News

Rising costs hit domestic aviation industry

It took off with aplomb after the war’s end but the domestic aviation industry is facing formidable challenges amidst rising costs.

Companies dependent upon air passengers are the worst affected. Those who run training schools are better off, though not much. Some airlines have now revised their targets and are expecting to break even later than anticipated. This includes Cinnamon Air, the only domestic airline that currently offers scheduled flights from Bandaranaike International Airport (BIA) to key tourist destinations. It is in its second year of operation.

“In the beginning, we were looking at a five-and-a-half year target to break even, because the numbers seemed achievable,” said Romesh David, Cinnamon Air Director. “Due to the slower start, we have revised it to six-and-a-half years, closer to seven.”

Companies such as FitsAir (formerly Expo Aviation) have suspended scheduled operations despite having flown profitably between Colombo and Jaffna in the past. Industry sources said the company was crippled by the Sri Lanka Air Force’s domestic airline, Helitours, which offers cheaper prices on the same route, uses in-house pilots, does its own maintenance and has tax benefits.

“They were seriously affected by the Air Force,” said a senior pilot, who did not wish to be named. “These were high density routes, mainly carrying Sri Lankan traffic to Jaffna and some to Trincomalee. It is really hard to compete with a 12-seater aircraft and all the overheads against a commercial operation by the military. Anybody who does not end up head-butting with the Air Force on their routes is lucky.”

But the travails of owning, maintaining and operating aircraft have not stopped still more parties from wanting to launch domestic private and charter services—if not scheduled operations. Fly Me (Pvt) Ltd, Richy Skylark (Pvt) Ltd., and F-Airways Ltd are the latest to have sought certification from the Civil Aviation Authority of Sri Lanka (CAASL). Meanwhile, IWS Aviation (Pvt) Ltd recently received approval and has imported one aircraft.

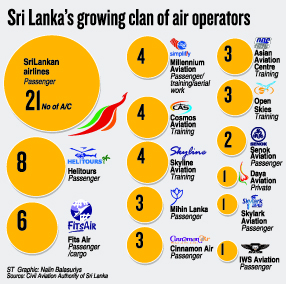

Once the new applications are passed, there will be a total of 17 air operators in Sri Lanka. These include SriLankan Airlines, Mihin Lanka and Helitours. Meanwhile, a haul of 64 civil aircraft are already registered in Sri Lanka—a hefty number for a small country. Of these, 21 are owned by SriLankan (with more on the way), three by Mihin and eight by Helitours. Several more are training aircraft belonging to private schools, as shown by our graphic.

Some companies and individuals are using their planes privately, or hiring them out on charters. Among these is Millenium Airlines (Ltd), a joint venture between a local firm and a Singaporean group of companies. But this is a limited, increasingly cramped market and others are certainly vying for a slice of the pie.

Take Cosmos Aviation (Pvt) Ltd, which started off as a flying school. One of its directors is Sajin de Vass Gunewardena, the Monitoring MP of the Ministry of External Affairs. It now conducts domestic charter operations and aerial work with three helicopters and one Piper Seneca twin engine aircraft. And it is only one of many.

“People consider it glamorous to own aircraft,” said an industry source, on condition of anonymity. “They see others flying and operating planes and they think it’s a lucrative business. Only when they enter the business and are asked to furnish various requirements, such as business strategies and feasibility studies, do they realise that it is neither easy nor profitable.”

The return on investment is less than three percent, admitted H.M.C. Nimalsiri, Director General of Civil Aviation. “Many factors have to be considered, unlike in other areas of investment,” he explained. “The industry is capital and labour intensive. It is safety sensitive and there are scarce resources, human or otherwise. The labour cost and fuel prices are high and there is not much demand locally.”

Domestic aviation is still considered expensive for average people, Mr. Nimalsiri continued. For now, it serves tourists and the business community. There is insufficient demand to operate schedules. Some fliers even use the smaller planes to accumulate flying hours. But the CAASL believes the industry must be promoted, despite the odds.

“We would like more and more aircraft to be brought in,” the Director General said. “Once they come, they have to be flown. There has to be maintenance. There will be an increase in activities, which we like to see.”

Several companies are operating flying schools. “We cannot say this is not lucrative but there may not be a constant supply,” the industry source earlier quoted cautioned. “People usually plan to join either SriLankan Airlines or Mihin. Whenever they advertise, aspirants get excited and try to obtain licences to align with the requirement.”

But the two carriers are mostly in need of captains, not necessarily cadets or first officers. “I think very soon that will also be saturated,” the source said. “SriLankan currently has 21 aircraft and this will increase to 30. If they have six sets of cockpit crew for each aircraft, I think they will be happy.”

Still, this does not account for the fact that SriLankan is routinely losing experienced crew to international airlines offering better financial terms and working conditions. Vacancies, though limited, will arise. At present, one of the biggest challenges faced by schools is spiralling overhead costs.

“Conducting an aviation college is difficult,” said Eleena Smith, Head of Marketing and lecturer at Asian Aviation, a 28-year-old flying school that was formerly known as CDE Aviation. “Overheads are high and fuel prices are really high. Even to land and take off costs us around Rs. 15,000 per flight.” But the schools provide a valuable service, producing Sri Lankan pilots at one-third of the cost of foreign institutions.

Meanwhile, there could be some momentum in the float planes sector. “This is where the demand is now,” said Mr. Nimalsiri. “If we bring in more up-market tourism, it will further improve. If we attract average tourists, this will not go up.”

The spending capacity of tourists, therefore, remains a key factor. And nobody knows it better than Cinnamon Air. “We started Cinnamon with the singular purpose of adding to the tourism infrastructure, to cater primarily to the tourist market,” said Mr. David. “It was an option for the higher spending tourist.”

Cinnamon introduced an amphibian operation out of BIA and operates a code-share with SriLankan Airlines. It has advertised in excess of 18 scheduled flights a week. “We fly even if there is one passenger,” Mr. David said. “But, yes, we planned to lose money and we are losing a lot of money. There are issues we are faced with. If they are addressed, we can mitigate those losses.”

“Fuel is a big number but something I think is kind of getting mitigated,” he continued. “The big cost is also hiring foreign pilots for the type of aircraft we fly. They are a rather scarce commodity and are mostly North American and European. SriLankan, when it employs foreign pilots, does not pay tax.”

The partners of Cinnamon have invested over US$10 million in the three float planes. They hope to build a pool of Sri Lankan pilots and have taken significant other steps—including investing heavily in backend operations—to make the venture viable. But it has taken time to spread the word. They still fly with 28-30 percent load factor when 65 percent is needed just to break even.

“It has to work,” Mr. David enthused. “All the assumptions we made are still valid. We think it’s just a matter of time.” He also believes that helicopters will be in demand in future.

FitsAir Consultant Azad Thowfeek said their business had been badly hit by the start of road transport to the north. He did not assign blame on Helitours. “Most passengers started taking the road,” he recalled. “We thought it was time to change the equipment from our large 52-seater aircraft to a brand new 12-seater. We were hoping it would suit the market. But after two years and taking a heavy beating, we stopped in March this year. We could no longer take US$30,000 to US$50,000 losses a month.”

Operating costs had been an issue, as had financing and crew salaries. Today, FitsAir runs an international cargo operation and also has some equipment based out of Sri Lanka. “When we were starting out, there was a big hype about tourism and that millions would come into the country,” Mr Thowfeek said. “But are these people who will pay such money?”

Sadly for the domestic aviation industry, the answer remains a “no”.