Reassessing the role of the independent directors

View(s):With the recent Entrust Securities saga, a call to reassess the role of the independent directors has come stronger. Independence stems from professionalism both at a corporate level in terms of how the company approaches the subject of board composition which isn’t evidenced by recent crisis in the financial sector. As all directors are the same by law and as Executive directors and Independent directors have the same duties and liabilities, there isn’t a strict definition of independence, an independent director of the public quoted company pointed out. “Today the independent director’s role has become more challenging due to intense scrutiny from stakeholders, the opinion about independent directors amongst all stakeholders and understanding the concept of true independence and what it requires is essential.”

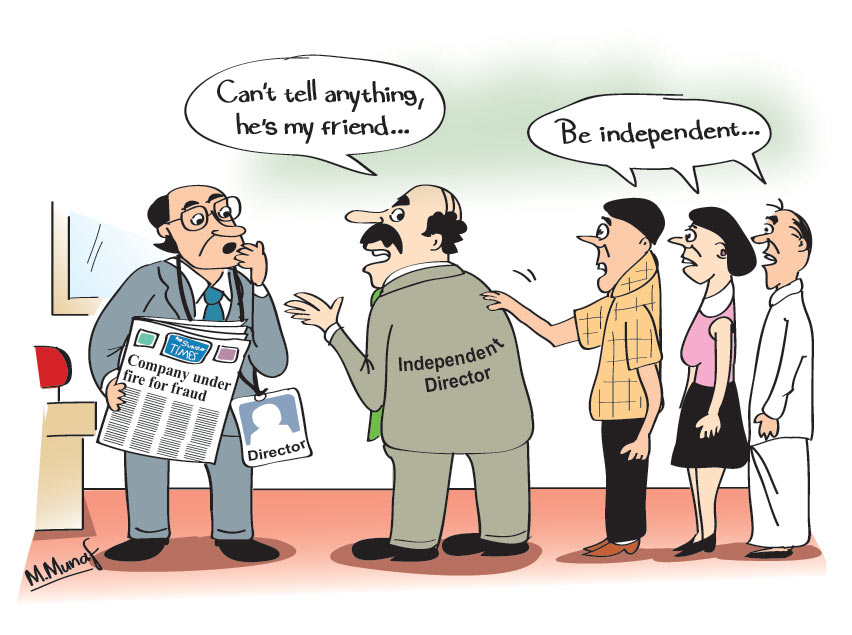

An analyst noted that what has been seen in corporate Sri Lanka is that one needs a lot of influence to become an independent director. “It is like getting invited to dinner at a friend’s house, and then being critical of the food served,” he said adding that an independent director should definitely be independent of the managerial roles. And, ideally, he should also be independent of the other service providers. “This means he and his close relatives should not be employees or owners of the service providers. The reason is to avoid conflicts of interest.” The independent directors should be picked frame a pool, an analyst focused on corporate governance opined. “They’re the ones who’re supposed to look after the minority shareholders. They should be responsible for risk, remuneration, etc, but most independent directors don’t come prepared for these meetings,” he lamented.

He accused that most independent directors who are on (especially listed company boards) are there, because they are either connected to a major shareholder / key management and most are under obligation to these connected parties. Most independent directors are ‘independent’ from a legal standpoint; however, independence in essence is a different ballgame, the analysts said, adding that the lack of ‘true’ independence also stems from the fact that most companies utilise board members personal network to search and appoint independent directors.

“When a non-executive director is identified, there are two broad factors applied – a relationship with the owners and their skills and the capability to add value is the global standard,” he said.

But others say that personal friendships outside the board room does not necessarily lead to independence being bargained within the confines of the board room if the individual is prepared to challenge and ask the right questions. “But how often is it done,” the analyst focused on corporate governance asked. ”There is a perception that a company with ‘famous’ names on its board is better managed. Also many say that there is a severe dearth of good candidates and there is a tendency to go back to the same names constantly. ”But such ‘known’ names on the board do not guarantee better standards of corporate governance. And if you look around more, then you can find fresh talent,” he said. He said that this is why the call to adopt a more professional, independent and transparent approach to appointing independent directors is stronger.