Columns

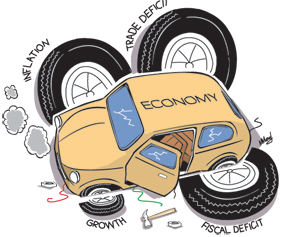

Declining economic growth, rising Inflation and widening trade and fiscal deficits

The Global downturn and drought have been underlying reasons for the deteriorating economic conditions that have arrested this year’s growth and generated a higher inflation rate. It is now more certain that the economic growth rate of 6 per cent that we predicted in this column of June 14th is likely owing to the adverse global market conditions for both agricultural and industrial exports and the impact of the drought on agricultural production and hydro electricity generation. Fortunately, the monsoon appears to have arrived at last to improve the water levels in the reservoirs.

The downturn in the global economy that has depressed the county’s exports markets has widened the trade deficit and accentuated the balance of payments problem. Slower economic growth, the lower trade turnover and reduced output of goods and services would reduce revenue and increase the fiscal deficit that has already increased. These developments tend to interact with each other to spiral the economy downward.

Food crops

The agricultural sector faced a setback due to the drought conditions that affected food crop production in several regions of the country, most notably in the North Central and Eastern regions, that account for a significant proportion of food production. Large extents of paddy land have been adversely affected by the drought and it is likely that there would be a decline of about 30 per cent in food production.

Tea production and exports

Tea production and exports fell in the first half of the year. Tea output fell 3.7 per cent to 135 million kilograms in the first five months of the year due to a fall in tea production from all elevations and kinds of tea in the first half of the year: a trend that is likely to continue for some time. Tea exports decreased by 11.8 per cent in the first four months mainly due to the volatile situation in the Middle East. Tea exports to Russia too have been adversely affected by competition from other countries. This decline in tea exports, the largest agricultural export, contributed much to the decline in agricultural exports of 11.7 per cent in the first four months compared to the same period of last year. The decrease in agricultural export earnings together with decreased industrial exports worsened the trade deficit.

Industrial performance

The industrial sector that accounts for about 29 per cent of GDP includes manufacturing, construction, electricity and mining. There is a trend of decreasing industrial exports, especially of garments. In March industrial exports declined by 10.2 per cent and in April it declined by 8.7 per cent, compared to the respective months of last year. The decrease in garments exports that constitute the main industrial export has been a serious setback to export earnings.

There is little prospect of a reversal of this trend till global market conditions improve. The decline in manufacturing during the first quarter owing to the dip in exports has continued. Textiles and garments that make a significant contribution to manufacturing are likely to grow slowly owing to the export decline. The credit restrictions, higher tariffs and, instability of the rupee would reduce industrial output.

The construction boom may continue for some time due to hotel construction and infrastructure development. Electricity generation that is part of the manufacturing sector and contributed 2.2 per cent to GDP last year is likely to decline. Drought conditions have reduced the generation of hydropower and domestic value added in the energy sector would decline with higher thermal generation based on imported oil. The higher costs of electricity generation due to inadequate rainfall for hydropower generation have compounded the balance of trade difficulties.

Services

The services sector that includes tourism, telecommunications, ports and transport, contributes about 60 per cent to GDP. It continued to grow by 5.8 percent in the first quarter of 2012 over 9.5 percent a year earlier. Tourism and services related to tourism are likely to boost growth in this sector. However there are indications that adverse global economic conditions may impact on high spending western tourists, as the rate of increase in tourist arrivals has decreased. The tourist boom that we have witnessed since the war ended three years ago we hope would maintain its growth despite the global economic downturn. Internal and external trade is likely to be retarded by lesser volumes of and lower imports and domestic output and expenditure.

Inflation

Meanwhile the rate of inflation has risen and is most likely that it would exceed 10 per cent this year. At the end of June a 1.9 per cent increase in prices pushed up inflation to 9.3 per cent year on year. The increase in the rate of inflation has been brought about by higher prices of imported basic food items and fuel and the decreased domestic food production. It is likely that inflationary pressures would continue in the second half to reach double digit proportions.

Fiscal deficit

Despite the Treasury’s intent of containing the fiscal deficit to its target of 6.2 per cent of GDP, the adverse economic developments are making it difficult to achieve it. The budget deficit has doubled in the first four months of 2012, with current spending growing at twice the rate of tax revenues. While revenues grew by 7.2 per cent to Rs. 305.5 billion, current spending increased by 23.4 per cent to Rs. 445.3 billion. As to be expected tax revenues grew 10.7 per cent to Rs. 276.4 billion, while non-tax revenues fell 17.5 per cent from a year earlier to Rs. 29 billion. The fiscal deficit, that is the gap between total revenues and current expenses, rose 86 per cent to Rs. 139.8 billion equal to 1.8 per cent of projected gross domestic product. An increase in the fiscal deficit would have serious repercussions on inflation and increase the public debt significantly.

Economic instability

Apart from the external and internal shocks that are affecting the country’s economic performance, there is a great deal of uncertainty in economic affairs. The volatility of the rupee exchange rate owing to the continuing adverse balance of payments situation has added to the economy’s instability.

The rupee has depreciated about 18 per cent since its devaluation in November to around Rs. 134 to a US dollar.

The volatility in the exchange rate is not conducive to investment. State interventions in the banking sector and in Colombo Stock Exchange transactions have had adverse impacts on the stock market and on investment. The Standard and Poor’s downgrading of Sri Lanka’s banking sector is also not helpful. In these circumstances it is likely that the sovereign bond issue of US 1 billion to stave off a balance of payments crisis will be at a high interest rate.

Prospects

There are a few positive developments. Hopefully oil prices will remain at the current low levels and not increase import expenditure. The US restoring the GSP Plus is also a factor that could revive manufactured exports and improve the country’s industrial exports. The large foreign borrowing, despite its adverse long term effects could strengthen the reserve position and reduce exchange rate volatility. Improvements in weather conditions that are being witnessed could improve agricultural production and enhance hydropower generation. These favourable developments we wish would lessen the adverse external and internal shocks on the economy.

comments powered by Disqus