Central Bank’s low interest rate policy and economic pitfalls

Guided by the policy rates of the Central Bank, Sri Lanka has been experiencing a declining trend in market interest rates since the latter part of 2012. In the background of slowing down of inflation, and the need to support the economy to attain its growth potentials, the Central Bank is likely to continue the low interest rate regime for some time. Being a heavy borrower in the domestic money market, apart from borrowings from foreign sources, the government is an obvious beneficiary of low interest rates. In line with the policy rate reductions, a continuous decline in the Treasury Bill and Bond Rates is evident. Thus, reducing the government’s debt service burden may also have been a determining factor for the inclination of the monetary authorities to keep interest rates down though it is not explicitly acknowledged.

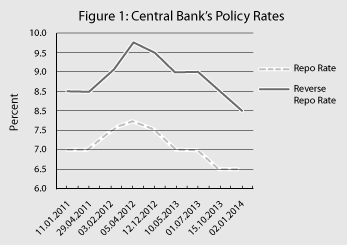

Continuing its monetary policy relaxation process commenced in December 2012, the Central Bank reduced the policy rates further early this year. Accordingly, it reduced the Reverse Repurchase Rate (now known as the the Standing Lending Facility Rate or SLFR) by 50 basis points to 8.0 per cent with effect from January 2, 2004. As the Repurchase Rate (now known as Standing Deposit Facility Rate or SDFR) remains intact at 6.5 percent, the Policy Rate Corridor (now known as the Standing Rate Corridor) is compressed to 150 basis points from the earlier 200 basis points. A gradual reduction of the policy rates is evident since the end of 2012 reflecting the relaxed monetary policy stance (Figure 1).

There are costs and benefits associated with prolonged periods of low interest rates. As anticipated by the authorities, low interest rates may have helped to augment credit growth needed to boost investment and economic activity. But keeping interest rates at low levels over long periods is found to generate inflation, and thereby defeating the very purpose of relaxed monetary policy – i.e. boosting investment and economic growth. There are also concerns about excessive risk taking and possible asset bubbles in low interest environments. Adverse effects of low interest rates on household savings and balance of payments should also not be ignored.

It is doubtful whether these concerns have been taken into account in preparing the Road Map 2014 which presents the Central Bank’s policy direction and work plan for the current year and beyond in a rather biased manner showing that the economy is progressing smoothly without any hindrances, as I elaborated in this column earlier (Business Times, January 26, 2014).

Pressures on the rupee

As predicted in my article mentioned above, the rupee already shows signs of depreciation in the face of high import demand buttressed by low interest rates. These mounting demand pressures will necessitate a depreciation of the exchange rate to arrest the surge in imports. Hence, maintaining a stable exchange rate in a low interest rate regime is a remote possibility. In this context, either a significant depreciation of the currency or an upward movement of interest rates or both is inevitable in the absence of tangible growth in the export sector.

‘Impossible Trinity’

Perhaps, the economic policy syndromes currently experienced by the country could be explained by a phenomenon called ‘Impossible Trinity’ or ‘Trilemma’. It states that the monetary authorities could simultaneously choose any two, but not all of the three policy choices – monetary independence, exchange rate stability and free capital flows. A small open economy like Sri Lanka wishing to maintain partial financial integration in the form of restricted foreign capital flows could exercise monetary independence by giving up the policy choice of exchange rate stability. Although Sri Lanka’s capital account is not fully liberalised, capital inflows and outflows taking place in the form of foreign borrowings, foreign direct investments and portfolio transactions have a bearing on international reserves and in turn, on the money supply.

Thus, the concept of ‘Impossible Trinity’ is applicable to the Sri Lankan case though there is no perfect capital mobility. In other words, the Central Bank has to choose either monetary independence or exchange rate stability in a situation of uncontrollable capital movements. In contrast, the Central Bank seems to have used both the policy interest rates and exchange rate interventions simultaneously as its policy instruments. It has attempted to push down market interest rates through the Policy Rate Corridor (Repo and Reverse Repo windows), which is the key monetary policy instrument. At the same time, attempts to stabilize the exchange rate through interventions by the Central Bank and/or state-owned banks have been evident during the last two years.

When demand pressures on imports build up due to credit growth supported by low interest rates, the authorities will have to give up exchange rate stability at some stage. The other choice is to give up the low interest rate policy stance. It is not practicable to have the best of both worlds for a long period as amply demonstrated by the impossible trinity theorem.

Consumer goods imports on the rise

Consumer goods imports on the rise

As reiterated above, maintaining low interest rates and a stable exchange rate side by side is an impossible task, since part of the excess demand propelled by low interest rates will shift to imported goods thus widening the trade deficit. This compels a depreciation of the rupee.

In this regard, low interest rates appear to have played a major role in augmenting imported consumer goods in 2013, as revealed in the recently released trade data. The import outlay on consumer goods rose by 6.3 per cent from US$2,995 million in 2012 to $3,183 million in 2013. In contrast, intermediate goods imports and investment goods imports declined by 8.9 per cent and 7.3 per cent, respectively in 2013.

Thus, low interest rates seem to have encouraged consumer goods imports rather than intermediate and investment goods imports which are much needed to accelerate economic activity as anticipated by the monetary authorities in lowering interest rates. Despite the rise in consumer goods imports, the decline in intermediate and investment goods contributed to a 6.2 per cent decline in the total import outlay, and thereby helped to reduce the trade deficit.

This trend of rising consumer goods imports, of course, could be anticipated in a prolonged low interest rate regime as consumers tend to shift their savings from low-return financial instruments to acquisition of assets including luxury vehicles and other consumer durables. Meanwhile, traders attempt to maximize profits by engaging in such import trade exploiting the low interest rate environment.

