Round-up of key company results

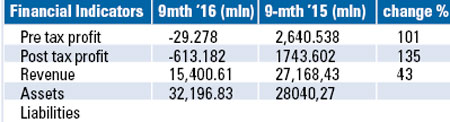

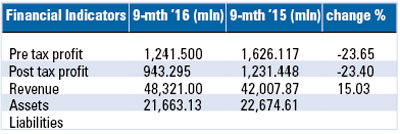

View(s):| Lion Brewery says ‘unfair and discriminatory policies’ Lion Brewery PLC has said that it’s been a very difficult time with challenges posed by the external environment – both natural and manmade – being many and of significant proportions. “The company operates under a patently unfair and discriminatory policy framework, competing against arrack and toddy players, most of whom evade taxes and the brewery was devastated by floods and not in operation for almost six months. This is the base from which the company will rebuild. It will be a strenuous turnaround but our consumers, brands and people give us the confidence that better days lie ahead.” It said in the quarterly statement that the government stepped in to permit beer imports on the payment of the manufacturers excise tax. “Then our partner Carlsberg assisted us with supplies of beer from four of their breweries in Asia, most of Lion Brewery’s trade partners stood by us notwithstanding a financial loss to them and consumers of our brands remained fiercely loyal to their favourite brew. Special appreciation is due to the staff for their commitment and dedication during the period of reconstruction without which the recovery process would have taken much longer. Words cannot adequately express our feelings of appreciation and gratitude to these stakeholders for helping us bide through what has been the most difficult time for the company.”

|

| Chevron loses key shareholder |

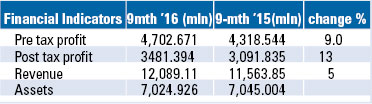

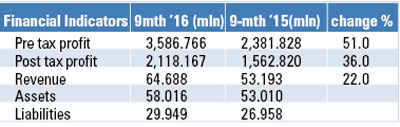

| Chevron Lubricants Lanka which lost Wasatch Frontier, its top shareholder since last year , has seen a 13 per cent rise in profits. Wasatch Frontier Emerging Small Countries Fund has exited Chevron’s Top 20 shareholders in 4Q2016, the results showed. It was the number two shareholder with 4,711,705 shares as at last September.

|

| Guardian Capital Partners PLC funds start-up | |

| Guardian Capital Partners LTC has said that it invested Rs. 42 million in start-up, Swiss Institute for Service Industry Development (Pvt) Ltd, during the last quarter. “Our total commitment is Rs. 52 million, the balance will be invested upon the company meeting set performance criteria. Swiss Institute is a start-up venture focused on providing vocational training to the hospitality and banking sector. The institute has entered into partnerships with the Swiss Hotel Management Academy of Lucern and the Swiss Banking Consulting and Training Academy, which will provide certification and curriculum,” the company has said in is management review. It added that the total value of investments in unlisted companies as at 31st December stands at Rs. 250 million. “The increase was on account of the new investment into Findmyfare, Swiss Institute and the value appreciation in hSenid. The largest unlisted position is LVL Energy Fund Ltd, followed by hSenid Business Solutions (Pvt) Ltd, Findmyfare (Pvt) Ltd, Swiss Institute and Kashmi Singapore Pte Ltd,” it has said. “Due to depressed market prices we continued to hold onto these positions during the quarter as we believe the current prices are below their intrinsic worth,” the statement said.

|

| Hayleys PLC posts Rs. 1 bln profit | |

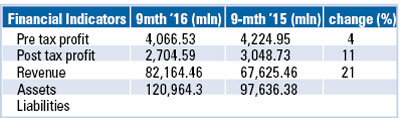

| Hayleys PLC’s profits after tax rose by 8 per cent Year-on-Year (YoY) to reach Rs. 1.1 billion during the quarter ended 31st December 2016 (3Q16). Revenue during the quarter increased by 27 per cent YoY to Rs.30 billion buoyed by strong performances across in the group’s Agriculture, Construction Materials, Transportation and Logistics, and Hand Protection segments, while operating profits expanded by 24per cent YoY, reflecting strong growth in core operating activities. For the 9 month period Profit After Tax (PAT) stood at Rs. 2.7 billion, reflecting a 11 reduction from the previous year. Strong performances were recorded across the group’s Agriculture Sector with PAT in the segment increased from Rs. 543 million up to Rs. 667 million. Hayleys’ Hand Protection business posted impressive turnover growth, increasing rapidly from Rs. 9 billion up to Rs. 10.9 billion while the segment’s profits increased to Rs. 390 million, as compared with a previous Rs. 225 million in 2015. The group’s Construction Materials sector performed well to record a substantial growth in profits reaching Rs. 491 million.

|

| Aitken Spence shows 10% growth in earnings for 9-months | |

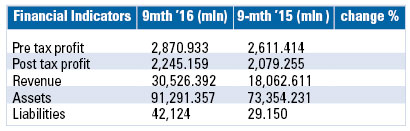

| Aitken Spence PLC closed the immediate 9-month period with a 9.9 per cent year-on-year growth in profits before tax amounting to Rs. 2.9 billion, and a 17 per cent growth in profit attributable to shareholders. The growth is attributed to strong financial performances posted by a number of key operational sectors in the reporting period, a company media release said. Bringing to fruition the long term investment strategy adopted by the diversified group, many of the key industry segments operated by Aitken Spence showed positive growth trends in the 9-month period that drew to a close on the 31st of December 2016. The top line for the same period grew by 69 per cent to a figure of Rs. 30 billion while earnings per share rose by 17 per cent to Rs. 4.09. The company achieved a 28 per cent growth in profit before tax in the third quarter amounting to Rs. 1.4 billion. Earnings per share rose by 36 per cent in the quarterly period amounting to Rs. 2.14 per share. Profit attributed to equity holders also rose by 36 per cent to Rs. 870 million year-on-year, for the quarter.

|

| Expolanka to exit from passive investments | |

| The ventures sector of Expolanka Holdings recorded a revenue of Rs. 1.1 billion during the quarter. The write-down in passive investments affected the profitability of the sector and efforts are being made to exit from these passive investments with value realisation to the shareholders, the company said in its statement. “The perishable segment had to encounter vulnerability partly due to volatile climatic conditions which prevailed during the year. The group is evaluating several proposals to achieve margin improvements,” it said.

|

| CT Holdings PLC cautions against macro challenges | |

| While being satisfied with the overall performance of the CT Group over the nine month period, the company in its statement has cautioned that macroeconomic challenges continue to remain. “These have been exacerbated by the prevailing drought conditions, which might further adversely impact agricultural production in the country. Agriculture and dairy being the main areas of engagement for the group, we will look to take meaningful steps to mitigate the possible adverse effects that may arise out of this prevailing situation,” it says.

|

| Profits fall at Kelani Tyres | |

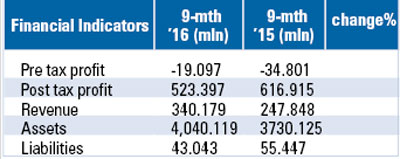

| Kelani Tyres PLC has seen a decline in profit amidst CEAT’s expansion. The company’s profits declined to Rs. 523 million for the 9-months of last year from Rs. 617 million in the same period the year before amidst its JV partner, CEAT Sri Lanka investing Rs. 800 million to expand the radial tyre manufacturing capacity to support the growing local and export demand.

|