News

It’s a question of this or that for families struggling to meet daily expenses

Many can only afford to buy small quantities of vegetables. Pix by Eshan Fernando

Rising prices amid falling incomes and slashed salaries are pushing more and more families to the brink of misery with many complaining they are unable to meet their immediate living expenses.

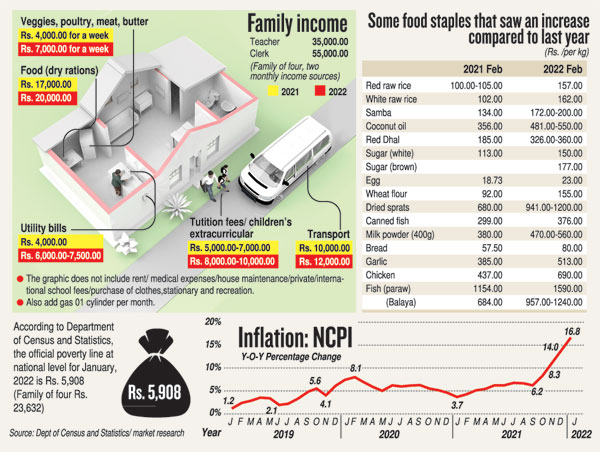

The inflation rate increased to 16.8 percent in January from 14 percent in December 2021. Food commodities accounted for 11.44 percent of January’s inflation.

According to the Census and Statistics Department, the National Consumer Price Index (NCPI) increased to 166.0 in January from 161 in December 2021. The NCPI — with its 2013 base year figure set at 100 — measures the total consumption expenditures of Lankan households in both food and non-food categories. Price increases in rice and powdered milk led the food category while transport, utilities, housing and private medical costs led in non-food groups.

S. Kanagratnam, an accountant

The country’s staple food, rice, has seen a sharp increase in prices compared to last year with red raw rice which was Rs. 100 a kilogramme in February last year, being sold at Rs. 157 while white raw rice has increased from Rs. 102 a year ago to Rs. 162. Samba prices at present range between Rs. 172 and 200 whereas the prices were around Rs. 130 last year. Red Masoor dhal which was Rs. 185a yearago is today Rs. 320-360. In February last year, a kilo of sugar was Rs.113 but today it is Rs. 150 with brown sugar being sold at Rs. 177. (Please see graphic for price comparison.)

People say they are being hit from all sides and now power cuts and fuel shortages are adding to their distress. Most people we spoke to said they had cut down some of their essential expenses or sell household items to cope with the rising cost of living.

The Department of Census and Statistics has fixed the poverty line at national level for January, 2022 at Rs. 5,908 a month, meaning those who earn less than this amount a month are considered to be living below the poverty line.

Prof. H.M.W.A. Herath, Head of the Department of Economics at the University of Peradeniya

“It is impossible for a person to survive with Rs. 6,000 a month. The cost of living is such that even Rs.50,000 is not enough to run the month as the prices of most basic items are now beyond the reach of the ordinary people. Most people had used up their savings during the last two years to cope with the financial difficulties during the past two years of the pandemic. Now with zero savings, we are struggling to manage family expenses with what we earn,” said Chandra Perera, a Nugegoda three-wheeler driver.

Priyanthi Silva, a mother of three young children from Kottawa, said every item had gone up in price and she dreaded going to the market to buy vegetables and other provisions for the week.

For those who have to pay house rents, housing loan instalments and school and tuition fees, meet higher education expenses of their children in addition to the transport costs, the choice is between this or that.

S. Kanagratnam, an accountant by profession, said he had sought help from an overseas relative to sponsor his daughter’s higher education.

“My salary lasts for about ten days. After paying loans, purchasing monthly provisions and paying the bills, I am left with a meagre amount to meet transport costs,” he said.

Prof. H.M.W.A. Herath, Head of the Department of Economics at the University of Peradeniya said the people should be ready to face more price shocks in the coming months because the fuel shortage and the financial crisis would cause the inflation to go up.

Chandra Perera, a Nugegoda three-wheeler driver

“The Central Bank increasing policy rates will have little impact in bringing down the inflation,” he said, adding that the Bank printing 1.4 trillion rupees by the end of year 2021 was one of the key reasons for the high inflation.

The professor also said Russia and Ukraine being oil and gas producing countries, the conflict between the two nations would have a severe impact on countries hit by the economic crisis during the pandemic.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!