CIFL ran like a Ponzi scheme, CB audit in 2011says

View(s):The Central Bank, in a 2011 July on-site audit of the accounts and affairs of crisis-hit finance company, Central Investments and Finance Ltd (CIFL), made a scathing attack on the management and the way the company was run.

“Currently with no earnings from 61.4 per cent assets concentrated in real estate, CIFL is dependent on new deposits to meet expenses and repayments, thus operating as a ponzi scheme,” the lengthy report said, according to one extract.

The company has been taken to courts by some depositors and the regulator’s 2011 audit report was filed as part of the documentation in court.

Here are important extracts of the report:

Credit Risk:

General Observations:

Total accommodation represents 22 per cent of the total assets of CIFL as at the examination date, hence the concentration risk on the lease, hire purchase and loan portfolio is comparatively low. The examination reviewed 34 per cent of the total accommodation, which covered finance lease, hire purchase and term loan facilities. Loans against real estate (Rs. 7.9 million) and bill discounting (Rs.2.0 million) were not verified due to the inadequacy of information received. The adjusted total non-performing ratio of the company (post examination) is 27.2 per cent as at 30.4.2011 which is much higher than the industry average of 8.6 per cent. The adequacy of the provisions for non- performing advances could not be verified due to the inadequacy of information available as at the examination date.

Overall, it is concluded that the credit risk of the company is high.

Non –availability of proper evaluation of the customers at the time of granting the facilities:

Eg:-

i. Go Green Limited- inadequate cash flow projection, integrity of some directors questionable, recently incorporated company 100 per cent funded by CIFL.

ii. 4 Ever Skin Naturals Pvt. Ltd- Past performance of the customer indentified as bad, negative cash flow of the company, new project of the customer not satisfactory evaluated.

iii. Intervest Corporation Pvt. Ltd- No information available in the credit file

iv. Lumbini Aquaria Wayamba Ltd- Inadequate guarantor evaluation, financial position of the company being weak due to operating losses, negative net worth and cash flows

v. Deraniyagala Tea Estates- Weak financial position due to operating losses.

vi. R.A.A.I. Nishantha – No security obtained.

vii. Landcorp Development – Non- availability of financial statements.

Accrued Interest Direction

The company takes into account as income, the accrued interest on total accommodation where the interest and /or capital repayments are in arrears for six month or more. Accordingly, total interest income has been overstated as at the examination date. However, the total reversal amount of accrued interest income as at the examination date could not be quantified since the IT system does not facilitate the identification of accrued interest income of non- performing facilities.

Single Borrower Limit Direction:

Section 5- The maximum of single unsecured accommodation granted and outstanding for a single borrower has exceeded 1 per cent of the core capital (Rs. 2.74 million) for five customers as at the examination date. Further, the aggregate of unsecured accommodations granted to and outstanding for all the above borrowers has exceeded 5 per cent of the capital funds (Rs. 13.7 million) of the company as at 30.04.2011.

Loans were granted to create a fixed deposit:

Eg: Kannangara M.G. – Rs. 17 million deposit created in the books of accounts by way of granting a loan to his customer.

Recoveries not properly monitored:

Eg: Go Green Ltd, Landcorp Development Pvt. Ltd, Intervest Corporation Pvt. Ltd, R.A.A.I. Nishantha, G.S.T. Chandrakanthi.

2-Investment Risk

2.1 – Importance of the portfolio to the company

61.4 per cent of the assets recorded in the books of the company comprise investments in real estate assets and investments in unlisted shares. Hence, the sustainability of the company as a going concern majority depends on the realization of these asset. The liquidity problem faced by the company is mainly due to the inability to realize these assets on an immediate basis.

However the realizability of these investments is in doubt due to several concerns observed during the examination.

2.2 Concerns regarding the investment portfolio

2.2.1 Lack of Ownership of Real Estate assets

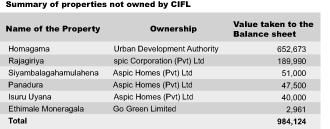

The company does not hold the legal ownership for six properties amounting to Rs. 984 million of the balance sheet and 97 per cent of the real estate assets. The company holds ownership of only three properties worth Rs. 42 million.

