Lankan public enterprises need an urgent solution

The number of State-Owned Enterprises (SOES) in Sri Lanka, rose from 28 in 1958 to 107 by 1977. Despite the economic liberalisation in 1977, the share of public sector in the economy remained high in the 1980s. In the mid 1980s there were over 280 public enterprises out of which 165 were identified as commercial, industrial and financial enterprises. By this time (mid 1980s) public enterprises were facing many problems such as -

- Operational inefficiency resulting in poor financial performance

- Poor product quality and supply shortages;

- Inability to mobilise resources to meet large investments to expand capacity and improve quality;

- Labour unrest; and

- Excessive dependence on transfers or credit guarantees from the government causing a heavy burden on the budget.

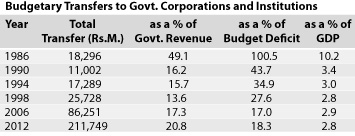

The following regional comparison may also be useful to understand the gravity of the excessive public sector involvement in the economy of Sri Lanka: (See table above)

The above statistics show that the public sector in Sri Lanka has been relatively larger than in the neighbouring countries in the Asian region except Malaysia. It may be useful for Sri Lankan policy makers to understand how and why Malaysia was able to become a “Tiger” in economic development even with such a large public sector and Pakistan and Sri Lanka failed. Many countries increased attention to the privatisation of public enterprises in the 1980′s after the progress made by the UK in this area. In Sri Lanka privatisation was announced as state policy in 1987 with a view to reducing the burden on the budget and to improve their efficiency and profitability.

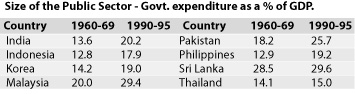

The gravity of the fiscal problem faced by Sri Lanka as a result of SOES can be seen from the following statistics – (See table above)

By end 2002, 84 public enterprises were privatised (including 20 plantation companies) and the total proceeds collected amounted to Rs. 61,214 million. A further amount of Rs. 13,680 million has been collected from 2003 to 2005.

Failure in Reforms

In 2004, the UPFA Government appointed a Board of Management to improve the State Owned Enterprises (SOEs) under a “Strategic Enterprises Management Agency” (SEMA). The following enterprises came within the purview of SEMA – Bank of Ceylon, People’s Bank, National Savings Bank, State Mortgage and Investment Bank, Ceylon Electricity Board, Ceylon Petroleum Corporation, Sri Lanka Ports Authority, Airport and Aviation Authority, Ceylon Government Railways, Ceylon Transport Board and Regional Cluster Bus Companies, National Water Supply and Drainage Board and State Pharmaceutical Corporation.

In a statement issued then by the Chairman and CEO, Mano Tittawella the objective of the government was to improve the efficiency, effectiveness and the financial viability of these strategic enterprises in a manner that will ensure greater benefits to the general public.

In a statement issued then by the Chairman and CEO, Mano Tittawella the objective of the government was to improve the efficiency, effectiveness and the financial viability of these strategic enterprises in a manner that will ensure greater benefits to the general public.

However, this concept was criticised by many due to its inability to tackle the real problem.

The failure of SEMA can be proved by the steps taken by the next President, Mahinda Rajapakse, in 2006. On 15.02.2006 he addressed a top level forum of public servants organised by the Ministry of Skill Development and Public Enterprise Reforms on the theme “Public Enterprises: Performance, governance and best practices – Strategies for success, where he said that he “got a mandate from the people to improve the effectiveness of state enterprises and this would be done not through privatisation but improved management and restructuring”. He said that all SOEs are required to enter into performance contracts with the Treasury for greater success. He said that people’s perceptions on State Owned Enterprises are far from positive and this must change.

Best and worst SOE’s

He said that “we have over 300 SOEs and the government will launch a programme to monitor their progress and end of the year we will announce the best SOE, best Chairman and Board of Directors to encourage best practices and success. At the same time we will also expose the worst SOE, Chairman and Board of Directors. Some SOEs are overstaffed as some of them are used to produce jobs. In other countries if the Chairman hires more staff than what is statutorily required, the Chairman has to make a payment per additional employee.”

At this Forum it was revealed that the public perceptions on SOEs include “inefficient, waste public funds, follow corrupt practices, insensitive to public needs, burden on the tax payers, do not effectively contribute to national development, politicised, unionised and bureaucratic, lack commercial sense and poorly managed with lack of effective leadership and good governance.”

Have the relevant authorities succeeded since 2006 in their strategies in relation to reforming SOEs?

SEMA was not a success. We have not seen any concerted effort taken by the relevant authorities to convert these so-called “monsters” (This is how one Senior Minister called these SOEs) into economically viable business entities. Further, we have not heard of any best “SOE and Chairman” or “the worst SOE and Chairman”!

