Sri Lanka has a superb window of opportunity as against other countries to exploit the latest scenario with the announcement of the G20 countries $3 trillion recovery package offered as a solution to the current global financial crisis. Contrary to the popular belief that the Sri Lankan economy will shrink with all its exports already declining and industries/business establishments closing down, the writer is of the opinion that if we are able to obtain foreign funds and fast-track “ongoing” infrastructure development projects the country could drive the economy out from the current temporary downturn. Sri Lanka has a superb window of opportunity as against other countries to exploit the latest scenario with the announcement of the G20 countries $3 trillion recovery package offered as a solution to the current global financial crisis. Contrary to the popular belief that the Sri Lankan economy will shrink with all its exports already declining and industries/business establishments closing down, the writer is of the opinion that if we are able to obtain foreign funds and fast-track “ongoing” infrastructure development projects the country could drive the economy out from the current temporary downturn.

As the Indian Prime Minister said at the recent G20 summit, the current global financial crisis was created by the western countries especially by the US but the leaders have now agreed to pump in as much as $3 trillion as a fiscal stimulus package. It is also reported that $1 trillion would be made available to IMF and another $800 billion would be available for other international lending agencies to be granted for developing countries needs. On the other hand, the US Congress has recently passed the American Reinvestment Act which contains “Buy American” clause.

This clause is protectionist and also discriminatory as all funds in future must be used to buy steel, iron, etc. under government procurement code even though it costs 25% more than those imported from say, companies from China. The banks in the US and the Western countries will now be able to lend more funds to the customers and as US President Obama himself predicted after the summit there would be more industrial activities and more job creation. The good news have already started flowing thus indicating manufacturing activities expanding for the first time in six months pointing towards stabilizing economies not only in the West but also in the Far Eastern counties.

The writer is of the opinion that the global financial crisis would end sooner than later. And it’s a matter of time that Sri Lankan exports will find their lost market share once again. So the challenge is to meet the deficit in the “Balance of Payments” in the current year 2009 until the world markets recover. It could come by way of capital flows for reconstruction and rehabilitation projects especially in the north and east with the liberation of the areas in addition to southern infrastructure development projects. The real challenge here would be to find counterpart funds from the government budget in order to obtain funds from the international lending organizations.

The writer in a recent article argued the need to adopt a more people-oriented, regulated market economic model for Sri Lanka, as opposed to the free market economic model as there is clear and sufficient evidence to conclude that Sri Lanka has not been able to achieve its desired objectives having implemented such economic policies for nearly 26 years. In June 2007 the Maubima Lanka Foundation launched its campaign in collaboration with the government to promote the idea islandwide and it has now become a powerful organization encouraging local industries and production.

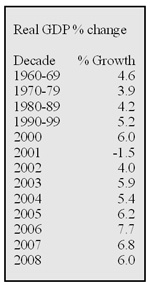

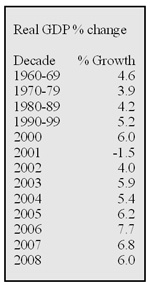

In the late 70’s, Sri Lanka attempted to transform its economy towards more open market system and reduced the role of the state in economic and business activities. Since then we have been following more market oriented open economic policies. Today in 2009, after 32 years of implementing these policies, there is sufficient evidence to show that the end results have been disappointing (in terms of achieving the originally set objectives of economic development). One of the key parameters of assessing the economic progress is to measure the growth of the economy in terms of real increase of the Gross Domestic Product in constant rupees. In fact, the main objective of transforming the economy into open market policies was to achieve a rapid economic growth. However it should be mentioned at the very outset that measurement of economic performance using GDP growth rate has its limitations and therefore should not be taken as the sole criteria in evaluating the economic development.

