Mobile number portability desirable or not?

Many users of telecom services in Sri Lanka after a while tend to stick with their respective mobile service provider. This tends to be the case even when rival service providers offer attractive incentives such as free minutes, free messaging, etc. One reason for this is due to the lack of number portability which means subscribers having to give up their existing mobile number when switching from one service provider to another. At the same time, the case for switching service providers is less clear cut as the use of services within the network (calls/messages to people who belong to the same network, known as on-net) is priced at a discount when compared with using the service outside of the network (Off-net). While Internet-based communication channels such as Whatsapp or Viber can alleviate the lack of number portability, consumers in general wish to avoid the hassle of switching their telecom service provider due to the inability to retain ones existing mobile number.

Negatives in number portability

Apart from the explicit connection fees associated with switching from one service provider to another as well as the favourable rate given for voice and text services made within the network, the lack of number portability represents an implicit cost to subscribers. This causes friction which results in consumers being disinclined to shift from one service provider to another (in telco parlance this is known as a decrease in churn rate). This switching cost tends to be greater for businesses as a change in its contact numbers could even result in a loss of potential revenue.

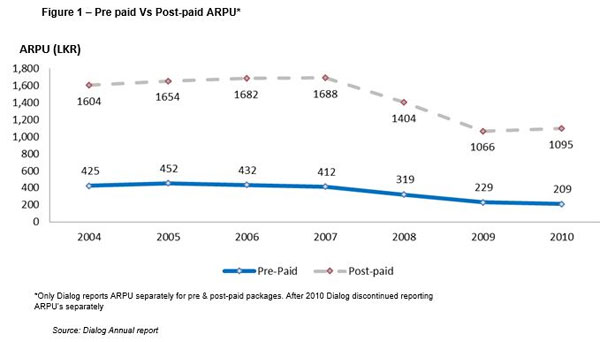

Based on what has been observed in other markets, firms tend to exploit this situation by charging high monthly rentals for their services. This can be observed to a certain extent by the fact that the Average Revenue Per User (ARPU) is higher for postpaid packages in comparison to pre-paid packages (Figure 1)

I have primarily focused on Dialog Axiata as it is the only service provider that consistently discloses information that can be independently verified as it is a listed entity.

Mobile number portability – potential solutions

An established solution to this problem is to introduce Mobile Number Portability (MNP) which allows consumers to retain the same mobile number when switching from one service provider to another. The implementation of such systems in most developed markets has shown to lead to a net benefit in the form of lower prices for consumers, higher competition and an increase in market efficiency and welfare.

These findings did go unnoticed by the Telecommunications Regulatory Commission of Sri Lanka (TRC) who in 2010 conducted a feasibility study to look into the possibility of implementing MNP in the fast growing telco market in Sri Lanka. However, in 2012 the TRC decided to scrap its plans to implement MNP in Sri Lanka citing various reasons.

I argue that this was the right call to make by the regulators given some of the unique characteristics of the telco market in Sri Lanka

Why MNP won’t be as effective in Sri Lanka

The telco market in Sri Lanka can be characterised as a budget market where most firms mainly compete on price by offering the most competitive tariffs for voice and messaging services. Consumers in such a market are more price sensitive and place less emphasis on value added services such as Mobile Internet, Mobile Banking, etc. Consumers are also much more aware of the difference in pricing between off-net and on-net services and hence would choose the provider that offers the most cost-effective rates. Therefore tariff rates offered by telco firms are likely to be set competitive. This can be clearly observed in Figure 2 where firms set tariffs close to the prevailing floor tariff rates.

Popularity of pre-paid packages

Over 90 per cent of the mobile subscribers in Sri Lanka have a pre-paid mobile connection which is in line with the budget network model. Pre-paid subscribers face no monthly rental charge which is the main tools used by firms to exploit their market power arising from the lack of portability. Hence any benefit from MNP is unlikely to accrue to the majority of subscribers as tariff rates offered for voice and text messaging services is likely to be already competitively priced.

Likely impact of MNP – Consumers

As previously argued, pre-paid customers are unlikely to witness a reduction in their effective cost of telco services, as the current tariffs offered may already be competitively priced. In fact the effective cost to pre-paid customers may in fact increase as the unified tariff price that is offered for both on-net and off-net services is likely to be higher than the prevailing discounted price offered to on-net services.

Hence the main beneficiary of the implementation of MNP is likely to be post-paid subscribers who are likely to see a drop in monthly rental rates. In the case of Sri Lanka, the majority of post-paid customers tend to be firms. While arguments may be made as to whether the use of telco services by businesses is more “productive” than its usage by retail consumers, given the current composition of the subscriber base in Sri Lanka which is skewed towards pre-paid customers, the overall impact of the implementation of MNP is likely to be negative for consumers.

Telcos

With the implementation of MNP, telco firms are also likely to see an overall reduction in industry profits. On the revenue side, firms are likely to see a decrease in contribution from the post-paid customers with the decline in rental rates. Contemporaneously, the enhanced competition amongst service providers is likely to place greater pressure on margins. Further, the telco operators may have to partly or fully bear the cost of building and maintaining the infrastructure necessary for the implementation of MNP. The feasibility study conducted by the TRC is 2012 estimated that the cost of implementing MNP in Sri Lanka would exceed US$96 million (Sunday Times, 11th Nov. 2012 <http://www.sundaytimes.lk/121111/business-times/common-use-mobile-number-proposal-rejected-trc-19471.html> <http://www.sundaytimes.lk/121111/business-times/common-use-mobile-number-proposal-rejected-trc-19471.html>).

Better way forward

– Unified tariffs

It is clear that TRC at the time made the correct decision by rejecting the implementation of the MNP taking into account the peculiarities of the Sri Lanka telco market. As an alternative, I believe that the TRCSL’s recent decision to introduce a single common floor tariff for both on-net and off-net services effective from 1st of February 2016 (Daily Mirror, 20th January 2016) is a step in the right direction. The decision while it does not have the full benefit of number portability, brings about one of the beneficial effects of MNP which is a unified tariff which would reduce the price distortion between off-net and on-net services and hence reduces the cost of switching from one service provider to another. This would improve efficiency as it would encourage consumers to move to their most desired service provider. It is clear that under the new tariff regime, most firms have followed suit and introduced a uniform tariff which is set close to the stipulated floor tariff rate (Figure 4).

From the firm’s point of view, while this would increase the level of competition, it would also encourage firms to focus on developing and promoting their value added services in order to differentiate their product offerings. Hence the overall impact of the introduction of a common floor tariff regime is likely to be a net positive.

(The writer is Vice President at Frontier Research (Pvt) Ltd. He can be reached on travis@frontiergroup.info. The opinions expressed in this article are the author’s own and does not reflect the views of his company).