Fraudulent activities taking place in the company with regard to transactions related to real estate

Two cheques were found in the company safe, which were drawn by Aspic Homes Ltd numbered 312501 for Rs. 25.46 million and 312509 for Rs. 10 million, respectively dated 30.09.2010. However these cheques have been accounted for as follows by the CIFL: A letter has been issued by K.N. Indatissa (a Director of CIFL since 27.01.2011) on 28.09.2010 to the CEO of CIFL to settle his loan outstanding at CIFL of Rs. 11,729,028.76 to pay the stamp duty of Rs. 1,017,400 for a land transfer and to pay him Rs. 1,513, 517.24 and the excess of Rs. 11,200,000 to be placed as a fixed deposit under his name. These instructions have been carried out by the company on 30.09.2010.

Another debit entry had been passed on 30.09.2010 for the same amount to investments in the real estate account by crediting suspense account creditors. Accordingly two entries have been passed for the same transaction.

On 28.03.2011 reversal entries to the cash book had been passed via voucher numbers 03/591 and 03/590 to Suspense Account Creditors. Hence this amount had been removed from the bank reconciliation from March 2011.

The same property had been mortgaged to CIFL from 2007 by K.N. Indatissa for the facility No. ML/811/07 and subsequent to several negotiations, sold the same to Aspic Homes for Rs. 25.6 million. The cheque No. 312250 was drawn by Aspic Homes to CIFL and the funds through not realized by CIFL had been utilized for the purpose mentioned previously.

An agreement to sell No 561 dated 24.03.2011 had been executed for Rs. 51 million to transfer the said property to CIFL and accounted for in the balance sheet as Siyambalagahamulahena land. The credit entry for the same had been passed to Homagama Joint venture project.

The Rs. 11.2 million worth deposits of K.N. Indatissa was opened on 05.10.2010 with the passport number PP- OL3638610 given as the identification number as six different deposits for a period of one year (5 deposits of Rs. 2 million each and Rs. 1.2. million deposit).

2.5 – Directors withdrawing deposits at a time that the company is in a liquidity problem:

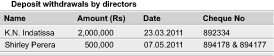

During the past three months two directors K.N. Indatissa and Shirley Perera have withdrawn their deposits while the company has unpaid matured deposits amounting to Rs. 57.6 million as at 14.06.2011.

The company has reported the average month end deposit liabilities of the preceding year as zero which is incorrect. To comply with the liquid assets direction CIFL should convert Rs. 220 million worth of its assets to liquid assets including approved seurities worth Rs. 151.7 million.

Financial Risk

Violation of Finance Companies (reporting Requirement) Direction No 05 of 2009:

CIFL does not comply with the monthly reporting requirements as per the above direction and fails to regularly update its financial data through the web-based data transmission system.

Dream Land (Pvt) Ltd

Dream Land (Pvt) Ltd is a related company under ASPIC Group. CIFL has incurred several expenses on behalf of Dream Land.

Earnings:

Despite the difficulties faced by the finance industry as whole during F/Y2009/10 and 2010/11. CIFL has managed to report profits amounting to Rs.2.1 million and Rs.13.74 million, respectively. During the detailed analysis of the components of earnings it was revealed that a major part of the reported income comprised unearned income, which actually should have been eliminated when accounting for profits. Therefore at present CIFL’s performance is exaggerated by accruing unearned income from joint venture projects carried out in collaboration with ASPIC Homes.

Investment income

i. Most of the investments are locked in fixed deposits placed with non investments- grade financial institutions, which too experience liquidity pressures themselves.

Other operating Income

1) Other operating income of CIFL is considered severely deficient compared to the high exposure to the real estate which is 63 per cent from the total asset base. Slow realization of real estate projects has resulted in liquidity pressure and deteriorating financial performance of the company.

2) Total profit realized from real estate projects for the Y/E 31/03/2011 and for the month ended 30/04/2011 is Rs. 9 million and Rs.8.5 million respectively arising from the sale of Deltara Land.

Heavy Operating Expenses

1) Irrespective of liquidity pressures and eroding profitability CIFL incurred heavy overhead expenses especially in the form of staff costs. The total staff costs of the Y/E 31/03/2011 is 55 per cent of the total operating expenses which amounts to Rs.116.0 million per annum.

2) Major parts of the advertising expenses have been deferred by understating the true expenses of the company.

Corporate Governance

According to the provisions of the Corporate Governance Direction No 3 of 2008:

1) As per section 2 (i) of the direction the Board of Directors of a RFC is responsible for ensuring the strength, safety and soundness of the company. Our overall conclusion (after perusing the Board Minutes for the years 2009, 2010 and 2011 April) is that Board of CIFL has failed in achieving this objective.

2) As per section 3 (i) of the direction, Board meetings must take place at least 12 times a year, at approximate monthly intervals. However, the company has failed to fulfill the expected minimum number of meetings that should have been in 2009, 2010 and 2011.

