Inflation administratively deflated?

The annual average rate of price change (annual average rate of inflation) in terms of the Colombo Consumer Price Index (CCPI based on 2006-2007 = 100) has been in single digits for over five years now. In 2008 the annual average rate of inflation (based on CCPI 2002=100) was 22.6 per cent, the second highest in the post-independence period after 26.1 per cent in 1980 (based on CCPI 1952=100). Since 2008 inflation has dramatically declined to single digit (see table) because of the revision of the methodology including the change in the base year.

The base year and the measure of the CCPI have been revised and updated in November 2007 (base year 2002=100) and in June 2011 (base year 2006-2007=100). The revision of CCPI in 2007, which was long overdue, included (i) expansion of the geographical coverage of markets where prices are regularly collected, (ii) changes in the weights assigned to different categories of consumption goods based on changing consumption patterns as reflected in the Household Income and Expenditure Survey (HIES), and (iii) dropping alcohol and tobacco from the basket of goods taken into account in the compilation of CCPI on moral grounds, purportedly.

While the expansion of the geographical coverage of the markets is objective because of wider representation of prices, dropping of alcohol and tobacco from the basket of goods is subjective because historically in Sri Lanka as well as almost all other countries of the world relatively higher proportion of the income of the lower income groups is spent on alcohol and tobacco. Therefore, the non-inclusion of alcohol and tobacco in the basket of goods underestimates the Consumer Price Index and thereby the rate of inflation.

Moreover, although the update of the base year was long overdue, in the base year 2002 the inflation was relatively low at 9.6 per cent and in the base year 2006-2007 the inflation was relatively high at 10.0 per cent and 15.8 per cent respectively. Therefore, the annual average rate of inflation measured currently is in terms of a higher base (2006-2007) which partly (only partly) explains the relatively lower rates of inflation since 2009.

Furthermore, anecdotal evidence suggests that the ordinary citizens, including this author, feel the declining rate of inflation in 2013 and 2014 to be unbelievable and unrealistic. Therefore, we checked the national product data presented in the Annual Report of the Central Bank of Sri Lanka in order to investigate the plausible cause/s of the discrepancy between the official statistics on the cost of living and the real-life cost of living.

The national output/product is computed by income method, expenditure method, and value added method. Basic economic theory underpinned by real-life experiences suggests that a rise in prices (or inflation) should reduce private consumption expenditure and a drop in prices (or inflation) should increase private consumption expenditure. That is, there is an inverse relationship between inflation and private consumption expenditure. Public consumption expenditure could, of course, increase or decrease irrespective of the rate of inflation.

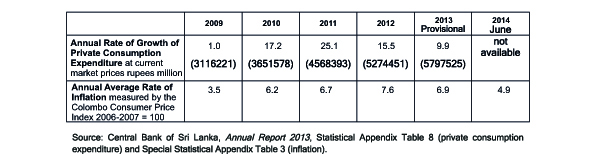

However, the experience in Sri Lanka in the past five years (2009-2013) has been the opposite (see table). That is, whilst the rate of inflation has been rising between 2009 and 2012 year-after-year (albeit at single digit – 6.2 per cent in 2010, 6.7 per cent in 2011, and 7.6 per cent in 2012), the annual rate of growth of private consumption expenditure has been rising as well between 2009 and 2011 year-after-year (17.2 per cent in 2010 and 25.1 per cent in 2011), which is anomalous. Only in 2012, rising inflation (to 7.6 per cent from 6.7 per cent in 2011) has reduced the rate of growth of private consumption expenditure (to 15.5 per cent from 25.1 per cent in 2011) in conformity with economic theory. In 2013, the decline in the annual average rate of inflation (to 6.9 per cent from 7.6 in the previous year) is accompanied by a decline in the annual rate of growth of private consumption expenditure (to 9.9 per cent from 15.5 per cent in the preceding year), which is also anomalous.

The foregoing anomalies between the rate of inflation and the rate of growth of private consumption expenditure are circumstantial evidences for doubting the inflation data compiled by the Department of Census and Statistics (DCS) and trumpeted by the Central Bank of Sri Lanka (CB). There are doubts and questions raised on the authenticity of economic data released by the CB and DCS by a growing number of economists in the country in recent times. Recently, this author exposed the huge underestimation of the rate of unemployment by employing an alternative method for computing the rate of unemployment.

The declining rate of inflation is cited as the reason for the reduction in the interest rate by the CB in order to stimulate economic growth. However, reduction in the interest rates (borrowing cost) has not resulted in growth in private sector borrowings which is dampening economic growth. This phenomenon strengthens the scepticism about the official economic data in Sri Lanka in recent years. Furthermore, slashing the interest rate by the CB is believed to be aimed at reducing the borrowing cost of the government rather than stimulating private sector borrowings.

The weights used for different categories of expenditure in the compilation of the Consumer Price Index should be reviewed and updated based on the results of the Household Income and Expenditure Survey (HIES) undertaken every three years throughout the country. CCPI is a weighted average of different categories of expenditure in the basket of goods taken into account. Further, the base year of the CCPI should not be arbitrarily determined by the fiat of selected mandarins or the Executive. Instead the base year should be the year in which HIES is undertaken and therefore should be mandatorily and automatically updated every three years when the HIES is undertaken. Moreover, the HIES should be undertaken during the fiscal year (January-December), rather than across two calendar years from July to June (of the following year) as has been the case in the last three surveys (2006-2007, 2009-2010, and 2012-2013), in order to make it uniform with the computation of the annual average rate of inflation.

It is high time that the DCS and CB make the raw data of CCPI available for independent scrutiny in order to allay the fears of the general public and restore the professional integrity of statisticians of the DCS and economists of the CB. Moreover, DCS should be reformed and renamed in order to make it independent of the Ministry of Finance (or any other Ministry for that matter) and to induct social scientists such as economists, geographers, sociologists, et al, into its professional personnel, which is hitherto monopolised by statisticians.

(The writer is the Principal Researcher of the Point Pedro Institute of Development, Point Pedro, Northern Province and could be contacted at sarvi@pointpedro.org)