News

Reforming unsustainable pension set to raise heat

View(s):By Nadia Fazlulhaq

A proposed contributory pension scheme could revolutionise the state sector, experts say. But, strong opposition has already emerged from unions.

This week, the Cabinet approved the “national contributory pension fund” for new state-sector workers and those who have been recruited after January 2016.

“The legal draftsman has been asked to prepare the draft bill and present it for any amendments. Once passed in Parliament, all new recruits to the government service will be included in the contributory fund,” a senior official at the Ministry of Public Administration said.

According to the proposal by President Ranil Wickremesinghe, 8 percent will be deducted from the basic salary of an employee and the employer will contribute 12 percent.

An independent entity governed by a board is to be established and a fund manager will be named.

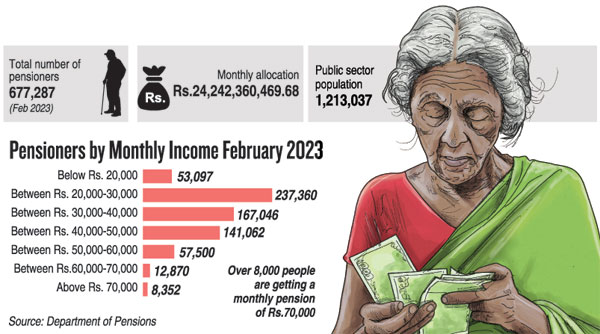

Central Bank statistics reveal that the public sector population is over 1.2 million (1,213,037) while the Department of Pensions said 677,287 receive a monthly pension. The Government last month spent Rs. 24 billion on pensions. While most pensioners receive a monthly income of between Rs. 20,000 and Rs 30,000, there are 8,352 retirees who get a monthly pension exceeding Rs. 70,000.

Dr. Tiloka de Silva of the department of decision science of Moratuwa University’s faculty of business said the public sector pension scheme is ‘expensive’ with the Government funding payments post-retirement through tax revenues.

“Pension schemes have always been a politically sensitive issue. It could be argued that our state sector pension is compensating for relatively low public sector wages. But this type of reform is inevitable. Many countries have phased out from defined benefit pension schemes like our present scheme,” said Dr. de Silva, who has researched Government pension expenses.

“While the impacts of the proposed scheme would need to be studied further, given that the pension is a drawcard for public sector employment, it is possible that the reform will reduce the queues for Government jobs and allow youth to explore more productive options in the private sector, and promote entrepreneurship and vocational jobs,” she said.

However, similar to the Employees’ Provident Fund managed by the Central Bank, the Government should ensure the fund is managed and invested responsibly.

W.A.L. Wickrama-Arachchi, secretary to the Sri Lanka Administrative Services Association said the proposal is being studied.

“Even before the International Monetary Fund (IMF) recommendations, a pension fund was discussed on the issue of managing state expenditure. A majority in the Government sector are civil service officers. So any changes in the salary and pension scheme will be analysed thoroughly and if there are negative impacts we will discuss them with the authorities,” he said.

But, most said they joined the Government service mainly for the pension.

M. Maddumage, a development officer from Kalutara, who was absorbed into the state sector in 2020, said despite an option to switch to the pension fund, she prefers the state pension due to the lifetime payout.

“Our salaries are low compared with the private sector, but the pension gives us financial security,” she said.

State-sector worker K. Perera, from Ratmalana said obtaining a lump sum is uncertain if not invested properly.

“The pension is an assurance that we have an income till death, and in some cases, if the beneficiary dies, the spouse gets the financial assistance or a disabled child. No pension fund will give this assurance,” he said.

State sector trade unions said protests will be mounted against the proposed contributory pension.

“This fund is the first move to abolish the pension scheme. The state sector, including teachers, plays an important role, and we serve for a meagre salary,” said Ceylon Teachers’ Union leader Joseph Stalin.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!