Post Covid-19 trends impact on retail sector in Sri Lanka

View(s):The COVID-19 pandemic has been one of the biggest disruptors of life and business in the recent history.

Apart from creating a sense of caution, fear and concern in people’s mind, it has also severely impacted most commercial activities. While most of the Sri Lankan businesses are trying to shift their operations to an online platform, retail sector is still struggling to make this transformation.

- Chathura Ganegoda

Since, crowded places like shopping malls and retail stores, can easily be possible carriers of the virus, there remains a certain fear attached to it. Such realities would be a game changer for the sector. There remains a lot of looming uncertainty making it difficult to accurately analyze the post-COVID scenario.

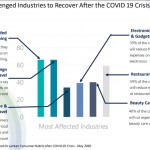

Within the retail sector, the effect on “multiple portfolio stores” (Super Markets, Clothing Outlets etc.) as compared to “focused portfolio stores” (Brand Focused Stores) including shopping malls would be very different. While it is true that many stores would be facing inventory pile ups, several others might run into severe supply issues.

Due to the current Import ban in Sri Lanka, various product categories are not able to manufacture and source raw materials. Thus, lesser manufacturing leads to lesser supply of goods. Additionally, retail requires a fast rotation of working capital. With inventory pile ups, many smaller stores might find themselves in a cash crunch.

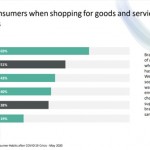

Differences in buying behavior

Looking at the situation from the point of view of a consumer / shopper, the outcome may vary across different goods. While there have been instances of panic buying, the trends across essentials and non-essentials would vary. With different consumption patterns, the trend within essential goods would also be vastly different. For example, panic buying of biscuits / dry rations / vegetables will not affect future purchases. Essentially, when consumers or shoppers purchase additional shampoo , toothpaste or groceries, consumption of these products will not necessarily increase. It possibly can be the case if a household consists number of members out of the usual pattern.

Super Market vs. Convenient General Stores – Challenges

Compared toSupermarkets, local convenient grocery stores selling essential items, might face a smaller impact. Especially, with people staying home, they tend to depend on their local grocery store more than ever. With a sustained supply chain these stores might register a growth. However, the story might play out a little differently with multiple portfolio stores like supermarkets.

Another crucial factor is reluctant to visit super-markets due to social distancing practice and even if they visit, they will ensure to limit the shopping time as much as possible.

Therefore, Supermarkets would need to divert their focus heavily to essentials during the lockdown and non-essentials immediately post the lockdown. Their location being in a mall does spell out some trouble for these stores. Additionally, these stores carry stocks of perishable items which may need to be discarded or sold off at massive discounts. Non-food products if bought would be stored at home and affect future sales.

For other non-food fast moving consumer goods, like apparels, IT products and consumer durables, the sector might see the largest drop. While people will be excited and eager to purchase newer commodities post lockdown, the contact points in such locations might be a cause of worry. Also, these stores would have to deal with the problem of excess stocks and styles going out of fashion. They might also lose out on seasonal sales due to this reason and would have to liquidate their stocks with the help of massive discounts. One major factor affecting the entire sector would be the purchasing power of people. With a potential recession in the global economy, with job cuts and pay cuts, consumer behaviourbecomes hard to predict. While consumers would be eager to shop again, there may be some constraints.

Options to follow to overcome challenges

- Super Market chains should now focus on driving foot fall to outlets by,

- Building the confidence among shoppers on Safety Measures

- Offering greater value for the Shopper Spend (Discount Schemes etc.)

- Strengthen their E-commerce plat forms to ensure end to end delivery

- Motivate & Train Staff on handling and

- servicing customers faster

- during a crisis

- Strengthen their supply chain to improve efficiency on deliveries and quality on fresh food

- Have an efficient delivery / route optimisation method to save running costs

- Have mobile operational systems to reach door to door. Ex- Mobile Outlet

- Non-food fast moving consumer goods, like apparels, IT products and consumer durables should find ways to,

- Reach their consumers / shoppers via digital platforms

- Analysis their portfolio and reduce slow moving stocks to strengthen the working capitol

- Building the confidence among shoppers on Safety Measures inside outlet

- Try to offer online ‘Fit-on’ methods, “How to use” kind of tutorials, so shoppers will not have the need to visiting the store

- Use of influencer marketing strategies to talk about the product

- Empower local manufacturers / entrepreneurs to avoid dependency on imports

While it is difficult to entirely predict the future trend now for the retail sector, it would be interesting to see how events unfold for the sector in the post COVID world.

“Lead the world to New Dimensions”

Feedback – Chathura.d.ganegoda@gmail.com

WhatsApp – 0777371229