Strategic Partnerships to Rebuild the Economy – POST COVID 19 “THE NEW NORMAL OF BUSINESS”

View(s):We are on a Temporary pause due to the 2nd Wave of Covid19. By now, everyone knows that the shattering impact of COVID-19 has brought on a business crisis without precedent in recent memory. On one level, though, the pandemic represents nothing new. For years, we have been hearing and talking about the “VUCA” (volatility, uncertainty, complexity, and ambiguity) world.

- Chathura Ganegoda BSc (USJP), MCIM (UK), MBA(UOC)

Regardless, the pandemic will fundamentally reshape how we do business from now on. Even if lockdowns end soon and the virus is stubbornly suppressed never to return, its effect will remain.

In many cases, business foot trac was reduced overnight. Entrepreneurs who are fighting for survival are now looking for new and innovative ways to keep their businesses open. As business owners navigate this chaotic time, many have chosen to embrace beneficial partnerships as a strategy to keep their doors open. In many cases, these synergies are proving to be a much more effective way to run their business.

What is Strategic Partnership?

Strategic alliance (aka strategic partnership) is an agreement between two or more parties to pursue a set of agreed upon objectives needed while remaining independent organizations. A strategic alliance will usually fall short of a legal partnership entity, agency, or corporate affiliate relationship.

Typically, two entities form a strategic alliance when each possesses one or more business assets or have expertise that will help the other by enhancing their businesses. Strategic alliances can develop in outsourcing relationships where the parties desire to achieve long-term win-win benefits and innovation based on mutually desired outcomes.

This form of cooperation lies between mergers and acquisitions and organic growth. Partners may provide the strategic alliance with resources such as products, distribution channels, manufacturing capability, project funding, capital equipment, knowledge, expertise, or intellectual property.

Types of Strategic Partnerships

Horizontal strategic alliances – Which are formed by firms that are active in the same business space. That means that the partners in the alliance used to be competitors and work together to improve their position in the market and improve market power compared to other competitors. Research &Development collaborations of enterprises in high-tech markets are typical Horizontal Alliances.

Vertical strategic alliances – which describe the collaboration between a company and its upstream and downstream partners in the Supply Chain, that means a partnership between a company its suppliers and distributors. Vertical Alliances aim at intensifying and improving these relationships and to enlarge the company’s network to be able to offer lower prices. Especially suppliers get involved in product design and distribution decisions. An example would be the close relation between car manufacturers and their suppliers.

Vertical strategic alliances – which describe the collaboration between a company and its upstream and downstream partners in the Supply Chain, that means a partnership between a company its suppliers and distributors. Vertical Alliances aim at intensifying and improving these relationships and to enlarge the company’s network to be able to offer lower prices. Especially suppliers get involved in product design and distribution decisions. An example would be the close relation between car manufacturers and their suppliers.

Intersectional alliances – These are partnerships where the involved firms are neither connected by a vertical chain, nor work in the same business area, which means that they normally would not get in touch with each other and have totally different markets and expertise.

Joint ventures – in which two or more companies decide to form a new company. This new company is then a separate legal entity. The forming companies invest equity and resources in general, like expertise. These new firms can be formed for a finite time, like for a certain project or for a lasting long-term business relationship, while control, revenues and risks are shared according to their capital contribution.

Equity alliances – which are formed when one company acquires equity stake of another company and vice versa. These shareholdings make the company stakeholders and shareholders of each other. The acquired share of a company is a minor equity share, so that decision making power remains at the respective companies. This is also called cross-shareholding and leads to complex network structures, especially when several companies are involved. Companies which are connected this way share profits and common goals, which leads to the fact that the will to competition between these firms is reduced. In addition, this makes take-overs by other companies more difficult.

Non-equity strategic alliances – which cover a wide field of possible cooperation between companies. This can range from close relations between customer and supplier, to outsourcing of certain corporate tasks or licensing, to vast networks in R&D. This cooperation can either be an informal alliance which is not contractually designated, which appears mostly among smaller enterprises, or the alliance can be set by a contract.

Operations and logistics alliances – where partners either share the costs of implementing new manufacturing or production facilities or utilize already existing infrastructure in foreign countries owned by a local company.

Marketing, Sales and service strategic alliances – in which companies take advantage of the existing marketing and distribution infrastructure of another enterprise in a foreign market to distribute its own products to provide easier access to these markets.