Investment decisions

Entrepreneurs take their long-term investment decisions mostly on the basis of long-term interest rates in the capital market, inter alia, whereas monetary policy influences the money market interest rates at the short end. Hence, effectiveness of an interest rate reduction in encouraging investment depends on the link between short and long-term interest rates.

This relationship is not well established even in developed economies. It is weaker in countries like Sri Lanka where money and capital markets are severely fragmented. There are also many other factors that influence investment decisions. These include return to capital, trade openness, foreign direct investments (FDIs), infrastructure, fiscal sustainability, business confidence, macroeconomic environment and political stability. In the circumstances, a reduction in interest rates does not necessarily lead to an increase in productive investments or to accelerate economic growth.

Drop in real interest rates dampens savings

The Road Map 2014 envisages a marginal increase in domestic investment to GDP ratio in the medium-term from 32 per cent in 2014 to 33 per cent in 2016. In the meantime, it is envisaged to accelerate economic growth from 7.5 per cent in 2014 to 8.5 per cent by 2016. However, domestic savings hovering around 17 per cent of GDP are hardly sufficient to meet the investment required for economic growth, and therefore, the country ends up with a savings-investment gap of over 15 per cent of GDP as in the past. The negative savings generated by the government in the form of current account deficits in its budget year after year absorb a part of savings in household and corporate sectors.

It is empirically evident that low interest rates are likely to dampen household savings, the reason being the positive relationship between interest rates and household savings. The Financial Report of the Bank of England (2012) states, “in a low interest rate environment, households and businesses may have very little incentive to deleverage and also may end affecting banks’ incentives to forebear on non-performing loans”.

The present low interest rate environment in Sri Lanka has resulted in a substantial reduction in real interest rates. For instance, the weighted average yield for 91 days’ Treasury Bills at the last week’s primary auction was 6.77 per cent as against the ongoing annual inflation rate of 6.50 per cent, thus leaving a real interest rate of only 0.27 percent. The near-zero real interest rates have negative effects on savings. These kinds of low real interest rate situations were identified as “financial repressions” in the then fashionable development economic theories during the 1970s.

Further widening of the savings-investment gap could be anticipated in the low interest rate environment restraining the country’s growth potential. The gap between domestic savings and investment is filled by foreign savings which are a mirror image of the current account deficit of the balance of payments. Therefore, an increase in savings-investment gap will lead to a rise in the external current account deficit augmenting the need to borrow more from abroad. This poses immense threat to sustainability of the balance of payments.

Excessive risk-taking and asset bubbles

It is empirically found in many countries that pushing down interest rates on financial instruments to very low levels by a monetary authority leads to distort investment decisions and to create asset bubbles. The excess fund holders tend to move to different alternative assets such as commodities, real estate and risky financial instruments. Meanwhile, speculators are encouraged by low interest rates to borrow funds and acquire assets in the monetary loosening environment. This kind of rise in the demand for assets results in a surge of asset prices leading to “asset bubbles”, thus creating adverse effects on financial stability as experienced by the East Asian countries during the financial crisis in the late 1990s.

Two instruments – two targets

As explained above, simultaneous attempts to use the two policy instruments – policy interest rates and foreign exchange market interventions – pave the way to create deviations of the exchange rate from its realistic levels and to bring down real interest rates to near-zero levels.

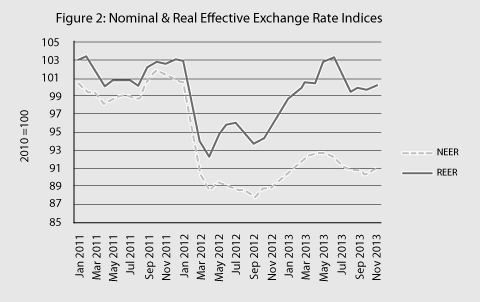

Foreign exchange interventions have led to erode the country’s export competitiveness. As depicted in Figure 2, both the Nominal Effective Exchange Rate (NEER) and the Real Effective Exchange Rate (REER) had appreciated until around June 2013, and they show a depreciating trend since then. However, the depreciation seems to have been suppressed to a certain extent in the last quarter of 2013 reflecting exchange rate rigidity. This again will have adverse effects on the country’s export competitiveness.

The current exchange rate trends reflect a deviation of the policy decision taken by the Central Bank in February 2012 to limit its intervention in the foreign exchange market so as to allow greater flexibility in the exchange rate. In response to that dcision, the rupee depreciated by almost 15 per cent vis-à-vis US dollar in the first half of 2012. However, it appreciated by around 5 per cent in the second half of the same year. It is noticeable that the real exchange rate has remained above the nominal exchange rate throughout the last two years reflecting the inadequacy of rupee depreciation to compensate for domestic inflation. This reflects the efforts taken by the monetary authority to defend the currency through exchange market interventions irrespective of excessive trade deficits. This was possible due an improvement in foreign reserves on account of migrant remittances and foreign borrowings.

Price stability is a prime objective of the Central Bank, and accordingly, the monetary policy is being directed towards inflation targeting. However, inflation targeting becomes ineffective when the Central Bank intervenes in the foreign exchange market so as to defend the rupee. In other words, inflation targeting and exchange market interventions are incompatible.

The outcome of the simultaneous use of the two policy instruments by the monetary authority for a prolonged period does not appear to be beneficial in the long run. It will only lead to aggravate the current macroeconomic imbalances manifested by high inflation, widened balance of payments deficits and low economic growth.

(The writer is a former central banker and university academic. He could be reached on sscolom@gmail.com)