5-pronged strategy including tax hike to curb rising vehicle imports

Sri Lankan authorities, tackling an acute case of depleting foreign exchange reserves and a rising vehicle population, is resorting to a 5-pronged approach to cut imports and make vehicles costly to the population resulting in a likely 20 per cent cut in vehicle imports.

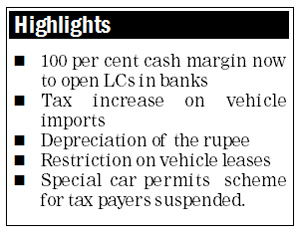

While a depreciating rupee in which the US dollar traded in the Rs.140-142 range this week from Rs. 134 flat a few weeks ago has made car imports costlier and restricted leasing facilities made it even more difficult to potential owners, an impending 100 percent cash margin for letters of credit (LCs), proposed hike in taxes and suspending car permits is seen plugging a hole in foreign exchange reserves.

While a depreciating rupee in which the US dollar traded in the Rs.140-142 range this week from Rs. 134 flat a few weeks ago has made car imports costlier and restricted leasing facilities made it even more difficult to potential owners, an impending 100 percent cash margin for letters of credit (LCs), proposed hike in taxes and suspending car permits is seen plugging a hole in foreign exchange reserves.

The special facility of car permits given to taxpayers whose income tax liability in respect of any period of five years of assessment of not less than Rs. 250,000 a year has also been suspended to curb vehicle imports. Economists say the country’s total debt has skyrocketed to Rs. 8.2 trillion ($58.7 billion), almost half of which is foreign debt.

The government’s annual debt servicing costs have now surpassed total government revenue, aggravating the country’s balance of payments problems. The trade deficit has increased to US$4 billion during the first six months of the year, a 15.6 per cent increase compared to last year.

The Government is to also re-impose a 100 per cent margin deposit requirement against the LCs opened with the commercial banks for vehicle imports, official sources said. “Accordingly, LCs for the importation of vehicles cannot be opened in commercial banks without a minimum cash margin of 100 per cent and this will affect motor traders badly specially small scale dealers,” Ashok L. Ganwani, Director Lekhraj Automobiles (Pvt) Ltd told the Business Times.

Small players will be affected greatly as they have to pay upfront the value of the vehicle which is a huge burden to them, he said, adding that they are being already battered with the currency depreciation. The high import bill is the main concern of the Central Bank (CB) with declining currency other than fuel cost (though it is low in current market) and exceeding traffic congestion, he said.

Whatever policy issues to be brought up in the near future for the interest of national economy only is to be shouldered at the expense of the community, he pointed out.He noted that vehicle importers will have to block large amounts of their money for LC’s till the landing of vehicles.

Earlier they had the facility of opening the LC with a part payment and the balance could be settled after the arrival of the vehicle, he added. Tilak Gunasekara, Managing Director of Sathosa Motors Plc, said the new margin facility should apply only for cars, not for commercial vehicles and buses. He said transport and logistics sector is important for the Sri Lankan economy as it impacts on the country’s transportation of agricultural produce from the fields to retail shops.

On leasing facility constraints, the CB imposed limits on banks and finance companies in which loans and leases of vehicles should not excess 70 per cent of the value of the vehicle compared to 100 per cent earlier. This was welcomed by Rajiv Gunawardena, Chief Executive Officer, Asia Asset Finance Plc, who said the move would have a positive impact on the finance industry as well as on the overall economy.

He noted that it will mainly affect first-time buyers and those who are looking for their second vehicle. It should not have an impact on those replacing their vehicles. Leasing and hire purchase loans of motor vehicles have been one of the biggest product portfolios for the finance industry; therefore in terms of business activity there will be an immediate impact until the market adjusts for the change.

However this will help to improve the quality of the vehicle loan portfolio in the longer term, he pointed out. Abans Finance Plc Managing Director Kithsiri Wanigasekera was of the view that this move could restrain future credit growth of Sri Lankan leasing and finance companies and also reduce bad loans and defaulters.

He noted that most of the finance companies are not allowing 100 per cent vehicle leasing facilities, therefore its impact will not threaten the industry.