Columns

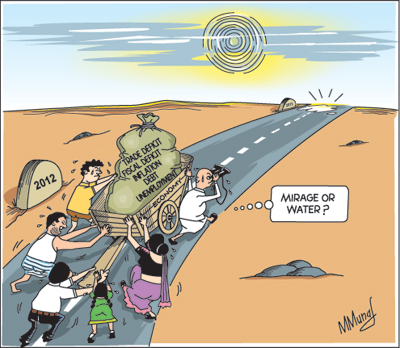

External and internal shocks rock the economy in 2012

View(s):The economy took a downturn in 2012 owing to severe external and internal shocks. These affected economic growth, the trade balance and fiscal outturn adversely. Economic growth is likely to dip below 7 per cent this year from the higher trajectory of 8 per cent planned for the country.

The global economic depression and the turmoil in the Middle East affected the country’s trade balance unfavourably. Exports fell more steeply than imports to result in a huge trade deficit for the second successive year.

Drought and floods depressed agricultural production. The decrease in tea and paddy production, lower generation of hydro power, reduced output of the oil refinery and decreased industrial production depressed economic growth.

Economic growth

Owing to these reasons the rate of economic growth is likely to plunge below 7 per cent from the 8 per cent growth recorded in 2010 and 2011. The decrease in tea and paddy production, lower generation of hydropower, reduced output of the oil refinery and decreased industrial production are likely to result in a rate of economic growth of about 6.5 per cent. The Department of Census and Statistics expects the economy to grow by around 6.7 per cent this year.

The slowing down of the economy is amply exemplified by the third quarter’s official estimates of GDP that revealed an economic growth of only 4.8 per cent in the third quarter of 2012, compared to 8.5 per cent a year earlier. Growth in the third quarter of this year was significantly lower in most sectors. Agriculture contracted by 0.5 per cent, while Industry grew 7.3 per cent compared to 10.8 per cent last year and services grew by 4.6 per cent down from 7.8 per cent in the third quarter of 2011.

Positive developments

The bright spot in the economy was the boom in tourism. One million tourists visited the country and likely to have brought in over US$ 2 billion. The boom in tourism has also had beneficial impacts on other related sectors. Increasing inflows of tourist earnings and workers’ remittances cushioned the large trade deficit and averted a serious balance of payments problem by offsetting about 70 per cent of the large trade deficit of about US$ 9 billion. Apart from its beneficial impact on the balance of payments, the tourist boom has had beneficial backward linkages to the gem and jewellery trade, travel and other services.

Trade deficit

The massive trade deficit of nearly US$ 10 billion in 2011 created a severe strain on the balance of payments that necessitated a large depreciation of the currency, high tariffs on consumer goods, increase in interest rates and restrictions in credit from the early part of this year that led to a curtailment of imports in the first ten months of this year. However, the decline in export earnings were steeper and consequently the trade gap widened to US$ 7.2 billion by the end of October. The trade deficit is likely to be about US$ 9 billion this year.

At the end of the first ten months of the year, export earnings fell by 8 per cent with tea exports decreasing by 6 per cent. Industrial export earnings decreased by 7 per cent with garments exports declining by 5 per cent. While tea exports improved in September and October, garments exports have been declining throughout year.

Despite an imminent large trade deficit of about US$ 9 billion this year, the Central Bank expects a balance of payments surplus of US$ 380 million based on expectations of higher workers’ remittances, tourist earnings, other service earnings, foreign direct investment and net inflows of capital to the stock market.

Whether these expectations would be realised, time will tell. Even if this were to be so, the lesson from the trade performance of the last two years is that the country cannot go on spending so much more on imports than it could earn from exports. Imports are nearly twice exports.

This fundamental disequilibrium has to be addressed by both decreased expenditure on imports and an increase in exports.

No doubt this year’s export earnings were severely affected by the slow growth of western economies that are our main markets for manufactured exports. The denial of the GSP Plus concession is also hurting exports to Europe. As a result, exports of manufactures fell 7.6 per cent in the first ten months. The turmoil in Middle Eastern countries and the US ban on trading with Iran, the country’s second biggest market for tea and main supplier of crude oil, aggravated the trade balance, both by decreasing tea export earnings and increasing oil import expenditure.

Foreign investment

While the external and internal shocks played a major role in depressing growth, the inability to promote major investments affected the capacity of the economy to maintain a high trajectory of growth. This is especially so with respect to foreign direct investments that is inadequate to spur higher exports. The expectation that foreign direct investments would flow after the end of the war has not materialised as the investment climate in the country is not deemed satisfactory. Major investments have been mainly in building hotels.

Increasing exports by diversifying export products and export markets is the long term solution. Increasing export volumes and products require a climate conducive to investment in export industries. Foreign investment in export industries is a key to this. However, the country has failed to provide an attractive and conducive investment climate to draw in adequate foreign direct investment, except in the hospitality trade. It would be difficult to develop such an investment climate without a policy framework that ensures security for investments. The law and order situation and social unrest are not conducive to attracting foreign investment.

Fiscal consolidation

Containing the fiscal deficit to the planned targets is vital for economic stability and long-term economic growth. Containing the fiscal deficit at 6.2 per cent of GDP this year is a daunting task as the fiscal deficit reached 6.44 per cent of GDP at the end of September. Government expenditure grew nearly twice as fast as revenue growth. Only a substantial increase in revenue and a severe curtailment of expenditure can achieve the target. The Treasury maintains that this would be achieved in the last quarter of the year. Expenditure cuts particularly in infrastructure projects that are being carried over to next year; increased receipts from dues from state enterprises; and increased inflows of revenues in the last quarter are expected to enable the fiscal deficit to be contained at 6.2 percent.

Inflation

Price stability is a cornerstone for economic growth. A fair degree of price stability was achieved this year despite the depreciation of the currency, higher import taxes on basic commodities and the drought. However the November inflation figure of 9.5 per cent is a sign of accelerated inflation and a matter of concern.

Looking ahead

Economic concerns have been of lesser interest than the political distractions during the year. Policy makers are distracted, among others, by the impeachment issue, conflict between the legislature and judiciary and the repeal of the 13th amendment of the constitution. Foreign policy lacks a focus on improving of trading with countries that matter. Being an export dependent economy it is vital that the country’s economic policies are directed towards improving export earnings. Dependence on worker remittances and other capital inflows to bridge the trade deficit may not be a viable proposition in the long run.

Follow @timesonlinelk

comments powered by Disqus