Further, we have not heard of any inquiry into excess staff or penalising any chairman on account of “excess staff”. In short, during the last six years we have not seen any formidable steps taken to clear the above mentioned bad public perceptions on SOEs.

New “hero” to tame the “monsters”

D.E.W. Gunasekera, Chairman of the Parliamentary Committee on Public Enterprises (COPE) who is an ardent/moderate communist, has now taken over the job of inquiring into various irregularities and in efficiencies of public enterprises. According to the “Budget-2013″ speech (page 58) made by the Minister of Finance, he has stated as follows -

“…….. following the report submitted by the Committee on Public Enterprises (COPE) chaired by Hon. DEW Gunasekera, I have advised the Ministry of Finance and Planning to pay close attention to the implementation of those recommendations. Although there are 270 such entities that come under the purview of COPE, only 70 of them are large scale entities operating in banking, insurance, ports, airports, aviation, petroleum, electricity, water supply, transportation, trade and marketing.”

So, the above speech confirms that, the real “monsters” in the public enterprises sector are still operating without any fear of punishment or any other stigma, pleasing their political masters. Recently, there were media reports highlighting severe critcisms made by MPs in parliament on the ineffectiveness of remedying irregularities reported by the COPE by the relevant authorities including the Bribery Commission.

Fiscal problems

Historically, these SOEs created problems to the annual budgets of respective governments, as already explained. According to the above “Budget – 2013″ speech, still there are about 70 large SOEs operating in Sri Lanka. Some enterprises create no budgetary problems but there are other social and economic problems created by them.

Ceylon Electricity Board (CEB)

During the period 2006 to 2010, the operational losses of the CEB were a massive Rs. 109,855 million. The reason given by the authorities was the higher cost of production and distribution. Are these costs genuine? How about the inefficiencies and corruption involved? The authorities do not take appropriate action due to pressure from politically motivated employees. Electricity tariff was increased by 8 per cent in 2011. Even after that in 2011 CEB and CPC combined losses were around Rs. 119.5 billion. CEB system losses have been increased from 13.5% in 2010 to 14.2% in 2011, despite the efforts taken by the authorities. This happens due to faults in distribution system and unauthorised electricity connections.

Ceylon Petroleum Corporation (CPC)

During the period 2006 to 2010, the net operational losses were Rs. 12,052 million, in addition to the losses incurred in 2011, as mentioned above. The reason may be high cost of the local refinery which is now outdated. The authorities failed to effect necessary modernisation in time and now the country reap the bad harvest of such inefficiencies.

Sri Lanka Transport Board (SLTB)

During the period, 2006 to 2012, the SLTB has incurred losses amounting to Rs. 21,766 million. The SLTB has around 7900 buses but operates only around 4400. However, the number of employees was more than 35000. It will be a real “wonder of Asia” if it can be operated profitably.

SLTB has never been able to compete with the private sector and as a result the public is suffering at the hands of private bus operators. However, their efficiency is better. Out of around 20,000 buses they own about 16000 buses are in operation.

Sri Lanka Railways (SLR)

During the period 2006 to 2012, the SLR has incurred losses amounting to Rs. 28,633 million. Although, fares were increased several times, due to inadequate capital infusion and inefficient management it was impossible to improve the situation. Other countries which manage better railway systems have not shown any interest to manage SLR due to lack of resources and labour problems.

In addition to above mentioned “monsters” Sri Lanka Postal Department, National Water Supply and Drainage Board, Sri Lankan Air Lines and Mihin Lanka, etc consume and waste scarce national resources and exert pressure on the national budget every year.

Profit making SOES

Although there was no pressure on the national budget, the monopolistic operations prevent economic benefits to the society. For example until recently, the Sri Lanka Ports Authority (SLPA) was enjoying a monopoly and when the private sector competitor SAGT came, the inefficiencies of the SLPA were revealed. For example output of SAGT with only about 600 employees was much higher than the output of SLPA which has about 14,000 employees.

In the area of state banks, commercial banks dominate the banking sector. Due to inefficiencies of a large number of employees, the operational costs are much higher in state banks when compared with private banks. Due to this, state banks charge a higher interest and other charges and create a benchmark thereby denying cheaper credit to the general public. Further, these banks act as the prime lenders to the government which exhaust all available funds.

Fiscal favours to SOEs

It is very strange that the government has offered various tax exemptions to certain SOEs, thereby violating the principle of equity. Further, the relevant institutions may not act in a fiscally prudent manner when they are not within the purview of tax authorities.

- Sri Lankan AirLines and Mihin Lanka have been given 10 year income tax exemption w.e.f. 01.04.2011. Further they have been exempted from the NBT as well.

- Ceylon Electricity Board, Petroleum Corporation, Sri Lanka Ports Authority and National Water Supply and Drainage Board have been given 05 years income tax exemption w.e.f. 01.04.2011.

