Gold crisis reveals cracks in SL’s pawning segment, S&P says

View(s):The recent reversal in gold’s fortunes could prove painful for Sri Lankan banks, says a report by Standard & Poor’s Ratings Services issued this week.

As gold prices soared over the past few years, Sri Lanka’s banks substantially expanded their pawning loans (gold-backed loans).

“Standard & Poor’s Ratings Services (S&P) believes that this has exposed Sri Lanka’s banking industry to the risk of high credit costs (provisioning expenses related to nonperforming loans [NPLs]) because of the recent about-face in gold prices,” the report noted.

“We expect defaults in pawning loans to increase over the next 12 months unless clear signs of gold prices stabilising emerge.Nevertheless, banks’ overall earnings will likely offer sufficient cushion against higher credit costs in the pawning segment”, it said.

S&P said the competitive nature and need for a rapid turnaround in the pawning business could compromise the ability of banks to perform thorough credit assessment of borrowers, including checking their credit histories recorded with the Credit Information Bureau of Sri Lanka.

Banks’ pawning loans grew at a steep average annual rate of about 50 per cent over the past three years, compared with average annual loan growth of 25 per cent for the banking industry.

Pawning loans constitute 14.4 per cent of the total loan book of Sri Lanka’s banks as of March 31, 2013, the largest sectoral exposure for Sri Lankan banks.

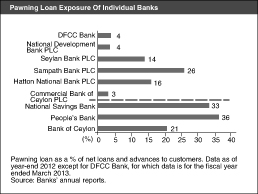

The banks with the most pawning loans outstanding are also the biggest in the country. Moreover, the share of pawning loans to total loans of many large banks, especially those that the government owns, is higher than the industry average in Sri Lanka.

The risk weight on pawning loans is as high as 125 per cent on gold loans (after deducting collateral value adjusted for potential volatility in the gold prices) in neighbouring India. “The zero risk weight in Sri Lanka, in our view, underestimates the risk of price volatility in a commodity such as gold. In addition, it provides an incentive for the banks to rapidly grow their pawning portfolio without the need to hold any regulatory capital for this business,” S&P said.

Sri Lankan banks have among the highest exposure to pawning loans. Globally, pawn shops (which pawn not just gold or jewelry, but also other valuable items) predominantly undertake the pawning business, and banks are seldom involved.

According to the World Gold Council, China accounted for 33 per cent and India 28 per cent of the total physical gold demand in the first quarter of 2013.

In China, pawning loans account for a very small proportion of total loans and such loans are provided by pawn shops.

In India, banks, finance companies, and local money lenders are active in pawning. Banks and finance companies have grown this business rapidly in the last few years. They have been gaining market share from the informal sector where the interest rates are much higher. Nevertheless, pawning loans still forms a relatively small part of banks’ portfolio. As of March 2012, gold loans formed 2.5 per cent of Indian banks’ overall loans.

S&P said that Sri Lankan banks’ ride on galloping gold prices could end poorly. This is because borrowers may choose to default and not redeem pledged gold, the value of which could be lower than the outstanding loan amount. “We understand that most banks do not hedge the gold-price risk. This is unlike a few large pawning companies in emerging markets, such as Mexico, that use derivatives to manage gold-price risk,” the report said.

“In our base-case scenario, we expect the earnings of Sri Lankan banks to absorb the higher credit costs associated with pawning loans. We do not expect these factors to significantly affect banks’ overall capital position,” it said.

Follow @timesonlinelk

comments powered by Disqus