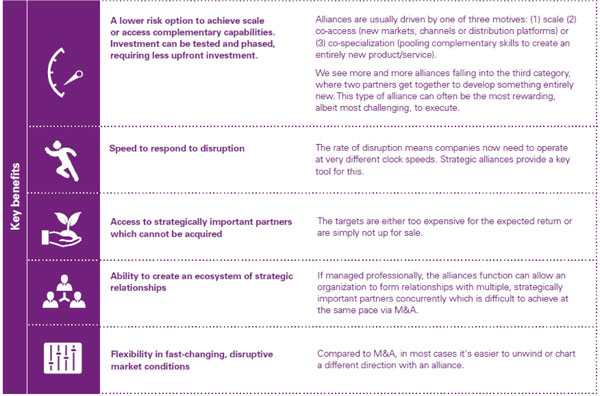

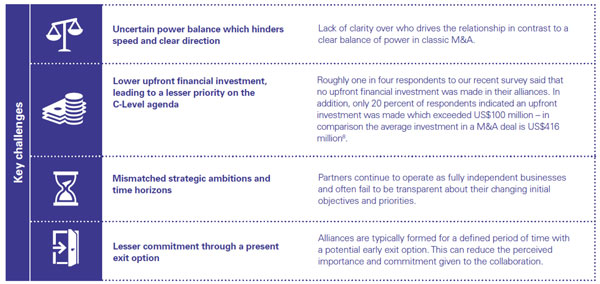

Key Benefits of Strategic Partnerships Figure 1 Key benefits of Partnerships – Source: KPMG Key Challenges of Strategic Partnerships Figure 2 Key Challenges of Partnerships – Source: KPMG

The Route to Success

As per the KPMG report on “Driving growth through strategic alliances”, for a successful partnership require following steps to be undertaken.

A clear and mutually understood strategic and commercial ambition Evaluate and challenge the rationale for partnering

Each partner needs to clarify the core capabilities it wants to preserve, and the additional capabilities it needs (which could be gained by building, buying or partnering) to meet changing market conditions Ensure clear links between alliance strategy and corporate strategy People involved in initiating and leading strategic discussions on alliances may not always be fully aware of the wider organizational strategic goals – and financial restrictions, and as a result could agree an alliance which risks being at odds with the corporate’s strategic objectives

Command full C-level focus

Strategic alliances need to assume a higher priority on the C-level agenda. With sponsorship and stakeholder clarity around key performance indicators (KPIs), such as return on investment or defined risk appetite, the alliance should have a better chance of receiving sufficient support and resources to succeed A detailed alliance business model

Maintain momentum

When it comes to working out exactly how an alliance will work, many big ideas seem to fall through the gaps. There are numerous examples of alliances where, following the CEO’s handshake and initial agreement on strategic direction, there have been challenges in translating these ideas into tangible results. Only through strong commitment on both sides can alliances make progress.

Translate the agreed strategic and financial aspiration into a clear, detailed business plan Once both parties have worked out the details of the unique joint proposition, and which markets and clients it’s going to serve, they need to address the more detailed question of valuation and profit-sharing models.

Test the business model with prospective clients Testing a proof of concept, before making a fuller investment, can reduce the risk of an alliance vis-à-vis an M&A or greenfield investment

A flexible operating model that underpins the business model Agree a lean operating model and realistic timetable Rush to set up complex operations resulted in subsequent corrections –or even an unwinding of the entire alliance, sometimes at great cost. Instead, the alliance operations should follow a well-defined business model, and be as lean and flexible as possible, to scale up or down when necessary – possibly at short notice

Target flexible contracts

Contractual flexibility is also vital, to enable a fast change of direction should market conditions change, or where one or both parties fail to fulfill their obligations. When a partner is locked into a contractual relationship that is no longer strategically viable or desirable, the result is often conflict, followed by a negotiated exit Build an alliance capability, with an experienced and highly professional team Today, virtually every company has a specialized M&A function, but many lack a similar dedicated Alliance department. As alliances become a more regular part of business life, companies of all sizes, across multiple sectors, should be confident in their ability to initiate and execute new partnerships. This means having a permanent, strong, professional alliances team that can lead or guide the process – possibly overseen by a Head of Alliances with overall responsibility across the organization. Naturally, the shape of the team depends on the overall organizational structure and geographical presence.

As business leaders in Sri Lanka , it’s a must to navigate the thinking towards innovative business models which as highlighted above. Not only these models will strengthen the revenue but also secure jobs for employees who are at the risk of loosing it.

Chathura Ganegoda BSc (USJP),

MCIM (UK), MBA(UOC)

“Lead the world to New Dimensions”

Feedback –

LinkedIn – @Chathura Ganegoda

Email – Chathura.d.ganegoda@gmail.com

WhatsApp – 0777371229