News

Skyrocketing coal prices aggravate power crisis

World coal prices are skyrocketing, aggravating an unprecedented crisis in the power sector which is already fighting to avoid electricity outages caused by insufficient foreign currency to secure fuel for various thermal plants.

The coal unloading season for the Lakvijaya coal power plant–when the seas are calm enough–is from October to April. Lanka Coal (Pvt) Ltd typically secured stocks annually through four spot tenders (of 300,000MT each) and a single-term tender of 1.2mn MT.

However, there were no bidders for the last two spot tenders called by Lanka Coal in 2021. The problem arose when suppliers asked for upfront payments–as news of Sri Lanka’s dollar crunch spread–for coal purchases instead of transacting through the usual method, which is letters of credit. It was compounded by a sharp rise in global coal prices. This made it completely unfeasible for Lanka Coal to buy the commodity in this manner.

Lanka Coal therefore recently called a fifth spot tender for 480,000MT and closed the deal at US$ 242 a tonne FOB leading to around US$ 272 a tonne with freight. This is the highest tender price received in the history of the CEB. But Lanka Coal says the price will later be adjusted based on coal market rates. The first shipment is expected next month.

Power sector sources point out that coal prices are, in general, “going sky high”. In the 2019/20 season, the average price of coal as purchased by Sri Lanka was US$ 89 a metric ton, authoritative sources said.

In the 2020/21 season it was US$ 84.49. But it rose sharply in the 2021/2022 season with the average price being US$ 167 a tonne (up to December 31). However, one shipment dated December 9 had a landed cost of US$ 232 a tonne, the highest in the CEB’s history. All these prices are without VAT.

“The cost of coal alone for a unit of electricity based on the received shipments is Rs 14/kWh,” the source said. “When overheads are added it would be over Rs. 18 per kWh (without loan interest paid by the Treasury).” These are estimates based on available information.

If the Government implements a partial float of the dollar, these costs will climb further. Meanwhile, various coal power plant units have suffered glitches leading, at times, to power supply interruptions. Lakvijaya’s Unit III is still under repair after the countrywide blackout on December 3, 2021, which caused a hydrogen leak inside its generator. It was earlier expected to be online by mid-January.

Adding to this is the “critical fuel situation for power generation” as flagged by the CEB to the Government–a shortage of dollars to import furnace oil. Peak hour power interruptions were experienced during the past few weeks, first when the Sapugaskanda power and the CEB’s power barge plant ran out of furnace oil and then when the Kelanitissa power plant could not secure diesel.

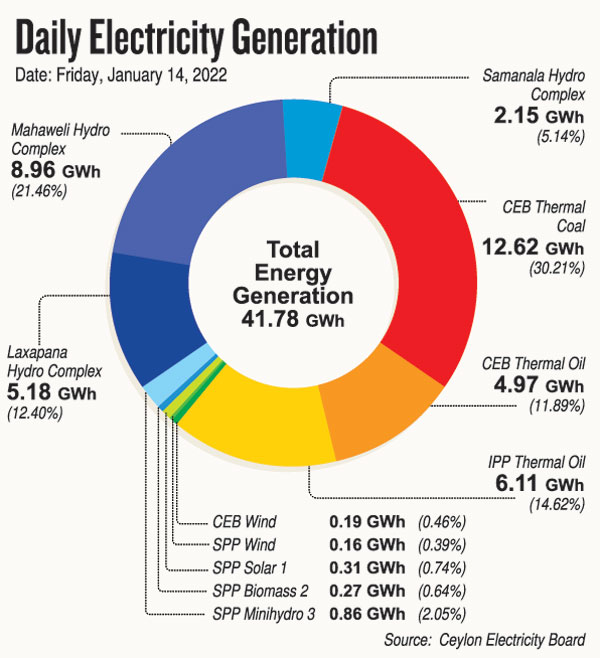

These shortfalls have led to the CEB drawing down heavily on its hydro resources. While nearly all the reservoirs were spilling in November, there was only 65 percent hydro availability by January 14.

“This is the lowest level in the last six years for mid-January whereas November 2021 showed the highest levels,” an analyst said. “So we went from the highest to the lowest in less than two months. Sri Lanka’s power sector is now affected on two fronts–generation capacity shortage and fuel shortage.”

More hydro is also being used because of the lack of oil and because several private power purchase agreements have expired. In 2019, Sri Lanka went through a major electricity crisis complete with power cuts. The analyst warned that this year was comparable, if not worse, as there was more hydro capacity that year in addition to private power plants that took up some of the burden.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!