Life gets that much harder for NRFC holders

View(s): In the movie “It’s a wonderful life”, George Bailey is a fictional businessman who shifts from despair to intense motivation.

In the movie “It’s a wonderful life”, George Bailey is a fictional businessman who shifts from despair to intense motivation.

Undoubtedly holders of foreign currency accounts locally can relate to the mood swings. Counterfactuals helped George Bailey in the movie. NRFC depositors may also benefit from such counterfactuals about the actions of global central bankers. Foreign exchange markets are the most notorious asset class to forecast due to its “supposedly” zero-sum outcome.

They can remain dislocated and out of long term fair value for extended periods of time. The Australian dollar is a good example of a currency that has remained overvalued by most measures for a few years running.

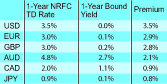

With central bankers around the world promising to keep the reins on monetary supply light, the question for a bulk of non-residents become the relative value of various currencies at this point in the cycle. The premium or discount on offer in 1-year term deposits by the local banks is a good indicator of local demand and supply factors for foreign currencies. They paint a telling picture on various counts and investors should read themwith some trepidation.

Source: 1-year NRFC TD Rates - Online survey of the 6 largest NRFC providers in the country.1-Year Bond Yield - Factset. All figures as of 24 October 2012.

While the Australian Dollar may provide the highest absolute yield, the premium on offer is behind most other major currencies. This disparity arises due to the trade demand for those other currencies and more importantly structurally driven due to a US dollar liquidity shortage as a result of the ongoing European banking crisis.

This is great news for migrants toiling away in West Asia, whose domestic currencies are pegged to the USD. However, those seeking higher yields and wanting to dash towards the AUD may be disappointed before long. They should also be cautious about reading too much into the latest round of “quantitative easing”" announced by the US Federal Reserve as a sign of debasing the USD. Money printing does not mean a weaker USD The casual assumption in financial markets has tended to be that because the US has undertaken a further quantitative policy program, the dollar must weaken. The logic of this is that if the money supply of the US is increasing, the amount of money supplied to the financial markets must increase, and therefore the dollar should decline against other currencies. The problem with such logic is that it is neither borne out by the evidence, nor by the theory. Money supply has no impact on currency values, ever. Surplus money supply may have an impact on currency values, but that is a different concept altogether.

Obviously I cannot deny that from time to time there will be some kind of relationship between money supply and a currency’s value. Money supply may produce surplus money if the change in monetary policy is not being motivated by a change in liquidity preference.

However, a Pavlovian reaction to the effect that quantitative policy will drive the value of a currency down is wrong. Any analysis of currency moves in the wake of quantitative measures should pay as much attention to the likely path of money demand as of money supply, if it is to have any chance of penetrating the mysteries of foreign exchange forecasting.

Incredibly falling Australian cash rate

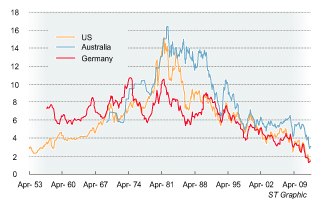

Meanwhile, the Reserve Bank of Australia (RBA) has been trying to play a catch up in the race to the bottom of the interest rate barrel. There has already been 1.25% worth of cuts over the last 12 months and bond markets are pricing in three more over the next 12. While two may be plausible, the overall weakness in the Australian economy portends a sudden fall in the AUD. This has traditionally been a feature of all commodity linked currencies. NRFC depositors should not only expect a marked drop in the yield on their one year deposits, but also face up to the possibility of sharp drop in the value of the AUD.

Source: Datastream, Last Observation as at 30 September 2012. Graph 1: Global Bond Yields are at historic lows. Returns for NRFC depositors will be poor for a while yet.

For those who are not comfortable with moving AUD positions to USD, an unlikely risk diversifier may well be another commodity linked currency: the Canadian dollar. The AUD/CAD pair is trading near historical highs and well above Purchasing Power Parity.Although both are “commodity currencies”, their factor exposure is different. Australia’s external sector is heavily reliant on steel production in China, whereas Canada’s outbound trade is more influenced by global growth (energy) and US economic activity. Canada appears to be in the early phase of a tightening cycle, whereas Australia appears someway through moderating policy. Both currencies are correlated to equities, though the AUD has a tighter correlation than the CAD. Thus, the protection offered under a risk-off environment will be lesser for the AUD/CAD than the AUD/USD.

Invest in global companies if you want to grow wealth

None of the currencies look appealing from a yield perspective. This will remain the case for some time yet. The Sri Lankan Rupee may look attractive in this backdrop. Unfortunately, the headwinds are severe and significant inflation shocks via global soft commodity markets may come through next year. Sri Lankan Rupee positions should only be considered if investors are drawing down portfolios for consumption in Sri Lanka.

For longer term savers, prospective returns unfortunately look, well, hideous. This is thanks to the government and various agencies still trapped in a time warp hoping to export (manufactured goods in particular) our away out of trouble. In this bizarre narrative, savers have and will continue to offer subsidies to large capitalist in order to facilitate government hand-outs and transfer payments.

While there are no guarantees in life, on a balance of probability, the best overweight positions on a risk adjusted basis for total return to a NRFC depositor may lie in being overweight US dollars, British Pounds and Canadian dollars. Holding currencies is not a path to grow real wealth. The only way to grow real wealth, with plenty of volatility over the next five years is by owning high quality companies around the world.

(Kajanga is a Portfolio Specialist currently working in Sydney, Australia. You can write to him at kajangak@gmail.com).

Follow @timesonlinelk

comments powered by Disqus