget would contain in the first place. “This response also provides some indication that budgets are no more interesting to the average person apart from the corporate world where everyone keenly awaits policies, directions and tax breaks,” the management professional said.

Among other comments received in the poll were:

On the stockmarket boom

- The market is steaming way ahead of the real economy. Most stocks are being valued at irrational levels, with expectation of future earnings taken to unprecedented levels. “Irrational Exuberance” is how I would describe it, a term used by Mr Alan Greenspan to describe the US Stock Market when it was shooting ahead of itself.

Unfortunately, the retail investor is being sucked into this mire, by questionable advice of market participants direct and indirect, who need them to sustain the growth of the market. These participants are likely to get burned and will lose confidence in the market, similar to what took place in 1994. The regulators need to take some corrective measures in order to cool this unbridled exuberance driving the market.

- It may not boom but grow but could fluctuate.

- The boom will be sustained at least for the next 12 months.

- Unsustainable as the movement in our stock market has never really been based on any logical analysis.

- The government wants to use the stockmarket as a showpiece to foreign investors.

On the budget vis-à-vis the stockmarket

- The budget if it runs a massive deficit which is then funded by borrowing from the local banks will provide the extra money which will flow to the stock market

- The budget will spell out a need to have a sound regulated framework and need to facilitate FDIs without focusing on short term gains from the stock market.

- Selected sectors are expected to benefit from a revision in taxation policy, though in general no drastic changes are envisaged.

- Government policies are seriously flawed as the planners/politicians believe in big government (state structures). There is no effort to restore productivity and competitiveness, nor improve governance, rule of law, independence and efficiency of the public service and the judiciary and the international reputation of the country.

No surprise in markets going crazy

The current run of the stock market is completely unsustainable. The Sri Lankan market has always been expensive by global standards, but was accommodated due to the oligopolistic business models of most of the large firms. However, since late 2008 the market has gone a bit akin to the technology bubble in the US during the late nineties. The budget is not going to have any bearing on the market, unless the government introduces some form of capital gains tax. But that will distort the supply of capital to the overall market and is not the best policy in the medium term.

The easiest solution to temper the market is to introduce a capital gains tax for holding periods of less than one year. Second, the government should introduce tax advantages available to stock investors to other investments, notably corporate bonds and credit markets. Don’t forget, the current misallocation of capital is hurting budding and deserving entrepreneurs and the SME sector. The odds are currently stacked against all other investments bar stocks. Why should anyone be surprised if the markets gone crazy?

Kajanga B. Kulatunga,

Investment

Specialist, Australia

Boom not based on logic

The stock market in Sri Lanka has not generally been driven by any logical criteria. Retail investors drive the market through their own expectations of the increases/decreases in price rather than actual changes in fundamentals. This could also be a consequence of a rumour in the market as may relate to a stock or the company which directly affects pricing. Although the market is currently booming, while there is talk of an improved economy, I don’t think there has been any obvious indication of increased investment by local corporates, or of any confirmation of major FDI. There was a point raised some months ago that many Foreign Funds identify stocks on the basis of liquidity. While this is not to say that popular stocks do not have a high marketability, again a question is raised on what drives our markets. All in all it does not seem to be based on any logical analysis.

Professional business

consultant

PE too high to sustain market

The current stockmarket boom is unsustainable as the average PE (price to earnings) ratio (both current and forward) of the market is not sustainable at all.

It’s crazy for someone to buy a stock that offers a PE of over 30 times with very low EPS. As far as the budget is concerned, I believe corporate taxes may be reduced progressively over the next few years to encourage more investment. Harmonization of taxes and duties too is likely.

Kishu Gomes,

Managing Director/CEO, Caltex

Punters should not spoil the party

A country’s wealth can be increased by producing more and more efficiently; finding profitable export markets; and better management of resources.

Ideally, the stock markets should be a reflection of the economic performance of a country, may be factoring in a realistic margin for future optimism. The danger in any economy is when the link between the economic performance and the stock markets gets blurred. That is what we need to watch and ensure that the ‘punters’ are not spoiling the party!

Hilmy Cader,

Chief Executive, MTI Consulting

Focus on untapped resources and missed opportunities

There is a need for the stockmarket to focus on these areas for further improvements:

- A platform to raise funds for companies and government corporations to grow as opposed to investors making capital gains by buying and selling of company stocks.

- Developing a bond market as a part of the capital market serving platform to collect funds.

- Feasibility of arranging futures and commodity trading markets.

- Encourage more institutional players and emerging regional funds to operate.

The Urban Development Authority successfully issued a long term bond and was able to raise Rs 10 billion towards real estate development without even being a quoted institution in the Colombo Stock Exchange (CSE).

This is a step in the right direction and the next phase would be to invite foreign and local investors to form consortiums to bring funds by way of issuing, say, 50-year bonds for property development in areas such as shopping complexes, city railways/hotels etc. Not only the real estate sector, even the agricultural and plantation sector would be benefited if they are allowed to raise long term bonds to develop their untapped resources thus transforming them into truly agro business ventures.

I believe that creating an enabling environment under Private –Public Partnership to flow more FDIs (Foreign Direct Investments) is more beneficial for the private sector and the government institutions to harness the true potential and to grow. This is on the basis that Sri Lanka has more untapped resources to harness outside the normal business domain of the quoted companies operating in the CSE.

Jayampathy Molligoda,

Senior Chartered

Accountant

BT poll gets expert assistance

The Business Times (BT) has teamed up with Research Consultancy Bureau (RCB), a market and social research agency, in expanding its popular email polls to reach a wider audience through man-on-the- street views and telephone interviews.

In its inaugural effort, the BT-RCB Poll sought a “Yes”, “No” or “Undecided” answer to two questions: “Is the current stock market boom sustainable?” and “Do you think the budget on November 22 will provide any further impetus to the stockmarket boom?".The poll combines BT’s historically proven channel of email responses elicited from its confidential database of professionals with the added credibility of RCB’s random sampling methodology comprising street intercepts and telephone interviews.

Now meshing the comments of a range of private and public sector business leaders, decision makers and even employees in areas as diverse as finance and banking, IT, services, telecommunications, garment and textiles, electronics, etc. along with the points of view of people on the roads; these complementary data collection methods have allowed the BT-RCB Poll to better tap public opinion, improved with a much higher number of poll respondents.

|

Interestingly in the email poll by the BT, which tapped a large percentage of CEOs and business professionals, quite a few said the market boom was not sustainable, a view that was however completely outweighed by the man-on-the street where the majority said the market will continue to ‘zoom’ at current levels.

Interestingly in the email poll by the BT, which tapped a large percentage of CEOs and business professionals, quite a few said the market boom was not sustainable, a view that was however completely outweighed by the man-on-the street where the majority said the market will continue to ‘zoom’ at current levels.