Local implications of China growing at 8%

View(s): Judging by the visitors over the last two weeks, this is the season for lords of finance to visit Australia. As impressive as the visitors and engagements were, there was surprising uniformity in questions that were discussed. All roads eventually led to China.

Judging by the visitors over the last two weeks, this is the season for lords of finance to visit Australia. As impressive as the visitors and engagements were, there was surprising uniformity in questions that were discussed. All roads eventually led to China.

The obsession with Australia in the midst of weakening Chinese economic growth is understandable, given the dominance of the resources sector for the Australian economy. However, there are more important consequences for wider Asia. There are specific repercussions for the Sri Lankan economy and broader investment markets.

There is growing global unease as China loses some of its steam of growing at over 10% over the last decade and normalises at a range between 7-8% over the next decade. The biggest worry however is the structural adjustments China will be making over the next three years as it focuses more on increasing domestic consumption and reducing dependence on capital investments. Such changes are easier on paper than in practice. The more bullish opinion is that it is easy in a command-and-control economy like that of China. However, I subscribe to the incentive structure theory, where any changes to society at large are driven by personal incentives. Looking at the required adjustments in China incentives are more aligned at the moment for China to keep doing what it has been doing for the last 20 years and not change its ways.

There is growing global unease as China loses some of its steam of growing at over 10% over the last decade and normalises at a range between 7-8% over the next decade. The biggest worry however is the structural adjustments China will be making over the next three years as it focuses more on increasing domestic consumption and reducing dependence on capital investments. Such changes are easier on paper than in practice. The more bullish opinion is that it is easy in a command-and-control economy like that of China. However, I subscribe to the incentive structure theory, where any changes to society at large are driven by personal incentives. Looking at the required adjustments in China incentives are more aligned at the moment for China to keep doing what it has been doing for the last 20 years and not change its ways.

The political difficulty for China lies in disagreements between the central government and those of the regions. The problem with “investment” led growth is the rise it has given to crony incentive structures at the local government levels, with major implications for the centre. To take the simplest example, the central government hypothetically allocates $1 billion for road works, which are distributed to the regions. The regional governments use the money and hand out contracts to the private sector. This is where things get interesting. The private sector is “connected” to the individual politicians at the state level and in most cases all the way to the central government. Contracts are granted to the extended families and friends of elected officials. Readers may find this eerily similar to nepotism in Sri Lanka (in equal measure across both the private and public sector). They would be correct. The problem for China now is the disagreements at the top where some members want to turn away from heavy over-investments, while others (worried about their personal economic situation) are resisting change.

Change in China however will be dictated by policy decisions in Washington. As the Fed keeps rates low for longer periods, China will import inflation and thus force itself to change or collapse. On a balance of probabilities, China will have a soft-landing, meaning the adjustment will be gradual and well handled. This was echoed in conversations with Jim O’Neill, the man who coined the term BRICs and is Chairman at Goldman Sachs Asset Management.

Change in China however will be dictated by policy decisions in Washington. As the Fed keeps rates low for longer periods, China will import inflation and thus force itself to change or collapse. On a balance of probabilities, China will have a soft-landing, meaning the adjustment will be gradual and well handled. This was echoed in conversations with Jim O’Neill, the man who coined the term BRICs and is Chairman at Goldman Sachs Asset Management.

It is also supported by Axel Webber, former head of Germany’s Bundesbank (central bank), and now  Chairman at UBS, a Swiss investment bank. “When I was first at a meeting of the International Monetary and Financial Committee in 2004, the then Chinese governor was asked by the then chairman of the Federal Reserve, Alan Greenspan: ‘Is it going to be a hard landing or a soft landing’? He replied ‘no landing’ and he was right [then],” Mr Weber recounts.

Chairman at UBS, a Swiss investment bank. “When I was first at a meeting of the International Monetary and Financial Committee in 2004, the then Chinese governor was asked by the then chairman of the Federal Reserve, Alan Greenspan: ‘Is it going to be a hard landing or a soft landing’? He replied ‘no landing’ and he was right [then],” Mr Weber recounts.

At complete odds with this rather rosy view of the world is Professor Michael Pettis of Peking University’s Guanghua School of Management. He has persuasively argued that political instability and the near impossibility of changing incentives will make it a hard landing over the next five years in China. I put all of this to Yang Wang, China Strategist at Bank Credit Analyst, a Canadian research firm.

“Despite these risks, our bias has been to expect growth to settle around 8%, beginning in the second half of this year. But even if it takes longer than we expect to stabilize the business cycle, an average annual growth rate of 8% seems reasonable over the next 18-30 months as Chinese policy converges with structural reality.”

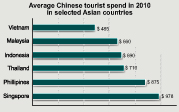

Implications for Sri Lanka come in two significant sectors; rubber and tourism. Commodities are the most sensitive to China growth figures. Rubber prices have held high and steady over the last few years. China accounts for a third of global rubber demand. Three-fourths of all Chinese demand goes into tires. Stories of overflowing bonded warehouses with record inventories should present a challenging short-term outlook for growers. Probabilities of a short term correction to find a new median price 20% lower than where it is today have dramatically increased in the last two months. Production cost increases and reduced final prices would mean difficult headwinds for local growers.

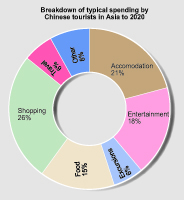

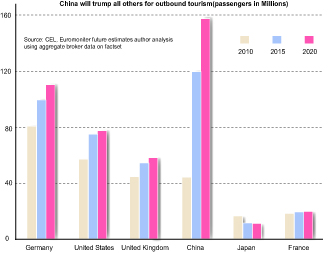

It’s distressing to see the local reaction to the consumption shift underway in the tourism sector. Many local operators still hold on to romantic notions of the 10-day British and German tourist and are not too keen on Indian, let alone tourists from China or the broader ASEAN region. This will be detrimental to the sector and the large diversified listed companies over the next five years. The destination Australia, Europe and USA has spent the most marketing their tourism product has been China. Yet Sri Lanka’s tourism sector is stuck in a time-warp trying to sell a product to a European market going through a tumultuous transition which will lead to lower discretionary consumption.

As the graphs show, the outbound China tourism market is the highest growing in the world. India and the rest of the ASEAN region are second and third respectively. It is also instructive to analyse the median spend of the average Chinese tourist within the ASEAN region and how it changes from country to country. The real problem for local operators may be in not getting the “correct type” of tourist to visit the island. That requires proper marketing, not racist hoopla about the “better” Western tourist.

As the graphs show, the outbound China tourism market is the highest growing in the world. India and the rest of the ASEAN region are second and third respectively. It is also instructive to analyse the median spend of the average Chinese tourist within the ASEAN region and how it changes from country to country. The real problem for local operators may be in not getting the “correct type” of tourist to visit the island. That requires proper marketing, not racist hoopla about the “better” Western tourist.

There is a big difference in what the government wants and what the tourism sector should be focussed on. The government is correctly obsessed about the number of arrivals, not necessarily their length of stay. That is because the largest take from tourist arrivals for the government is in airport and passenger taxes, which are independent of whether passengers stay for a day or 10. While collection of a longer stay tourist is higher through consumption taxes, it dwindles beyond a 4 day stay.

China at 8% will mean a further Eastward tilt for the country, for better or worse.

(Kajanga is an Investment Specialist based in Sydney, Australia. You can write to him at kajangak@gmail.com).

Follow @timesonlinelk

comments powered by Disqus