Directors

Chairman of the Board Prof L R Amarasekara has failed to attend 1 out of 3 meetings held in 2011 (up to April) 6 out of 9 meetings held in 2010 and failed to comply with section 3(4) of the Corporate Governance Direction by doing so.

In March 2011 Independent Non Executive Director K.N. Indatissa has been entrusted with the task of liaising with the CID to resolve D Net Case and Non Executive Directors D.M. N. Ramanayake (now resigned) and S . P. Daluwatta have been made responsible for signing FD certificates, renewal letters and Embassy letters. However, by virtue of the definition, Non Executive Directors cannot participate in such routine business functions.

The major shareholder of CIFL Deepthi Perera has played a dominant role in the decisions made of the Board Meetings held in 2009. His excessive-influence is viewed as hindering the independence of the Board, which curtails progressive decision-making towards the well-being of all stake holders. Though his presence is not visible at subsequent Board Meetings, we feel that his dominance is still present in most of the major decisions made by the company, especially as he’s the Aspic Group Chairman, and the extent of fraudulent related party transactions done by CIFL and fraudulent accounting entries passed by CIFL in relation to parties related to the Aspic Group.

There was lack of attention to detail, non-existence of questioning culture, lack of guidance and supervision by senior officials.

Daily operational issues were not addressed on a timely basis (creating backlogs forever)

There was high dependence on few individuals rather that relying on good systems and procedures.

There was employee ignorance on routine tasks performed, reluctance to acknowledge responsibility, lack of integrity.

Human Resource Management

There was a lack of qualified and skilled staff and inability to retain quality staff. There have been 130 resignations in 2010 and 95 resignations in 2011 (up to 01/06/2011)

Having an excessively high number of employees and incurring extremely high staff cost including salary and other benefits (Vehicles, fuel allowances and so on). The total staff count as at the examination date amounted to 313, including 301

CIFL Depositors at an earlier meeting to discuss their problems.

permanent members, 9 casual staff and 3 consultants. The total salaries and allowances per month is approximately Rs 8, 551,075. The average cost for an employee per month is about Rs. 32000.

The Chairman has exceeded the maximum number of eligible years that a director can be in service, which is 9 (section 4(2), by serving as a Director on the Board for the past 33 years. In addition, as per section 5(1) of the Corporate Governance direction (subject to transitional provisions), a person over the age of 70 years shall not serve as a Director of a finance company. Accordingly, the present Chairman and the Deputy Chairman must step down from their directorships by 31.12.2011.

CIFL has formed an integrated Risk Management Committee (IRMC) on 23rd March 2010. In line with section 8(3) of the CBSL direction on Corporate Governance which requires the committee to assemble at least on a quarterly basis.

However from the date of initiation the Committee has met only twice and from May 2010 up until the date of the examination has failed to meet at least once. According to the Committee minutes the main objective of the meetings have been on enhancing the brand and corporate reputation and there is no evidence to support that the Committee has given the Board any suggestions relating to managing CIFL’s total risk portfolio in a timely and appropriate manner.

However from the date of initiation the Committee has met only twice and from May 2010 up until the date of the examination has failed to meet at least once. According to the Committee minutes the main objective of the meetings have been on enhancing the brand and corporate reputation and there is no evidence to support that the Committee has given the Board any suggestions relating to managing CIFL’s total risk portfolio in a timely and appropriate manner.

CIFL has formed an Audit Committee (AC) on October 2009 in line with section 9 (2) of the CBSL direction No 3 of 2008 on Corporate Governance. It is a requirement of this direction that the Committee must meet on a regular basis to discuss related issues in order to make necessary recommendations to the Board.

CIFL has formed an Audit Committee (AC) on October 2009 in line with section 9 (2) of the CBSL direction No 3 of 2008 on Corporate Governance. It is a requirement of this direction that the Committee must meet on a regular basis to discuss related issues in order to make necessary recommendations to the Board.

However, from the date of its initiation, the Committee has met only five times and from July 2010 up until the date of the examination, has failed to hold even a single meeting.

Operational Risk

The company does not have a properly articulated operations manual (covering all operational functions), which lays down procedures and systems that emphasize on the consistency of functional operations and contingency arrangements.

In general, due to the following the company is facing high operational risk and the CEO claims to be unaware of most of the operational aspects of the company.

Eg:

i. Improper record keeping and inability to trace important documents

ii Non maintenance of vouchers with serial numbers and source documents

iii Lack of transparency in operations, raising ad hoc vouchers and entering ad hoc entries to the system.

