Columns

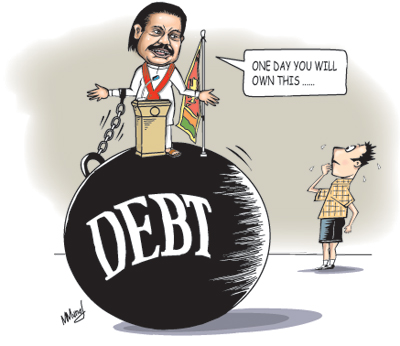

Fears over increasing foreign debt

The current balance of payments difficulties owing to the growing large trade deficit are being financed by further foreign borrowing; mostly commercial loans. Furthermore, additional borrowing is needed as there is a large repayment of debt and debt servicing costs in the coming months and foreign reserves are inadequate. The large foreign borrowing is a tacit admission that the net reserves position is weak, that there would be a balance of payments deficit and that the debt service payments this year are a strain on the reserves.

According to the Central Bank, the recourse to this additional borrowing would give it more room to defend the weakening rupee that reached a record low 133 to a dollar at the beginning of the week. There is an expectation that the strengthening of the reserves through such foreign borrowing would support the value of the rupee.

Current borrowing

The government is taking steps to sell sovereign eurodollar bonds worth up to $1 billion to add to its dollar reserves. This is in addition to the last tranches of the IMF standby facility. The issue will be Sri Lanka’s fifth sovereign bond issue since it first sold a $500 million five-year euro bond in October 2007. Recently the Bank of Ceylon issued a bond for US$ 500 million.

In addition to these are the IMF tranches of the standby facility and a World Bank soft loan of US$ 500million that is expected this year. It appears that 2012 would be a year of large foreign commercial borrowing. The foreign debt is likely to increase by at least US$ 2 billion during the course of this year.

The Central Bank sold a $1 billion, 10-year euro bond in July 2011 priced at 6.25 per cent. The new sovereign bond of US1 billion is likely to be at a higher interest rate of 6.5 to 7 per cent owing to the weaker external finances of the country and unfavourable ratings of international rating agencies.

The proceeds of the bond are expected to be used for the redemption of its Eurobond that matures in October this year. The Central Bank is expected to sell $150 million worth of 3-year Sri Lanka Development bonds to retire maturing securities used for development financing.

Foreign debt

The growing foreign debt is a serious economic concern. Foreign debt increased significantly in the last decade. The increase in foreign debt is particularly sharp since 2008. Between 2008 and 2009 foreign debt increased by 10 percent; between 2009 and 2010 by 14.4 and it increased by a further 14.5 percent last year. By the end of 2009 foreign debt had more than doubled what it was in 2000 to reach US$ 18 billion.

In 2010 it reached US$ 21.4 billion and at the end of last year it had ballooned to US$ 24.5 billion. The large borrowings this year is likely to result in the foreign debt reaching around US$ 27 billion.

Recent increases in commercial borrowings have also tilted the debt profile more towards commercial borrowing from the earlier bias towards concessionary loans from bilateral and multilateral sources. In 2011 the proportion of concessional debt decreased to 63 percent from71 percent in the previous year.

External debt servicing costs

The large increase in the country’s foreign debt in recent years and increasing foreign debt servicing costs is a serious concern. The Ministry of Finance and Planning estimates Sri Lanka’s foreign debt servicing costs comprising both principal and interest payments for 2010 at US$ 810 million.

The debt service payments was expected to be US$ 954.5 million in 2011 and expected to nearly double in 2012 to an estimated US$ 1,539.4 million. The sharp increases in debt servicing costs are due to increased borrowing in recent years, especially those since 2009.

External debt servicing costs were 12.6 per cent of export earnings in 2011. It was much higher in 2010 at 15.9 per cent and 19 per cent in 2009. This is not an excessive burden, but the increasing trade deficit and poor performance in exports make it a strain on the balance of payments.

Foreign debt servicing has been sustainable owing to the large inflows of foreign remittances. When these are taken into account the external debt servicing ratio falls to much lower levels.

Uses of foreign funds

It would be quite wrong to think of foreign borrowing as bad. Foreign borrowing can spur an economy to higher levels of economic growth than its own resources permit. Foreign borrowing can assist in resolving constraints in foreign resources for development, supplementing inadequate domestic savings for investment and undertaking large infrastructure projects.

It can also assist in overcoming temporary balance of payments difficulties.

|

|

However, the extent, costs, terms of borrowing, and use of funds have significant implications for macroeconomic fundamentals. Foreign borrowing could have either beneficial or adverse impacts on economic stability and development.

The use of foreign funds for investment in export earning or import saving enterprises could reduce the burden of foreign borrowing.

Foreign debt should be incurred for developmental purposes. According to the Ministry of Finance 75 percent of recent foreign borrowing has been for infrastructure development such as for power and energy, ports, roads, bridges, water supply, agriculture, fisheries and irrigation, among others. Nevertheless all infrastructure development is not necessarily justified from an economic perspective. Infrastructure projects that either save or earn foreign exchange are the least burdensome. Prioritisation of infrastructure development on this criterion is a prudent economic strategy.

The extent of borrowing, costs and terms of borrowing, of foreign funds and the use of funds have significant implications for macroeconomic fundamentals. These could have either beneficial or adverse impacts on long-term economic development. Therefore containing the foreign debt and decreasing debt servicing costs are vital for economic stabilisation and Sri Lanka’s economic development.

Summing up

There has been a significant increase in foreign borrowing from international capital markets. These have been mainly to resolve the balance of payments difficulties caused by the widening trade deficit. Furthermore, the foreign reserves were inadequate to meet this year’s debt servicing costs. The resort to foreign borrowing should take into account the uses of the funds. Given the current balance of payments difficulties, it is imperative that government use of foreign exchange be pruned down to assist the balance of payments.

comments powered by Disqus