Columns

Towards smaller trade deficit and balance of payments surplus

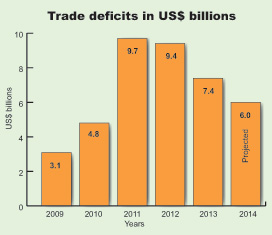

View(s):The prospect of reducing the trade deficit to about US$ 6 billion this year presents an opportunity to generate an overall balance of payments surplus that could increase foreign reserves, reduce foreign borrowing and decrease foreign debt. These could be achieved provided the economy is managed sensibly and there are no negative external shocks.

Increased export earnings, especially in the fourth quarter of last year, give rise to expectations of an improved trade performance this year. The reduction of the trade deficit from over US$ 9 billion in 2011 and 2012 to US$ 7.6 billion in 2013 is a significant achievement. The reduction of it to about US$ 6 billion provides an opportunity to stabilise the external finances.

Increased export earnings, especially in the fourth quarter of last year, give rise to expectations of an improved trade performance this year. The reduction of the trade deficit from over US$ 9 billion in 2011 and 2012 to US$ 7.6 billion in 2013 is a significant achievement. The reduction of it to about US$ 6 billion provides an opportunity to stabilise the external finances.

If export earnings continue at around US$ 1 billion a month that was achieved in the last quarter, and import expenditure contained at around last year’s US$ 18 billion, the trade deficit would decrease to about US$ 6 billion. This would be a decrease of about 35 per cent from the trade deficits of over US$ 9 billion in 2011 and 2012.

Impact on BOP

Impact on BOP

Such an improvement in the trade deficit could turn the overall balance of payments (BOP) into a substantial surplus as workers’ remittances, tourist earnings, other service receipts and capital inflows would offset the trade deficit and bring about a substantial BOP surplus. The increase in export earnings by 6.3 per cent last year to US $ 10.4 billion, compared with US$ 9.8 billion in 2013, is a noteworthy achievement. More significant is the increase in export earnings in the second half of the year that appears to be a trend that is expected to continue into this year.

This turnaround in exports is attributed to the recovery of western economies that increased demand for garments and other manufactured goods. It is also likely that the depreciation of the rupee during the year by 2.7 per cent against the US dollar, 6.8 per cent against the euro and 4.7 per cent against the pound sterling enhanced competiveness in manufactured exports. If this were so, the lesson to be learnt is to ensure that the rupee is not allowed to appreciate as the balance of payments improves.

Improved tea prices and a higher exportable surplus were responsible for the increased tea export earnings by 9.2 per cent to US$ 1.5 billion last year. Other agricultural exports too contributed to increase last year’s agricultural export earnings by 10.2 per cent to US$ 2.6 billion. The continuation of last year’s high tea prices and a good tea harvest is vital to maintain tea export earnings. Unfortunately tea production may suffer from bad weather conditions this year and problems in the plantations. A consequent reduced exportable surplus may decrease tea export earnings unless prices improve.

Import expenditure

The decrease in the trade deficit was also achieved by the reduction of import expenditure by 6.2 per cent to US$ 18 billion, compared to US$ 19.2 billion in 2012. Yet imports have been nearly twice the export earnings (184 per cent) in recent years. While expenditure on consumer imports increased by 6.3 per cent, both intermediate and investment goods imports decreased by 8.9 and 7.3 per cent, respectively.

Despite the significant decrease in the expenditure on crude oil imports by 14 per cent to US$ 4.3 billion from US$ 5 billion in 2012, oil imports constituted 24 per cent of total import expenditure. Oil imports are likely to increase if drought conditions result in lesser hydro electricity generation. Conservation of electricity and fuel consumption are needed to restrain fuel imports. Hopefully international oil prices would remain at current levels.

Despite the strong growth in export of textiles and garments, there has been a steady decline in the import of textiles. The Central Bank attributes this to improved backward linkages and higher value addition in the garment industry. This requires to be verified because both backward linkages and increased value addition assume an improvement in competitiveness. The source of this improvement requires to be found out.

On the other hand, it is also possible that there were stocks of raw materials due to reduced exports. With the increasing trend in garments exports, imports of textiles and related materials may rise again. Textile prices too may increase owing to increased demand.

Consumer imports

Consumer imports

Although there were increases in food and non-food consumer goods, total expenditure on consumer goods at US$ 3.2 billion was only 17 per cent of total import expenditure. Food imports constituted only 7.6 per cent of total imports, while other consumer items accounted for 9.4 per cent of total import expenditure. Vehicle imports contributed significantly to the increase in consumer goods imports. The 92 per cent increase in car imports in December 2013, is hopefully an aberration that will not continue into 2014.

Policies to contain imports must bear in mind that consumer goods imports constitute only 17 per cent of total import expenditure, while intermediate and investment goods imports at 59 and 24 percent, respectively account for 83 per cent of imports. While food imports account for less than 8 per cent of import expenditure, oil imports are 24 per cent. Therefore, policies to constrain imports must focus on fuel and investment goods of which transport equipment is a high proportion.

In conclusion

While there is a prospect of enhancing exports and reducing the trade deficit to a manageable proportion, external and internal shocks could increase import expenditure. Fuel and textile prices could increase; oil imports may rise due to insufficient water to run the hydro electricity generating plants at full capacity; tea production could decline and tea prices could dip. Furthermore, the decline in the paddy harvest may require import of rice.

The easing of monetary policy, as well as complacency in economic policies, could increase imports. Prudent management of monetary and fiscal policies is needed to get the optimum benefit from the global turnaround that could increase manufactured exports and reduce the trade deficit. These good outcomes have to be sustained to bring about medium term benefits. And, that would depend on whether the good outcomes are merely transient or permanent.