Remuneration of directors of banks under CB review

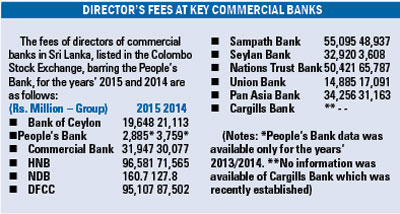

The notion that banks’ and finance company directors in Sri Lanka are wildly overpaid, is indeed becoming true.

The notion that banks’ and finance company directors in Sri Lanka are wildly overpaid, is indeed becoming true.

The Central Bank (CB), in a possible bid to better monitor salaries to enhance corporate governance of this sector, has written to all banks to send details of the remuneration of their directors.

CB Governor Arjuna Mahendran told the Business Times that the regulator wants the financial sector entities to contain their costs and limiting fixed costs such as high director salaries was one way to do it.

”For an example, an entity’s cost to income ratio shows a company’s costs in relation to its income. It is an efficiency measure that shows how efficient an entity is run and the lower it is, the more profitable a company is. But when costs are high, its profitability drops. So with high directors’ salaries as fixed costs, the profitability drops, which is what we aim to curtail,” he explained. He added that a recent example was the exorbitant salaries of the primary dealer (Entrust) which the CB took over in January.

Salaries in commercial banks as well as finance firms are trending upwards, with directors receiving increases that are unprecedented, a depositor said adding that as a regulated industry, the CB has the right to monitor the salaries of directors. He said that some shareholders complained that not only were directors setting their own compensation, but that the amount paid to banks directors was huge and not in sync with economic realities. “Many say that it is necessary to prevent them from stealing depositors’ money, and also in view of the amount of work they have to do to generate earnings for their banks.”

A second depositor told the Business Times that taking into consideration the economic decline, many think the banks can equally cut the package they take home to mirror the present economic realities.”There are some allowances for banks’ executives that need to be cut down or completely removed. It is time for companies to tighten their belts given the crisis which had affected the country’s income,” he said.