News

Lower taxes for greater kicks dampen industry spirits

Government’s new taxes on alcohol discriminate against milder beverages, giving a competitive edge to stronger spirits, industry sources said this week.

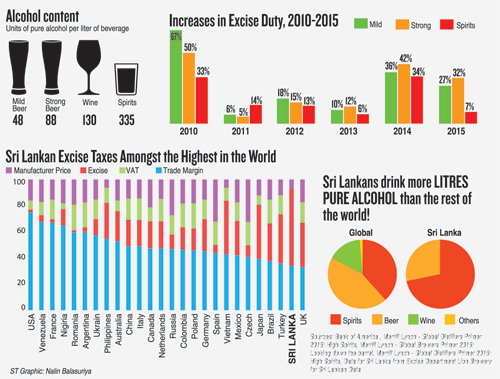

A similar trend has been observed over the past five years. The excise duty on mild beer was recently increased by 27%, strong beer by 32% and arrack by just 7%. In 2010, the excise duty on mild beer was increased by 67%, strong beer by 50% and arrack by 33%.

This tax regime could dissuade consumers from choosing milder drinks over strong spirits, industry sources said, adding that, the social implications of alcohol being well known. “Alcohol can be harmful,” said one leading player, “you need to look at it from the perspective of what is least harmful.”

From a global perspective, it is the accepted norm that a product with the least amount of alcohol is the least harmful. In Sri Lanka, there were primarily five types of products available: mild beer, strong beer, wine, arrack and toddy.

At less than 5% (4.8%), mild beer had the lowest alcohol content. Strong beer had more at 8.8%; wine had between 11% and 14%; and arrack had between 27% and 33.5% alcohol. Toddy was usually above 5%.

“When you look at it from the perspective of alcohol, you would expect Government policy to be formulated in a way where milder alcohol products are consumed more than stronger alcohol products,” the industry source quoted earlier said. “You would also expect to see that taxation is levied accordingly.”

“Ideally, mild beer would have the least tax and, as you go up the chain, the stronger beverages would have greater tax,” he explained. “When you look at it, Sri Lanka taxes mild beer the most. Over the last so many years, arrack got preferential treatment.

The increase in mild beer is the highest, in percentage terms, the increase in strong beer is next while arrack is the least.”

| Religious leaders go to court against issue of toddy licences for 2016The Colombo District Secretariat last month called for bids to rent out toddy licences for 2016, earning the ire of religious leaders who challenged the move in court. There is no guarantee that premises where taverns operated in 2015 will be available for use, the tender notice states. Successful bidders will be responsible for finding suitable premises and for securing a permit from the Excise Commissioner for such premises. The District Secretariat not being responsible for same. The relevant gazette, issued on September 18, 2015, states, taverns can stay open from 11 am to 2 pm and from 5 pm to 8 pm. An annexure lists out all the areas in which taverns could be operated. They span the entire Colombo district. Four religious leaders representing Buddhists, Hindus, Muslims and Christians have filed a Fundamental Rights petition against the Gazette. They contend that the proliferation of taverns would affect morality and disrupt the peace of neighborhoods, as well as negatively impact on families and children. They said the Colombo District Secretariat had acted without consultation. |