News

Rs. 654 m slump in ETF due to bad investment in shares

View(s):By Chandani Kirinde

The Employees Trust Fund (ETF) has suffered staggering losses due to investments in shares, according to the Auditor General. The Auditor General’s report submitted to Parliament noted that the capital gains received on sale of shares and units during 2011 had recorded a more than Rs. 654 million decline or 54 per cent drop as compared to 2010.

According to the 2011 annual report of the ETF Board, income on equities during the year was Rs. 719 million compared to Rs. 1,334 million the previous year. The board attributed the decline in income to the depressed share market.

The report detailing ETF losses comes amid opposition claims that the Employees Provident Fund (EPF) has lost more than Rs. 12 billion because of bad investments.

The AG’s report pointed out that the ETF Board had made several bad investments, including Rs. 152 million in five companies, whose shares had not been sold in the capital market for periods ranging from two to five years

The five companies were Sri Lanka Telecom, Lanka IOC, Light House Hotel, Chemanex PLC and Raigam Wayamba Saltern.

In its response to the Auditor General’s query, the ETF Board had said the Treasury in 2008 advised not to sell any Telecom shares without its approval. Accordingly, the sale of Telcom shares was suspended.

With regard to the shares of other four companies, the ETF board said they were not transacted in 2011 due to the sluggish market conditions but they hoped to sell them in the future and make profits.

The ETF Board told the Auditor General that it had made provision of more than Rs. 911 million against any loss on Rs. 7.2 billion investments it had made in 63 companies.

However, the AG’s report noted that neither the capital gains nor the capital invested could be recovered from Korea Ceylon Footwear Ltd. and Magpec Exports Company – two companies in which the ETF Board had invested more than Rs. 25 million — as they had been liquidated while Veyangoda Textile Company, in which over Rs. 4 million had been invested, was delisted in 2011.

The AG’s report added that the ETF Board in 2011 reinvested Rs. 29.3 million in ten companies even though it had not received any income from Rs. 138.4 million invested in them. In its defence, the ETF Board said that it hoped to make capital gains when the market conditions improved.

The ETF Board in 2011 also purchased shares of John Keells Hotel and Pan Asia Bank and the rights issue of Marawila Resort Company.

In addition to this, the Auditor General’s report said that action had not been taken to recover interest – receivable for nine years — from more than Rs. 27.8 million investments made in debentures and promissory notes in two companies even as at December 31, 2011. The interest receivable from Elkaduwa Plantation Company was around Rs. 12.2 million and from Vanik Incorporation Rs. 15 million.

The ETF Board had earned capital gains of more than Rs. 554.9 million in 2011 by selling shares.

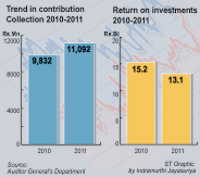

In 2011, the total investment income of the ETF was Rs. 13.1 billion, a Rs. 2.1 billion drop from Rs.15.2 billion in 2010 while the value of the investment portfolio increased from Rs. 119 billion to Rs. 134 billion at the end of 2011. The reason for the decrease in income was attributed to reduction of fixed income interest rates during the year.

The total net asset value of the Fund exceeded Rs. 141 billion at the end of 2011 while the total contributions from employers were Rs. 11.09 billion — an increase of Rs. 1.26 billion in comparison to 2010.

Follow @timesonlinelk

comments powered by Disqus