News

Amended Standing Orders to better COPE as waste, corruption continue unabated

Parliament is looking to amend Standing Orders, to give more teeth to the oversight committee on Public Finance, the Committee On Public Enterprises (COPE), its Chairman, Minister D.E.W. Gunasekera said on Friday.

The Minister’s comments came when he presented the Second Interim Report of COPE to Parliament, in which, once again, massive waste and loss of public money was exposed.

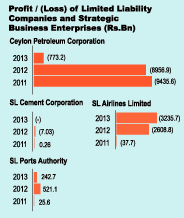

The Central Bank (CB), Ceylon Petroleum Corporation (CPC), Sri Lank Port’s Authority (SLPA), SriLankan Airlines, Sri Lanka Cricket (SLC) and the Road Development Authority (RDA) were among the State institutions that came under COPE scrutiny between May-September 2014.

The CB incurred a net loss of Rs 22,248 million before taxes, in 2013, the Report said. CB Governor justified this saying that, even though a loss has been reported, as per the International Financial Reporting (IFR) Standards, the Bank had actually made profits in terms of the Monetary Law Act.

COPE had questioned CB officials about the violation of Exchange Control regulations in respect of Sterling Pounds 3 million (around Rs 615 million) as well as losses incurred by the CB’s investment in Greek Government Bonds in 2012.

COPE also found that, despite a previous directive in December 2013, on an overpayment of US$ 2,060,842 (around Rs 250 million) by including the premium twice in the agreement made to procure fuel from a foreign company, an internal investigation had not been conducted to find the officers responsible.

The Committee also inquired about the action taken against those responsible for the loss of US$ 75.3 million, due to the hedging transaction. CPC officials had informed the COPE that the transaction had taken place on a Cabinet policy decision, and that the Deputy General Manager in office at the time had been sent on five years compulsory leave, while an inquiry is also under way.

The COPE report said that, due to continuous losses, the CPC carries a negative net asset position of Rs 228, 545 million and Rs 236,529 million at the end of 2012 and 2013 respectively.

COPE said it would summon CPC officials in the next few weeks to query the import of 55,000 metric tonnes of substandard fuel in 2011 and 2012. “The contribution of CPC on placing orders for petroleum products has been very poor, as they had not maintained proper records of stock levels,” it said.

COPE also exposed massive losses in the SLPA. It said both Trincomalee and Galle Ports had lost Rs 240 million and Rs 47 million respectively, by end 2012. The SLPA also lost Rs 391 million on the improvement of the Colombo Port, as the project, funded by the Asian Development Bank had been abandoned later. SLPA officials told COPE they abandoned the project because of change in Government policies.

Similarly, even though construction work of the Oluvil Port had been completed at a cost of Rs 6,780 million received from Denmark’s DANIDA Agency and Rs 444 million of SLPA funds, but operations were yet to commence. It was also revealed that the Port can accommodate only small vessels due to its low depth of around nine metres.

As for SriLankan Airlines, COPE said the net loss for 2013-2014, after tax, was Rs 26 billion. Even though Airline officials attempted to justify the losses, stating they could not turn around the losses due to high fuel prices, which is 6-8 per cent higher than that in the region, and also due to the devaluation of the Rupee, COPE said this argument is invalid, as, even after the removal of the 6-8 per cent cost of fuel, the loss would still stand at Rs 21 billion. It also noted that the Rupee had been fairly stable during this period.

With regards to the RDA, COPE said that, although Rs 131,564 million was borrowed from both private and State banks, for the reconstruction of 53 roads, only Rs 33,728 had been spent on these projects in 2013. COPE wanted the RDA to justify these funds utilisation in a fruitful manner; a report on this from the RDA is pending.

The Report also revealed that during the period 2009-2011, 38 contracts amounting to Rs 198,762.75 million has been directly awarded to contractors specified by the lending agencies, without following a competitive bidding procedure.

Meanwhile, SLC had recorded a loss of Rs 1.1 billion in 2013. SLC’s Chief Accounting Officer had told COPE that the loss included a depreciation factor of Rs 674 million, and that the actual loss was Rs 436 million. He added that profitability depended heavily on the availability of tours.

COPE also noted that the SLC’s entire procurement process to grant local TV broadcasting rights in 2011 was not transparent, and only one bid had been received in response to the Tender notice which had not been given adequate publicity due to the small size of the advertisement and the insufficient time given to respond to the notice.

“Offering the Tender to a company in which the SLC’s Secretary was the Chief Executive Officer, also gives rise to a clear conflict of interests,” COPE said.

| Is SL Cement Corp. worth it?: COPE

COPE said the necessity of Sri Lanka Cement Corporation (SLCC) should be reviewed, given the small market share it holds and the massive losses it has incurred over the years.“SLCC’s present activities do not comply with its vision, mission and objectives stipulated in the Act. The privatisation of several small factories in 1992 and security matters in the north had led to production being abandoned,” the COPE Report revealed. COPE said the stance of SLCC’s Chief Accounting Officer (CAO) that the existence of the institution is vital to maintain control of cement prices in the market, is not valid. “There is no rationality in the argument of the CAO, as price control can even be handled by the Consumer Affairs Authority or a similar entity. COPE said that a 2011 Cabinet decision to amalgamate Lanka Cement Co. Ltd and the SLCC, and re-launch the Kankesanturai cement factory is yet to materialise. Meanwhile, the land has been acquired by the Army. SLCC officials told COPE that the Northern Provincial Council had objected to excavation for limestone, as there was the risk of contamination with sea water. COPE said expenditure had increased exorbitantly between 2010 and 2012, increasing from Rs 32,418,704 to Rs 81,710,913. The rise in expenditure has been attributed to losses incurred due to the confiscation of a consignment of 18,000 expired bags of cement worth Rs 1.2 million, settlement of a very old credit balance of US$ 300,000 pertaining to a period prior to privatisation in 1992, and a Rs 40 million loan from the Bank of Ceylon. |