From the above ratios, it can be seen that even after adopting open market policies, there have been no significant increases in the growth rates as originally predicted, except during 2006 and 2007 and also 1968 and 1978. Another objective of the open economic policy is to have an export led growth strategy and to accelerate international trade and investments. This would enable the country to eventually have a positive trade balance (exports to exceed imports) and a surplus in the current account of the Balance of Payments. They also believe that trade liberalization would enhance a country’s income by forcing resources to move from less productive uses to more productive uses. However what actually happened was that most of the so called inefficient industries and other agricultural or “service’ ventures had to close down under pressure from international competition. It had destroyed existing jobs but no new job opportunities in the so-called productive ventures were created. This is mainly due to the fact that there is a shortage of capital and entrepreneurship. Further there was a lack of infrastructure facilities available for smooth functioning of businesses.

Today even the World Bank and the IMF have accepted that they have pushed the liberalization process too far and in fact, it had contributed to the global financial crisis. Joseph Stiglitz-former Chief Economist at the World Bank and winner of the Nobel Prize for Economics 2001, in his book titled “Globalization and its discontents” mentioned “Globalization today is not working… for many of the world’s poor…for much of the environment…”He argued that trickle-down economics was never much more than just a belief. The Free market capitalist policies, if not managed properly, are undesirable in terms of achieving true economic development and improve the quality of life of the people.

According to Central Bank reports, since 1977 there had been not a single year with a positive trade balance. Also, there was always a deficit even in the current account of the Balance of Payments.

It would be recalled that Sri Lanka’s total debt as a % of GDP was exceeding 102% in 2003 and 2004 and since then the country has been achieving higher growth rates and as a result the overall debt as a % of GDP is now around 86%.

The writer is of the opinion that the main challenges faced by us namely, the economic downturn and the North- East problem could be addressed through a vision driven approach as opposed to adopting problem driven approach hitherto practiced. Also it is a necessary pre requisite that we create and build a new socio/political culture based on our traditional values, heritage and our expertise and it is necessary to make attitudinal changes in the hearts and minds of the people.

The conclusion here is that the free market economic policies if not managed properly, are undesirable in terms of achieving true economic development and improve the quality of life of the people. Therefore what is desirable is to continue the present economic policies adopted under “Mahinda Chinthanaya” based on socially- oriented market economy. However, as can be seen from the above figures, debt as a % of GDP is around 85.8% compared with 96.6% in the 1990’s. Also part of the problems faced by the Sri Lankan balance of payments difficulties are due to the liquidity crunch faced by the foreign customers of our exporters on account of current global financial crisis. In the circumstances, there is nothing wrong in borrowing long term concessionary funds for capital development projects where repayment terms include grace periods and low interest rates.( It is likely that more Foreign Direct Investments (FDI’s) may flow into the country followed by these funds once infrastructure is in place ) .

It appears that a more positive private/ public partnership and greater participation by “people’s organizations” at village level in the infrastructure development activities are necessary pre-requisites to drive the economy out from the current temporary downturn faced by the Sri Lankan economy today.

(The writer is a senior chartered accountant with a masters in Business Administration. presently holding Directorates in few public quoted companies.) |

Sri Lanka has a superb window of opportunity as against other countries to exploit the latest scenario with the announcement of the G20 countries $3 trillion recovery package offered as a solution to the current global financial crisis. Contrary to the popular belief that the Sri Lankan economy will shrink with all its exports already declining and industries/business establishments closing down, the writer is of the opinion that if we are able to obtain foreign funds and fast-track “ongoing” infrastructure development projects the country could drive the economy out from the current temporary downturn.

Sri Lanka has a superb window of opportunity as against other countries to exploit the latest scenario with the announcement of the G20 countries $3 trillion recovery package offered as a solution to the current global financial crisis. Contrary to the popular belief that the Sri Lankan economy will shrink with all its exports already declining and industries/business establishments closing down, the writer is of the opinion that if we are able to obtain foreign funds and fast-track “ongoing” infrastructure development projects the country could drive the economy out from the current temporary downturn.