Rentals to witness a glut

Landlords of upscale properties in the country are bracing for rough conditions in 2017 that will likely force them to slash rents and offer deep concessions as a glut of supply brings the apartment boom in Colombo to an end, analysts say.

Landlords of upscale properties in the country are bracing for rough conditions in 2017 that will likely force them to slash rents and offer deep concessions as a glut of supply brings the apartment boom in Colombo to an end, analysts say.

The slowdown in rentals, they say is being driven not by shrinking demand but rather a torrent of new apartments. Demand for urban properties – especially rentals – jumped over the past decade as young, high-earning professionals shunned homeownership and flocked to the big city. Developers responded by focusing most of their efforts on high-end properties and those who lapped these properties – say two at a time – were mostly eyeing rental income.

Now, though, the number of upscale apartments coming onto the market appears to be outpacing the number of renters able to move into them. Current industry statistics show that some 4,000 new luxury apartments are coming to Colombo within the next two years. Amongst these Shangri-La-La, Altair, Cinnamon life and City Centre (Abans) will fetch around 450 apartments each while ITC, HTC and Astoria will bring around 600 apartments each.

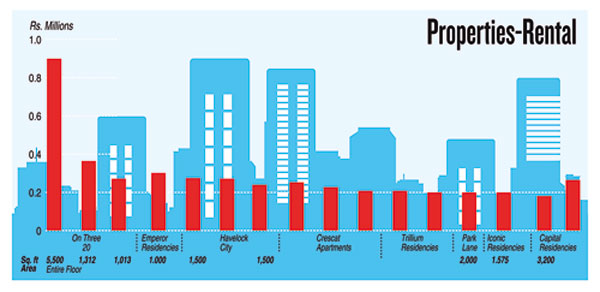

“These are only the big names. There are some small timers too,” an analyst noted. So in rupee terms the range of rents for a 3-bedroom condo in Colombo city is Rs. 75,000 to Rs.240,000 depending on the location.

These yield figures according to some analysts are “gross” as they don’t take into account costs such as servicing a mortgage, maintenance costs, or add-ons etc. They can’t sustain with these costs, an analyst said. The point is that this type of cash won’t be thrown around anymore and in that light their rentals will drop. But builders are not predicting that rents will plunge, they do expect them to stagnate and perhaps ease in the short term.

However industry statistics reveal that rentals yields in an over-supply scenario will decline drastically.

The over-supply of retail space triggering a rise in the number of vacant units and a corresponding fall in rental returns in some older shopping centres has seen the office space market facing a greater saturation scenario once all these projects are completed, together with other office developments that are currently under construction, analysts say. “It also depends on the current economic conditions,” says an interested property observer adding that there is a retail space oversupply in particular in the metropolitan areas because of the economic downturn. A saving grace is that there is a lot of office projects that are linked to residential and retail as well as mixed developments, which will make them more appealing to offices.