- Sri Lanka Savings Bank Ltd and Lanka Puthra Development Bank Ltd have been given open ended income tax exemption.

The most in-equitable and unfair exemptions have been given to the co-op sector -

- Registered Co-op Societies are exempt from income tax indefinitely. Further, they are exempt from VAT including Financial VAT and NBT also.

- Lak Sathosa also enjoys income tax, VAT and NBT exemptions.

It may be interesting to find out why these institutions need not pay any tax on liquor and tobacco which are taxed heavily now!

World Trends

It is true that many countries in the world depend on SOEs to manage certain sectors of the economy, specially due to security reasons.

China – Historically, both local and central govt. engaged in almost all economic activities. Now many such organisations were replaced by listed companies. As of 2011, around 35 per cent of business activities and 43 per cent of profits were derived from SOES. All such organisations are managed by “State Owned Assets Supervision and Adm. Commission.”

India – As of 2012, there were 261 public sector undertakings. Almost all major economic activities are included. Air India, Air ports Authority, Bank of India, State Bank of India (the largest bank), Indian Oil Corporation, Natural Gas Corp. Coal India Ltd, Steel Authority of India are some of them.

Singapore – It is interesting to note that around 60 per cent of country’s GDP is produced by state-linked corporations. Singapore Air Lines, Sing Tel, ST Engineering and Media Corp are some of them. Singapore has the best managed SOEs which are owned by the state-controlled agency “Temasek Holdings.” The lesson is that if there is good governance SOEs will also be good.

USA – Even the US which is a prominent free market country has a few federal govt. organisations such as Postal service, Railway and some banks and other enterprises. Many state governments are also operate business under takings.

Japan – Japan Post (to be privatised) Japan Railway, Nippon Telegraph and Telephone, and Japan Tobacco were formerly owned by the state. This is the country having zero SOEs.

UK – BBC, Channel 4 and Royal Mail (to be privatised) and few banks are operating under state supervision.

Russia – Russian Railways, Aeroflot – Russian Airlines and Channel One Russia. After disintegration the situation has been changed drastically.

Australia – Australian Broadcasting Corp; Australian Post (Pvt considered) and Air Service Australia (Pvt considered) are some of the SOEs.

In Sri Lanka, due to certain political (outdated) thinking of the authorities and employee interests, many loss making SOEs are protected. The private sector contributes an average 80 per cent of overall investment. Therefore, public sector investment is not that important. In relation to industries the main public sector institution is the Ceylon Petroleum Corporation which accounts for more than 95 per cent of total public sector output.

Hidden subsidies to state media institutions -

All state institutions and other public authorities transfer public funds to state media institutions such as Lake House, Rupavahini, ITN and other miscellaneous institutions by way of costs of advertising. They are prevented from using other media institutions and thereby may be paying higher amounts to state. media institutions. It has been reported that even with such hidden subsidies the Rupavahini Corporation incur losses. Even other state media institutions could go bankrupt without these hidden subsidies provided by the government.

Very often massive amounts are spend by the SOEs to please their political leaders by publishing massive advertisements and cutouts, etc. This type of misuses of funds may not be questioned by the so-called COPE investigators.

Business enterprises of armed forces

The recent trend in permitting armed forces to engage in business enterprises could create another obstacle to free market operations in the near future. It may be the new face of SOEs in Sri Lanka which can lead to numerous economic and social problems.

Conclusion

The Governor of the Central Bank, presenting his “Roadmap for Monetary and Financial Sector Policies for 2013 and beyond”, in January this year has emphasised the need to contain fiscal deficit. He has said that the only way to reduce the fiscal deficit to 5.8 per cent as targeted in the 2013 budget, is to reduce the massive losses in public enterprises.

That may be the most appropriate course of action. But, the Minister of Finance in his “Budget – 2012″ speech has stated certain challenges in strengthening public enterprises -

- Non – availability of competent and professionally qualified personnel.

- insufficient capital infusions.

- necessity to maintain concessionary prices in the interest of consumers.

He said that, “Therefore, losses recorded by these state enterprises correspond to the economic benefits and subsidies that the general public enjoys”.

Then, again in his “Budget – 2013″ speech he has stated that “the evaluation of state enterprises purely from the point of view of commercial profit is not justifiable considering their contribution to economic and social welfare . . . . if electricity and fuel are supplied to the market at cost price, at least Rs. 200 billion losses could be eliminated . . . if such action is taken, how many other enterprises will suffer and how many will lose employment ? What would be the extent of the decline in living standards? These aspects should also be given consideration, when critically evaluating the so-called loss-making CEB and CPC”.

This is Sri Lanka and a country with an economy full of free passengers and subsidized passengers. Over to you sir, the Governor of the Central Bank of Sri Lanka. What a mythical fiscal consolidation? .

(The writer is a Senior Tax and Investment Consultant in Sri Lanka.)

comments powered by Disqus