One of the favourable developments last year was the drastic reduction in the trade deficit. The trade deficit was reduced to the extent that it was more than off-set by the inflows of remittances. There were however certain features of the trade performance that makes one wonder whether the external trade performance this year would be as favourable.

The outstanding feature of last year’s trade performance was that the reduction in the trade deficit was brought about by a decline in import prices. The second feature was that the improvement in the trade balance was not the result of an improvement in export performance. In fact export earnings in 2009 dipped by 12 percent. The improvement of the external trade account or the reduction in the trade deficit was brought about by import expenditure declining by more than the fall in export earnings. The question arises as to whether this situation would prevail this year.

|

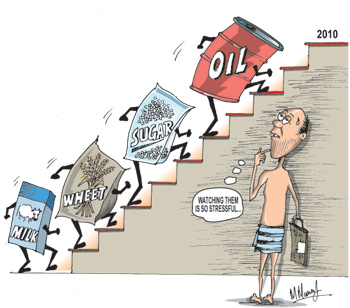

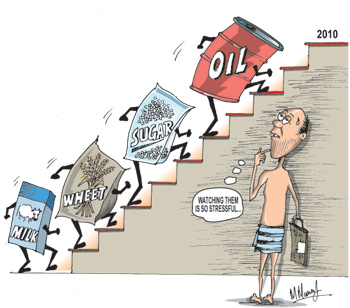

The indications are that the global situation is not likely to be as favourable in 2010, as it was in 2009. On the import side there has been a steady increase in the prices of critical imports of the country. Chief among these is the rise in prices of oil. While oil prices may not reach the dizzy heights of 2008, it is most likely to be higher than what they are today and certainly higher than the average prices of 2009.

In fact oil prices have been rising in the last six months. This will increase the country’s import expenditure significantly. Food imports have also shown distinct increases in prices, especially sugar, wheat and milk. So the prediction for the country’s import expenditure is that it would be higher than that of last year. This is an unfavourable development.

As we noted earlier, the export performance has been unsatisfactory last year and this trend appears to continue into this year as well. This is especially so in respect to industrial exports that have shown a decline. The continuing decline in the country’s industrial exports is a serious setback to the economy. Declining industrial exports in the last two years have been a danger to the country’s employment and incomes of workers. The export performance in January this year is a continuation of the declining trend of last year when industrial exports fell by as much as 13.8 percent. Industrial exports constituted 75 percent of total exports in 2009. Such a decrease in industrial exports not only affects the trade balance adversely but affects incomes and employment adversely.

One of the reasons for the decline in industrial exports in recent years was the recessionary conditions in North America and Europe. These two main markets for industrial exports shrank owing to the lower incomes and high unemployment in these countries. The global economic recovery is very sluggish and therefore the country’s industrial exports would have to compete in a market that is not expanding. This is especially so in respect to the American market that is still gripped by recessionary conditions and continuing high unemployment. The loss of the GSP + concession would aggravate the serious problem of competitiveness of the country’s industrial exports.

Kenyan tea production has revived and in fact Kenya displaced Sri Lanka as the leading tea exporter. This together with uncertain weather conditions does not augur well for tea export earnings. On the other hand, rubber prices are likely to rise and enhance export earnings. An export import economy such as Sri Lanka is always vulnerable to international supply and demand that alters the terms of trade. This has happened so often that even the ordinary man knows of it through the consequences he feels. The most recent experience was in 2008 when import prices rose sharply.

The prices of essential food items rose in international markets and as the country was heavily dependent on several essential items such as wheat, sugar, milk and lentils it not only increased the import costs and resulted in a huge trade deficit, but increased the costs of living of everyone, especially that of the poor and low and middle income groups.

Apart from the high costs of imported food, the rise in oil prices was a big blow to the economy. Petroleum prices rose threefold and fertilizer and several other commodities that are closely linked to oil also rose in price. This caused a huge dent in the trade balance and the country records the highest trade deficit ever. While food imports are only about 10 percent of the country’s import bill, oil imports are about 40 percent. Therefore, in as far as the trade balance was concerned, it was the rise in oil prices that had the most serious consequences. Food prices, on the other hand, affected the cost of living and increased the rate of inflation that rose to over 20 percent.

There were a few consolations. The rise in oil prices increased incomes in oil producing tea consuming countries and as a result the demand for tea increased and international tea prices increased. This trend was compounded as Kenyan tea production had problems. Therefore the country benefited from higher international tea prices.

The other advantage was that the oil price hike resulted in natural rubber prices rising. This reversal of prices was of significant benefit to natural rubber producers who had had rather low international prices. The price increases in rubber resuscitated the rubber industry that has shown an increase in production. However the benefit to the trade balance was minimal as the capacity to increase rubber production was limited and much of the country’s rubber production was consumed locally in rubber based industrial products that are exported.

A small import export economy is inherently vulnerable to the vicissitudes of international price movements. Yet neither this fact, nor a complacency derived due to the large inflow of remittances that offset the trade deficit, nor the large foreign reserves that are mainly borrowed funds, should make policy makers abstain from taking countervailing measures to improve the trade balance. The declining exports are a serious factor in the country’s long term economic growth and development. It behoves policy makers to be concerned about this in the long term interests of the country. Then again, they could take comfort in Lord John Maynard Keynes famous saying that “we are all dead in the long run”. |