Iv Preparation, checking and authorization of transactions carried out by the same individual without proper segregation of these duties.

Excess recruiting of marketing staff merely for the purpose of increasing the deposit base. As per the details submitted, the marketing staff as at the examination date amounts to 160 members, which exceed 50 per cent of the total staff that is viewed as a superfluous expenditure. Also the lack of training received, lack of integrity and dire need to achieve deposits targets has lead to uncontrollable and unethical behaviour by staff, which includes customer deception.

Central Finance and Finance Lt d(CIFL )

- Report of the statutory Examination

The statutory examination of Central Investments and Finance Ltd (CIFL) was carried out in terms of section 12 of the Finance Companies Act No. 78 of 1988- during the period from 01.06.2011 to 30.06.2011. The findings are based on the information gathered and verified from the books and records of the company as at 30.04.2011.

2. Scope of the Examination

The examination was focused on an assessment of the company’s exposure to risks, i.e. credit, investment, liquidity and operational risk, the management of these risks and the adequacy of resources to mitigate these risks at prudent levels.

3. Assessment of the overall financial position of the company

At the time of examination, the overall risk exposure of CIFL was considered very high, given the inadequacy of resources to mitigate the risks.

3.1 Currently with no earnings from 61.4 per cent assets concentrated in real estate, CIFL is dependent on new deposits to meet expenses and repayments, thus operating as a ponzi scheme.

3.2 CIFL, which is in the Aspic Group, continues unethical, fraudulent business practices specifically with respect to real estate transactions similar to those found in the other group companies such as Industrial Finance Ltd (IFL), a distressed RFC.

Profile and Financial Position of CIFL

CIFL is owned by Aspic Corporation (Pvt) Ltd and its Chairman Deepthi Perera with shareholdings of 75 per cent and 22 per cent, respectively.

The overall financial condition of the company has deteriorated over the past significantly. The quality of assets, total accommodation, profitability and capital of the company indicate a declining trend and the company have incurred losses during the past few years. NPA is high at 27.2 per cent whereas the industry average is 8.7 per cent.

Capital of the company when adjusted as per the findings of the examination turns to a negative net worth of Rs. 1.47 billion.

The liquidity risk of the company is high due to its long term negative maturity gap. These indicators highlight the unsound financial condition of the company.

Issues related to Corporate Governance

Non Compliances with Corporate Governance Direction

i)Section 2 (1) – After perusing the Board Minutes for the years 2009, 2010 and 2011 April it is concluded that the Board of CIFL has failed ensure the strength, safety and soundness of the company.

ii)Section 3(1) – Board meetings must take place at least 12 times a year, at approximate monthly intervals. However, the company has failed to fulfill the expected minimum number of meeting that should have been held in 2009, 2010 and 2011

Recommendations:

Based on the findings of the examination following recommendations are made.

Credit Risk:

i)Rectify the violations of Finance Companies (Provisions for Bad and Doubtful Debts) Direction No 03 of 2006, Finance Companies (Single Borrower Limit) Direction No 04 of 2006 and Finance Companies (Lending) Direction No 1 of 2007.

ii)Develop a system to classify facilities as non- performing without manual intervention

iii)Special attention required to improve its credit evaluation and credit administration process in order to improve the credit quality of the company.

Investment Risk

i)Require the Board of Directors (BOD) to take immediate action to legally execute the transfer of all the properties on CIFL Balance Sheet and produce the same to D/SNBF

ii)All lands should be valued by an independent professional valuer in order to report the actual value of the property.

iii)Reverse unearned income accounted for in the profit and loss account and cease accounting for profits at the rate of 30 per cent per annum on the joint venture projects and realize profits to P.L on cash basis.

iv)Obtain mortgages from Aspic Homes Ltd to secure the unsecured exposures.

v)Purchase of new real estate lands should be immediately stopped.

Liquidity Risk

1)Rectify the violation of Finance Companies (Liquid Assets) Direction No 2 of 2008.

2)No advertisements shall be made by CIFL soliciting deposits until the deposit ceiling is removed.

3)Immediate action should be taken to prepare the maturity profiles of its assets and liabilities, implement the liquidity policy and contingency funding plan.

Operations Risk

1)Immediate action should be taken to rectify the imprudent accounting practices in order to show the true financial position of the company.

2)Immediate action should be taken to conduct a comprehensive special audit to ensure the true financial position of the company.

3)A policy should be formulated for apportioning of expenses in real estate projects, in accordance with the Sri Lanka Accounting Standards.

4)All transactions with related parties should be accounted for in a transparent manner.