News

Foreigners heavily involved in scams, frauds and passing counterfeit currency

A businessman and regular overseas traveller, last month received an email that he was a winner of the ‘Barclays Mega Fortune Award’ in UK, and was entitled to a lottery prize money of 700,000 Pounds, or over Rs 140,000 million.

The businessman believed that it was from a draw at the Singapore airport, as only recently, he had purchased over US$ 100 worth of liquor, and was entitled to two draws.

“I purchase lotteries overseas and also take part in various competitions which have many draws. I was happy that one of them had eventually brought me a large prize money,”the businessman who wished to remain anonymous, told the Sunday Times.

The businessman responded to the email and sought further information on how he could collect the prize money.

“I received another email saying that one of their representatives would be visiting Sri Lanka to hand over the money. However, I was told that I would have to pay a tax of 700 Pounds, or Rs 142,000, as an initial deposit, enabling the representative to bring the money into the country,”he said.

He was told that he will also be entitled to a free ticket and accommodation in London, to participate in a TV programme regarding the lottery win.

“Thereafter, I received a call from a local number saying a representative had already arrived in the country, and that, I should deposit the money required in a local bank account. I was told to deposit Rs 100,000, and the rest later. However, I had only Rs 30,000 at that time, and wanted to deposit that amount,”he said.

‘When I was close to the bank, I received another call. They told me that they were monitoring my movements through a GPS (Global Positioning System). It immediately raised some doubts. Thereafter, I decided to inform the Cyber Crime Division of the Criminal Investigations Department,”he said. The businessman acting on the CID’s instructions, returned the call saying he was now willing to deposit Rs 100,000.

“Accordingly, I was told to deposit Rs 100,000 and withdraw the money immediately. I was told to email the deposit slip, to give the impression that the money had been deposited. Thereafter, I had no communication with the persons,”he added.

The CID which had taken over the investigations, tracked down first suspect by tracking down his location through the mobile phone. Two others were also arrested.

It was thereafter that the CID became aware that two Nigerian nationals residing in Sri Lanka were involved in the rackets. Raids carried out on their rented homes found they were in possession of 22 mobile phones, 18 SIM cards and a laptop among other items.

Further investigations carried out by the CID revealed that the two Nigerians were part of a gang of two other Nigerians already in custody for a similar racket.

“The modus operandi of the suspects are that, when they are arrested after committing a fraud, they inform courts that they could pay back the money in installments. Thereafter, they get their visa extended and continue to commit the same fraud,”a senior CID official involved in the investigations said.

One of the Nigerians arrested recently was out on bail. The other two Nigerians were arrested trying to exchange fake dollar notes to three businessmen.“The Nigerians initially make contact with a businessman and inform him that they have dollar notes, but warn them that the notes will be disfigured within a six-month period . They offer the dollar notes for half the price,”he said. “Thereafter, they offer the businessmen any of the notes to take with them and get it changed from any place.

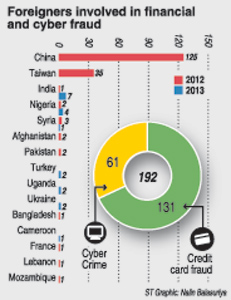

The notes are in fact genuine and therefore, they have no problem getting it changed. However, when they return for the second time, they mix the bundle of notes with ordinary paper, and vanish soon after the transaction is carried out,”the officer said. A series of cases where foreigners have been involved in credit card scams and financial frauds, have been reported with at least 176 arrested since January last year. Most of them arrested have been Chinese with 108, followed by 35 from Taiwan. The other arrests include India (8), Syria (4), and two each from Afghanistan, Pakistan, Turkey, Ukraine and Uganda.

“Our experience is that foreigners involved in crime, who are arrested and released on bail, continue to engage in the same crime. The best thing would be to deport them soon after they are arrested, as their continued stay only helps them to continue their criminal activities,”a senior CID officer said. “They could be harmful to the country’s economy as well, as they take money out of the country,”he added.

comments powered by Disqus