Columns

Economic challenges of an uncertain and unpredictable international environment

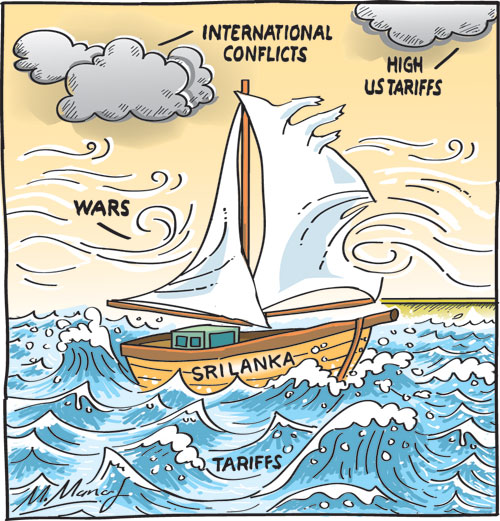

View(s): The unpredictable and changing international environment is not conducive for the growth of Sri Lanka’s trade-, tourism- and remittance-dependent economy. The multiple conflicts around the world, especially in West Asia, and the uncertainty in US tariffs render the country’s external trade and finances highly unstable and vulnerable.

The unpredictable and changing international environment is not conducive for the growth of Sri Lanka’s trade-, tourism- and remittance-dependent economy. The multiple conflicts around the world, especially in West Asia, and the uncertainty in US tariffs render the country’s external trade and finances highly unstable and vulnerable.

International economy

The world is on the verge of several wars that could erode the country’s foreign earnings. Higher prices for our essential imports of oil, food and fertiliser; disruption of the flow of tourists to the country; reduced exports owing to higher tariffs and international tensions; and a fall in remittances, if the West Asian region becomes insecure, are severe economic threats.

International tensions

There are no signs of an easing of international tensions on the horizon, or, to change the metaphor, light at the end of the dark tunnel of international conflicts and arbitrary tariffs. In fact, there could be outbreaks of conflicts in other regions of the world, such as between China and Japan—a conflict that could adversely impact our trade.

Merchandise exports

The recent imposition of a 25 per cent import duty on our tea imports to the US because of our trade ties with Iran is illustrative of difficulties we may face in the coming months.

US tariffs

Already we are facing higher US import duties on our exports to the US. Currently we are facing the impact of high reciprocal tariffs imposed by the United States. Even after our negotiations with the US last year, we are facing significant disadvantages in tariffs compared to our regional trade rivals.

Tariffs

After negotiations, our exports to the US face a 30 per cent tariff. This rate was negotiated down from an initial rate of 44 per cent imposed in April 2025.

Competitors

Despite this reduction, Sri Lanka’s 30 per cent tariff remains higher than that of competitors like Vietnam at 20 per cent and India at around 25 per cent. It is slightly lower than the tariffs on Bangladesh—30-37 per cent. Apparently the government is continuing to negotiate with the US, but in the current context there is little prospect of a reduction. In fact, the US could impose import taxes for various reasons, as it did recently in imposing an import tax of 25 per cent on our tea imports to the US.

Apparel exports

The most affected export to the US, accounting for nearly 40 per cent of our exports, is apparel. The 30 per cent duty could lead to substantial losses in export earnings this year. Furthermore, there could be thousands of job losses. It is therefore imperative to seek new markets.

Rubber

Facing severe contraction, US-bound exports are projected to decline by as much as 63% under high-tariff scenarios.

Tea

While bulk tea is less impacted, value-added products like branded retail packs have seen a sharp rise in landed costs, reducing their shelf appeal in American markets.

Sri Lanka’s import-export-dependent economy is facing threats and challenges of an uncertain and unpredictable international economic environment. The wars in West Asia, unpredictable tariffs, sanctions, transport disruptions, additional tariffs, higher import costs and increased import needs are severe threats to the country’s economic recovery.

Imports

Higher import costs and lower export earnings could result in a further widening of the trade balance. Hopefully, the country’s main sources of foreign earnings—remittances and tourist earnings—will continue their upward trend.

Oil Prices

International oil prices fell this week but could rise sharply if conditions in West Asia and Venezuela restrict oil exports and shipping is disrupted.

Merchandise exports

In 2025 merchandise exports reached a record US$ 8 billion in spite of higher tariffs. This may have been due to exporters rushing goods into the US. The full blast of the higher tariffs is likely to be felt this year. This is especially so for our main export to the US—manufactured garments. In addition, the US has imposed an additional 25 per cent tariff on our tea exports to the US. While this may not affect our tea exports by much, the sanctions on our trade with Iran are of much concern.

Tea for oil

The important trading partnership with Iran could affect our exports and imports. Iran is an important trade partner, as we have the tea-for-oil agreement with it. Iran accounts for about 25 per cent of our tea exports. Even more important is the fact that we import our crude oil for our refinery from Iran for payments from tea exports.

As far as our tea exports are concerned, we may be able to increase our exports to other West Asian countries.

Oil prices

The future of oil prices is difficult to predict in the current developments in Venezuela and West Asia. The recent drop in oil prices may be a temporary phenomenon. It is likely to be followed by a hike in oil prices. We would be affected by an increase in oil import prices, as well as by our inability to refine oil in our refinery, which is better suited to process Iranian crude. An increase in international oil prices would also increase prices of our imports of fertiliser and food.

Remittances and tourism

The implication of these adverse movements in our trade is that our dependency on rremittances, tourismand exports of ICT services would be enhanced. If conditions in West Asia deteriorate. This could affect remittances adversely.

Summary and conclusion

The Sri Lankan economy is, has been and will be heavily dependent on external trade, tourism, and remittances. This makes the country’s economy highly vulnerable to a range of external shocks that destabilise the economy by impacting on the balance of payments, inflation, and foreign exchange reserves.

Sharp increases in the prices of essential imports such as petroleum, food and fertiliser have a major adverse impact on the trade balance and domestic inflation. Conversely, a decline in prices for key exports like tea and rubber also negatively affects export earnings and the terms of trade.

Hopefully, there would be a return to sanity in international affairs and tariff policies that would not disrupt the country’s trade and foreign earnings.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment