Now Treasury seeks IMF loan of $500 mln

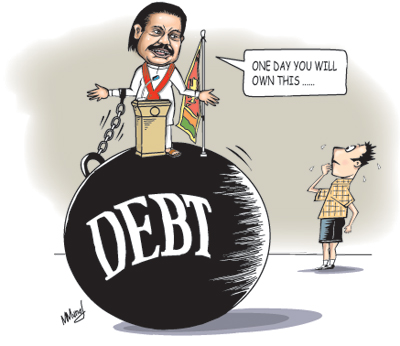

Sri Lanka’s cash-strapped authorities are seeking an US$ 500 million Extended Fund Facility from the International Monetary Fund (IMF) to continue its economic development initiative despite the huge trade deficit which is expected to climb to US$13 billion this year from US$10 billion in 2011.

Earlier in April, Treasury Secretary P.B. Jayasundera announced that they planned to raise US$500 million dollar bond in October 2012 maturing in 10 years.

Now Finance Ministry officials say that it would be either this (dollar bond) or that (IMF loan). “If the IMF loan is not forthcoming then we’ll proceed with the bond issue,” one official said. Sri Lanka has to maintain a debt ceiling of Rs. 1139 billion when making local and foreign borrowings in accordance with the 2012 budget and Central Bank (CB) sources said further borrowings would only be possible under the 2013 budget.

The public debt sustainability is improving and the debt to GDP ratio which was below 80 per cent in 2011 was the lowest recorded in the past 30 years, a CB source said.

Negotiations are underway between an IMF team now in Sri Lanka on obtaining this new loan facility, months after the CB received the final installment under the $2.6 billion IMF Stand-by Arrangement, the Finance Ministry official said.

“The main objectives of seeking new loan facilities are to rebuild the external reserves, strengthen the fiscal position, maintain monetary stability and reinforce the domestic financial system,” he added. Risk indicators of Sri Lankan public debt have been improved and Sri Lanka qualified as a less indebted country in five out of six indicators and as a moderately indebted country in one indicator, he disclosed.

The IMF team will look at all these factors when considering the new loan request, he said. Sri Lanka’s balance of payment is set to record a deficit despite considerable foreign remittances from workers abroad projected at $6.5 billion, high tourism earnings projected at $1.2 billion and Foreign Direct Investment inflows targeted at $ 2.0 billion, he revealed.

The Treasury plans to resolve foreign resource constraints through foreign borrowing. It will help in supplementing insufficient domestic savings for investment and undertaking large infrastructure projects in the country. It can also assist in overcoming balance of payments difficulties, he added.However the Governor of the Central Bank Ajith Nivard Cabraal told the Sunday Times last week that the country is not engaged in any discussion with the International Monetary Fund (IMF) for an additional loan facility. He has said that officials from the IMF are currently in Sri Lanka for a routine visit.

According to the Governor, the team is studying the impact of monetary policy changes the government made in February and March to cap the ballooning trade deficit.

Follow @timesonlinelk

comments powered by Disqus