Most Asian economies to grow in 2013 : SCB report

View(s):While growth in the region had slowed down over much of 2012, it would again kick up in the first half of 2013, with most countries in the region following in this regard, according to a 2013 forecast of Asian economies, compiled by Standard Chartered Bank (SCB).

The report, entitled “Standard Chartered Asia Focus: The resurgence”, which was published on September 24, also suggested that the Philippines “should be the star of 2013″ with a growth level of 5.4% expected as well as a surging business services sector and foreign exchange inflows. The report also revealed that the Philippines is also likely to benefit from a sovereign upgrade in 2014.

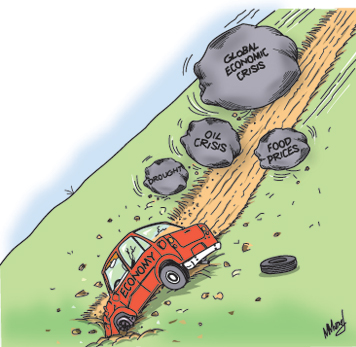

Meanwhile, in terms of the rest of Asia, the report also cautioned that “expected food-price increases and rebounding oil prices could create inflationary risks for H1-2013″.

On the other hand, commenting on Sri Lanka, the report predicted that the country, despite slowing global demand and rising food prices, would achieve a 6.8% growth on average during 2012, and this would pick up further, to 7.5% in 2013. However, it was also suggested that there will be “lower export growth in 2013″ because of slowing global demand. But, also expected, domestic activity would compensate for lower exports.

The SCB report also stated; “We expect growth to slow to around 6.3% in H2-2012 from 7.1% in H1, and inflation to moderate. Although the Central Bank of Sri Lanka (CBSL) is mindful of higher inflation risks arising from domestic supply-side constraints ad external factors, it will likely keep policy rates on hold in the near term to avoid jeopardising growth”.

At the same time, it also commented; “We have revised our full-year 2012 growth forecast to 6.8% from 7.1%, with risks to the downside, to reflect the following factors: (1) The Euro area, which accounts for 30% of Sri Lanka’s exports, remains vulnerable to event risk and is expected to stay weak. (2) With reduced hydropower supply due to a drought, Sri Lanka has had to shift to higher-cost thermal power generation. (3) The drought has had a significant impact on agricultural output, destroying close to 50,000 hectares of rice, according to the Finance Ministry. This has resulted in increased subsidies, with Rs. 10 billion allocated to drought relief for farmers. (4) We do not expect the 18% credit ceiling on banks’ lending, which has considerably slowed domestic consumption, to be lifted in the near term, as the central bank’s tight monetary policy stance is likely to prevail until inflation moderates”.

The report also added; “Inflationary pressure seems to be dissipating, with the rate of food inflation declining due to improved supply from the north. However, we expect headline inflation to hover around double digits approaching the year-end, limiting the central bank’s scope for monetary easing to stimulate growth (unlike its regional counterparts)”.

In addition, it also emerged that Sri Lanka’s Balance of Payments was improving and that the “monthly trade deficit has been narrowing since December 2011 and is at its lowest level since February 2011 thanks to slower import growth. The Sri Lankan rupee (LKR) is stable at 132.0 versus the US dollar, and credit growth – at 31.6% year-on-year in June – is showing early signs of moderating”.

However, also noted; “We are also concerned about the contraction in imports of investment goods, as it likely signals a moderation in domestic investment and production – two key growth drivers”.

The SCB report also indicated; “According to the Finance Ministry, policy adjustments implemented in H1-2012 (including an increase in import duties to curb demand for imported consumer goods and a reduction in fuel

subsidies) and the re-prioritisation of development activities will allow the government to achieve its fiscal deficit target of 6.2% of GDP in 2012. However, we expect the authorities to overshoot this target. We forecast a deficit of close to 7.0% due to losses at state- owned enterprises (SOEs), electricity subsidies, and the impact of the drought. Fiscal consolidation may prove challenging in the near term given that growth is expected to slow in H2-2012 and tax collection on external trade has fallen short of targets”.

Commenting on the progress of the rupee, in terms of the US dollar (USD), the report signalled; “We are now less optimistic on the LKR over the medium term and have revised our USD-LKR forecast, expecting it to settle at around 130.0 in Q4-2012 (versus our previous forecast of 123.5). (JH)

We expect USD-LKR to remain within the 130-132 range until end-2012, as export weakness is likely to prevail. We expect some appreciation pressure in 2013, taking USD-LKR to 126.5 by end-2013, due to a revival of risk appetite as global growth starts to pick up and amid prolonged USD weakness.”

Follow @timesonlinelk

comments powered by Disqus