Columns

Writing on the wall: Mind the trade gap

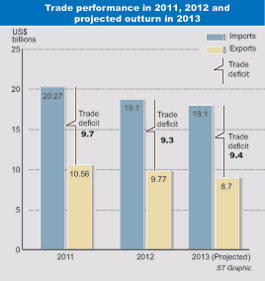

View(s):Early signs point to another massive trade deficit this year. The trade gap of US$ 780.4 million for the first month of the year, when projected for the year, amounts to US$ 9.36 billion.

This is of the same magnitude as of last year and about 4 percent less than the trade deficit of 9.7 billion in 2011. If this year’s trade deficit reaches this magnitude, then it would be the third successive year when the trade deficit exceeded US$ 9 billion.

One should of course be cautioned by the age old saying that a single swallow does not make a summer. Nevertheless, it is important to take note that all’s not well with the country’s trade. Despite this January’s deficit being 24 percent lower than that of January 2012, such a large monthly deficit over the next 11 months would result in a massive trade gap. Therefore it should not be interpreted as an improvement from that of last year but taken as a warning of an impending huge trade deficit, if corrective action is not taken.

Optimistic picture

The Central Bank interpretation of the January trade performance is indeed favourable: “The trade deficit continued to narrow and recorded a 24 per cent year-on-year decline in January 2013. The policy measures implemented early in 2012 to discourage non-essential imports have continued to ease pressure on the trade deficit and therefore on the current account balance.”

The trade figures of January this year must be interpreted cautiously as they are a comparison of data before the policy measures to curtail imports. Policy measures taken, or perhaps thrust on them by the IMF, early last year, curtailed imports. On top of a decline in imports by 5.8 percent last year, imports declined by a significant 21.3 percent in January this year compared to January of last year.

The import side of the trade equation is hopeful according to the Central Bank: “Imports of refined petroleum declined by 58.4 per cent, year-on-year, in January 2013, partly due to increased hydro power generation. Lower expenditure on imports of transport equipment, gold and vehicles also made a significant contribution toward the decline in import expenditure in January 2013.”

Reductions in imports in 2013

These trends and other reductions in imports during the rest of the year may assist the trade balance. The curtailment of imports has been most successful with respect of consumer imports. Consumer goods imports declined by 51.7 percent in January 2013 compared to January 2012. Imports of food, non-food consumer goods and vehicle imports, which declined last year continued to decline in January.

The Central Bank admits there have been certain weaknesses on the import side as well with certain intermediate goods such as chemical products, agricultural inputs, plastic and wheat and maize imports, which accounted for about 11 per cent of imports increasing in January 2013 compared to a year ago. In fact there should be further measures to contain imports, especially investment imports that are still high.

Investment goods imports

The continuing high expenditure on investment goods imports is a serious concern for the trade balance. Although import expenditure on investment goods declined by 15.9 percent in January 2013, import expenditure on building materials, categorised under investment goods, increased Investment goods imports that accounted for 23.5 percent of total imports in 2012, and accounted for 29 percent of January’s imports. This is a high proportion of imports and unless investment goods imports are reduced considerably, a significant improvement in the trade balance cannot be expected.

Investment goods imports projected for the year on the basis of January’s imports of US$ 440.2 billion will amount to US$ 5.28 billion about 56 percent of the trade deficit. The reduction of investment goods imports is vital to reduce the trade deficit.

Persistent trade deficits

The continuing large trade deficits are ominous. They should be recognised as such in order to take countervailing measures. The trade deficit can be reduced only by a two pronged strategy of decreasing imports further and increasing exports. Admittedly expanding exports immediately is difficult owing to the economic slowdown in Europe and the US that are the markets that matter for our exports of manufactures. The disruption of tea exports to the country’s two main markets in the Middle East is constraining agricultural exports.

Silver linings

There are a few silver linings in the dark clouds that may improve this year’s trade performance. On the side of imports, the trend of decreasing consumer imports is likely to continue. Oil imports have decreased and may continue to decrease owing to higher generation of hydroelectricity that would reduce the need for thermal generation.

There are signs that oil prices too may slip owing to lower demand due to the European recession and increased supply in the US of shale oil. Shale oil is crude oil distilled from heated shale, a dark fine grained sedimentary rock composed of layers of compressed clay, silt or mud. A decrease in expenditure on oil imports are very significant for the trade balance as on average 25 percent of the import bill is for oil.

The exportable surplus of tea too could be higher this year owing to increased production. However reduced demand from Middle Eastern countries that are in turmoil and the Iranian embargo may restrict this prospect. Increase in spice crops offers a means of enhancing agricultural exports this year.

The crux of the problem

The crux of the problem is that the country’s exports are inadequate to finance its imports by a large margin. Imports are about twice the value of exports. The declining imports are inadequate to bridge the gap by much. Both agricultural and industrial exports have declined. This is a continuing trend from last year and indeed an ominous sign.

The Central Bank points out: “As demand for exports remained fettered by the slow recovery of major export destinations, namely, the EU and the USA, the decline in export earnings continued into 2013. Earnings from exports declined by 18.2 per cent to US dollars 727 million in January, as earnings from all major categories of exports declined, on a year-on-year basis.

The decline was mainly driven by industrial exports which declined by 20.7 per cent. Earnings from exports of textiles and garments declined by 8.9 per cent. Exports of transport equipment, gems, diamonds and jewellery and rubber products were the other categories of export that contributed significantly to the decline in export earnings. Earnings from agricultural exports declined in January 2013, as a result of earnings from both traditional and non-traditional agricultural exports declining. Despite exports of tea continuing to fetch favourable prices, the drop in demand from main markets led to a decline in earnings from tea exports in January.”

Since the prospects for increasing exports is bleak owing to the recessionary conditions in most of the country’s main export makes, the immediate solution has to be in a further curtailment of imports. The reduction of investment goods imports that account for as much as 29 percent of the import bill is imperative to make a significant dent in the trade gap. The key to this is the reduction of public expenditure on investment projects that have large import content. Such a measure would also assist in the reduction of the fiscal deficit.

Conclusion

The trade performance in January is no reason to be complacent about the balance of trade outturn this year. On the contrary, it is a continuation of the adverse trends in the trade balance experienced in the last two years, when the trade deficit exceeded US$ 9 billion. Such a large trade gap is one to be concerned about.

Although there has been a decline in imports by 21 percent in January, the decline in exports has offset this benefit to an extent to result in a trade deficit of US$ 780.4 million. If this trend were to continue the trade deficit would once again reach an unmanageable magnitude of US$ 9 billion. Such a large trade deficit could create a strain on the balance of payments despite services receipts, worker remittances, and net capital outflows offsetting a large proportion of the deficit.

The pattern of the January trade performance indicates the needed countervailing measures to reduce the trade deficit. Instead of proffering excuses and extenuating circumstances to explain the adverse trade performance, firm remedial actions should be taken to reduce imports to improve the trade balance.

Follow @timesonlinelk

comments powered by Disqus