Interblocks Ltd., Sri Lanka’s leading channel banking solutions provider, continues to blaze a trail of success across the region as MegaLink, the premier ATM consortium in the Philippines, goes live with iSwitch, its transaction switching and management software.

The transition to iSwitch is aimed at enabling MegaLink’s goal to move beyond ATM switching and become a complete shared financial services facility providing mobile and online banking as well as POS payments and cross border ATM transactions. With all transactions happening online and in real time, MegaLink takes speed and convenience to the next level.

The founding concept for the shared ATM network has evolved, says Benjamin P. Castillo, President and CEO of MegaLink: “Financial services through the ATM encompasses more than the simple withdrawal and balance inquiries of yesteryear.

Today is about immediate availability across more channels, a wider variety of financial products and services and cost efficiency for both provider and consumer. After years of playing the role of a traditional ATM switch provider, MegaLink was ready to take a step up to the next level and iSwitch with its flexibility and range of supporting products was the ideal platform for this transformation.”

A landmark implementation for Interblocks, the first phase of the project went live within three months, meeting the MegaLink launch date of 1 November 2010, with the second stage going live within the following three months.

“With iSwitch we have provided MegaLink with the platform to transform its business and set a global standard for shared ATM networks,” said Dinesh Rodrigo, Managing Director & CEO of Interblocks Ltd.

“Working in partnership with a company that recognised the potential for the payments landscape and understood how they could leverage the iSuite platform to realise this was a great opportunity,” he said, adding that the speed and success of this implementation was a result of the combined effort of both Interblocks and MegaLink teams working together towards a common goal and a clear vision of the roadmap.

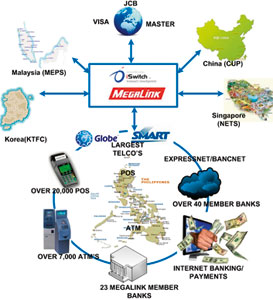

MegaLink is an ideal example of how the payments industry is evolving today and how shared ATM networks can provide a wide range of value added services creating a range of new revenue streams while providing greater convenience to customers. At present the switch is powering over two million transactions a day, in a network spanning over 7,000 ATMS, 20,000 POS devices and 30 channels.

In addition to the standard functionality MegaLink, leveraging on iSwitch capabilities, is providing a range of value added functionalities including; mobile top up and load fulfilment, bill payments, online and batch Inter-Bank Fund Transfers (IBFT), payment and deposit transactions, online payroll transactions, multi-bank/multi-merchant internet payments, local and international remittances and mobile payments and commerce.

The Philippines Inland Revenue Department is one of the primary merchants on the MegaLink network for the BIR Tax Payment Gateway, giving taxpayers the opportunity to pay their taxes online.

One of the primary goals of the project was to enable cross border transactions, and as such MegaLink will initially be connected to Korea (KFT Switch), China (CUP), Malaysia (MEPS) and Singapore (NETS) as well as having countries such as Indonesia and Thailand in their immediate pipeline. MegaLink will be in-effect a hub enabling transactions across the ASEAN region providing greater connectivity and convenience for customers.

Apart from connecting to Visa, MasterCard and JCB, MegaLink also connects the two largest telecom services providers in the Philippines with a base of over 50 million subscribers enabling mobile top ups.

With its 20 year history of innovating payment solutions and supporting over 11 million cardholders MegaLink marks one of the biggest implementations for Interblocks to date, and is yet another step as they continue to set the standard for the payments industry, creating the future for how money moves.

Interblocks is a leading provider and innovator of integrated, electronic payment processing solutions. Empowering banks and financial service providers across global markets with the ability to provide their customers with truly pervasive, personalised financial service experiences that dramatically change the way financial transactions are conducted today.

Having pioneered the use of the IFX-XML standards in their software in 2001, Interblocks has focused on the consumer experience to build a platform for financial transactions that anticipate user requirements for conducting secure and fast financial transactions across a multitude of channels. The company continues to expand and spread its wings across borders with its portfolio of transaction management solutions.

|