Columns

Economic prospects in 2013: No great expectations

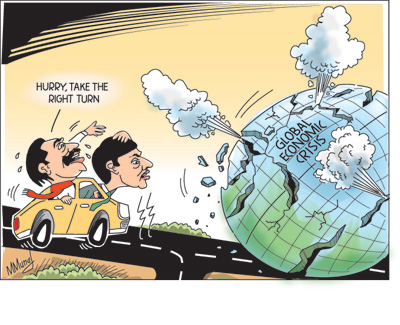

View(s):Sri Lanka being a trade dependent economy, global economic conditions will play a defining role in its economic performance in 2013, as it did in 2012. The global economic slowdown is likely to continue especially as western economies are not likely to recover much.

The political situation in the Middle East and US intervention in the region could continue to affect tea exports adversely and increase the cost of petroleum imports. An improvement in weather conditions could raise agricultural production, increase hydropower generation and reduce oil imports. The continuation of the tourist boom would enhance foreign exchange earnings and boost demand in related economic services. Workers’ remittances will continue to offset over one half of the probable trade deficit.

The political situation in the Middle East and US intervention in the region could continue to affect tea exports adversely and increase the cost of petroleum imports. An improvement in weather conditions could raise agricultural production, increase hydropower generation and reduce oil imports. The continuation of the tourist boom would enhance foreign exchange earnings and boost demand in related economic services. Workers’ remittances will continue to offset over one half of the probable trade deficit.

Western economies and Middle East

It is unlikely that European economies would improve much this year. The euro zone’s GDP is expected to grow by less than 0.5 per cent in 2013. The economies of Germany and France are likely to grow by even less than this. Greece and the economies of Spain and Portugal are expected to be in recession. The US is likely to grow by about 2 per cent in 2013, much less than the trend growth rate. However, the developments in the US are very much dependent on whether the “fiscal cliff” is resolved, and in what way.

The performance of the US and European economies are what matter most as they are the country’s main export markets, especially for manufactured exports. Depressed demand for them implies that growth in export earnings cannot be expected. Overall only a modest improvement in their economic growth is expected.

The political situation in the Middle East and US intervention in the region that affected both Sri Lankan exports of tea and the cost of petroleum imports in 2012 will be the other important determinant of the county’s fortunes. The US embargo on trade with Iran affected tea exports seriously, as Iran was the country’s second largest tea export market. Furthermore this embargo resulted in the import of oil at higher costs. It is estimated that this embargo cost between US$ 1-2billion extra. This burden is likely to remain with us in 2013.

The political situation in the Middle East and US intervention in the region that affected both Sri Lankan exports of tea and the cost of petroleum imports in 2012 will be the other important determinant of the county’s fortunes. The US embargo on trade with Iran affected tea exports seriously, as Iran was the country’s second largest tea export market. Furthermore this embargo resulted in the import of oil at higher costs. It is estimated that this embargo cost between US$ 1-2billion extra. This burden is likely to remain with us in 2013.

Remittances and tourist earnings

Despite the global slowdown, the country has continued to benefit from workers’ remittances and increased tourist earnings. Workers’ remittances have continued their increasing trend even though there has been a slight deceleration in them. In 2012, remittances increased by about 17 per cent from those of 2011 and are likely to bring in about US$ 6 billion. Remittances are likely to rise by about 15 per cent this year to about US$ 7 billion.

Tourist earnings leapt last year to exceed US$ 1 billion with tourist arrivals exceeding 1 million. A further 25 per cent increase is not unlikely in 2013. Tourist earnings may increase this year to about US$ 1.25 billion. If the trade deficit can be contained at the 2012 level, remittances and tourist earnings would offset about 90 percent of the trade deficit and a balance of payments surplus is not unlikely in 2013. However, to achieve this, it is important to continue with a flexible exchange rate policy that contains imports and incentivises exports.

Improvement in weather

One hopes that the internal shocks that the country faced last year will not be repeated in 2013. Although climatic conditions have become an unpredictable global feature, we can presume there wouldn’t be a recurrence of drought this year. If weather conditions return to normal agricultural production could be expected to increase. Besides this good rainfall would reduce dependence on thermal generation of electricity and consequently reduce oil imports. This would be a relief to the trade balance. Despite the increased consumption of oil to generate electricity, there was a noteworthy decrease in imports of oil later last year owing to reduced consumption in other areas owing to higher prices. If the oil import bill could be reduced then it would be a considerable relief to the trade balance and balance of payments.

Fiscal deficit

The containment in the fiscal deficit to 6.2 per cent of GDP last year would be a challenging task as the expenditure of the Government has already overshot the budgeted figure and revenue has shown a decline. Whether government expenditure is likely to be reined in significantly and government revenues increased substantially remains to be seen. There is little evidence to be optimistic, but the Treasury’s resolve in the midst of difficult economic conditions is commendable. If the deficit is contained at below 7 per cent of GDP it is reasonable in the economic context of last year. What is important now is to bring down the fiscal deficit in 2013 to 5.8 per cent of GDP as targeted in the 2013 budget.

For this to be achieved it is vital that the revenue to GDP ratio is increased substantially from its current 15 per cent of GDP and public expenditure is reduced drastically. A key to achieving this is the reduction of the massive losses in public enterprises. Most other expenditures such as the debt servicing costs, salaries and pensions and other recurrent costs of the government are committed expenditures that cannot be reduced. Therefore efforts to reduce public enterprise losses are vital to achieve a reduced fiscal deficit. A reduction of such expenditure would enable the government to spend more on social infrastructure such as on education and health that would have an important bearing on long term economic development.

Price stability

Price stability is a cornerstone for economic growth. A fair degree of price stability was achieved last year despite the depreciation of the currency and import taxes on basic commodities and the drought. However the November and December inflation figures of 9.5 and 9.2 per cent is a sign of accelerated inflation. This is a matter of concern, especially as imported commodities are likely to continue increasing with international prices of food increasing. Further taxation measures too could increase consumer prices. Increased food production this year would help in containing consumer prices.

Economic growth and stability

All things considered the economy is likely to grow at about 7 per cent in 2013: higher than the likely 6.5 percent growth in 2012. The 7 per cent growth rate has been described as “graceful growth” by the Governor of the Central Bank. Certainly it is not disgraceful in comparison with other countries! Yet “graceful growth” is lower than the projected trajectory of growth after the end of the war that is now admitted to be unsustainable due to global conditions and the inability to undertake economic reforms.

Containing the fiscal deficit to the targeted 5.8 per cent of GDP and reducing the trade deficit are vital to ensure economic stability in 2013 and beyond. Both these are very much dependent on government expenditure that must be reined in by cutting unproductive expenditure.

While international developments will play a determining role in the fortunes of the country, domestic economic policies must ensure that their impact is lessened. Global economic developments are beyond the country’s control, but policies that strengthen the public finances and reduce the trade deficit are means of coping with the problems of the external economic environment. It is vital for the government to recognise that there are fundamental weaknesses in the economy that have to be addressed. These economic concerns should be the core interests of the government and political distractions should not result in inaction on economic concerns.

Follow @timesonlinelk

comments powered by Disqus