HNB says wise asset and liability management practices helped growth

View(s):Prudent Asset and liability management practices coupled with the timely re-pricing of the bank’s loan book and a simultaneous healthy growth of 17.3 per cent in net advances last year enabled a strong growth in income from Core Banking, HNB has said.

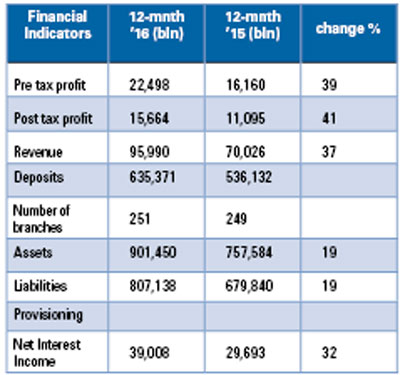

Net Interest Income for the year grew by 30.5 per cent to Rs. 34.4 billion, which is a substantial improvement over the 5.8 per cent growth reported in 2015 while the Net Interest Margin for the bank stood at 4.3 per cent, compared to the industry average of 3.6 per cent.

Growth in net interest income was well complemented by a strong performance in Fee and Commission income which grew by 22 per cent to exceed Rs. 7 billion. “Credit Cards along with Trade Finance, Guarantees and Remittances continued to be the main contributors towards this growth. HNB’s strategic focus on offering ultimate convenience and new experience to its clientele through a comprehensive digital banking proposition proved to be successful as the Bank witnessed strong growth in fees from digital banking products and services,” a HNB media release said.