|

23rd May 1999 |

Front Page| |

|

"Please sir, can I have some more?"

New price index to replace consumer indicesThe Census and Statistics Department is in the process of computing a new price index which will replace the Colombo Consumers' Price Index (CCPI) and the Greater Colombo Consumers' Price Index (GCPI), a department official said. Unlike the CCPI and the GCPI, the new index will cover nearly 90 per cent of the population and the basket would reflect the consumption habits of this sector, Deputy Director, Mr. D.C.A.Gunawardene said. The new index, which is yet to be named, will reflect the price movement of goods as well as inflation level, he said. The data for the index was collected during a consumer survey last year, but the new basket is yet to be decided as officials are in the process of tabulating the data, he said. However, the department is confident the new index will be out in time for the millennium. A revised consumer price index has been a long felt need as the wages of most working class people are linked to the CCPI or the GCPI. The CCPI has a base year of 1952 while the GCPI a base year of 1989. This has prompted many economists to lobby for the baskets of each indices to be revised to reflect the changing consumer needs. Since the Census Department was taking time to revise the indices, the Central Bank began computing a new index called the Colombo District Consumer Price Index (CDCPI) last year. An IMF delegation was in Sri Lanka last year to study the various price indices. The delegation commended the CCPI and GCPI and the data collection network, but urged the government to have a single index as soon as possible, Mr. Gunawardene said. The GCPI was introduced by the Census Department as an alternative to the CCPI. Due to protests from various labour unions, the department was compelled to continue to compute both indices. Officials are hopeful the new index would receive union approval so that it would eventually replace the two aging indices. Meanwhile, the Central Bank is putting the finishing touches on the Producers' Price Index, which is expected to be released in the coming weeks. (MG)

Unit trusts open to foreignersBy Mel GunasekeraIn an attempt to open up the unit trust industry, foreigners may be allowed to invest in Unit Trusts, a top government official said. The Securities and Exchange Commission (SEC) has forwarded proposals to the Central Bank to enable foreigners to invest in unit trust and remit their money through the SIERRA account, SEC Director General, Kumar Paul told The Sunday Times Business. At present, the SIERRA account is limited to foreigners investing in equity. Since Unit Trust (UT) investments are limited to Sri Lankan nationals, the UT code will have to be amended to allow foreigners to participate, Mr. Paul said. However, foreign participation will be limited to equity based funds for the time being, since foreigners are not allowed to invest in the government and corporate debt market, he said. Since the launch of the first unit trust in 1991, there are 12 unit trusts managed by five unit trust management companies. With around 25,000 unit holders, the industry has mobilised over Rs. 3 bn since its inception and mainly channelled funds to the equity markets. Last year the Unit Trust Association of Sri Lanka (UTASL) called for sweeping reforms and forwarded a proposal to the SEC suggesting setting up 'bearer funds'. Bearer funds would allow unaccounted, or black money, on which tax has not been paid, to flow into the industry. The proposal based on a J A R Felix Commission report for tax in 1988, stated that 'unaccounted funds' account for around 44 per cent of GDP. Fund managers estimate total unaccounted money in Sri Lanka to be over Rs. 300 bn, almost equal to the total legitimate money supply, making it a huge reserve for unit trusts to tap. If there is an instrument that effectively mobilises such deposits and channel them to capital markets development, the country could use these funds for its development efforts, UTASL proposal said. The proposal would require a change in the country's Unit Trust Code of 1995. Under bearer funds, investors are not required to register, instead they would get bearer certificates, to protect their identity. The Association said, there were large amounts of undeclared money in the country and the registration system was preventing the money flowing back into the legal economy.

Business briefsHorana Plantations suspendedTrading of Horana Plantation shares were suspended by the CSE last week on a SEC directive. SEC officials said they were investigating the business activities of Horana Plantations. Company officials are believed to have spirited large sums of money, market sources said. Horana is in crisis, with tea not being plucked on certain estates, difficulties to pay salaries and buy fuel, sources said. This was denied by Horana Plantation's Chairman, Premajay Fernando. "Its an absolute nonsense, all estates are in operation, there is nothing wrong in our accounts," he said. He said he "has not been officially informed about the suspension yet." Dr. PBJ resignsDr. P B Jayasundera, Deputy Secretary to the Treasury resigned from the Boards of Sri Lanka Telecom and Hotel Developers Ltd last week. Commercial Leasing debenturesCommercial Leasing company is to issue a Rs. 250 mn - Rs. 300 mn debenture to source long term funds for their leasing activities, market sources said. The issue will be guaranteed by the IFC (50%), DFCC Bank (25%) and Commercial Bank (25%).

CDC dumps Vanik, Nahil Wijesuriya picks it upCommonwealth Development Corporation (CDC) sold its 8 % stake in Vanik to Chairman East West, Nahil Wijesuriya last week. A parcel of 5.8 mn shares changed hands at Rs 4. In January this year, CDC's representative on Vanik's board Steven Enderby resigned. "CDC is owned by the British government and has sold some of its investments in the region prior to privatising. Vanik was one of them," Vanik officials said. Mr. Wijesuriya explained his purchase saying, "I have 300 mn worth of debentures in Vanik and want to keep a closer eye on Vanik." Earlier this month, CSE refused to list Vanik's new debenture. Instead the debenture was issued via a private placement.

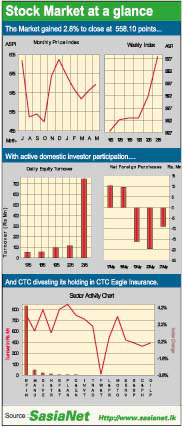

Zurich comes hereThe Zurich Financial Services Group (ZFS) sealed its strategic alliance with the National Development Bank (NDB) when it acquired 80% stake in CTC Eagle Insurance Company (CTCE) through Zurich NDB Finance Lanka (Pvt.) Ltd. last Friday, a Colombo Stock Exchange release said. This 80% stake represented Eagle Insurance Company (64%), Capital Development and Investment Company (15%), NDB (1%), James Finlay (5%) and public (15%). The Swiss based ZFS, is the fourth largest insurance company in the world, and the alliance could have far reaching repercussions affecting even Sri Lanka. The merged entity has US$ 375 bn in assets under management, US$ 45 bn in gross insurance premiums, US$ 415 bn assets under management and 33 mn customers in 60 countries. While globally BAT has divorced itself from all financial services as they merged with ZFS last year, CTC's operations continued to remain a 'mixed bag' with tobacco and financial services. From ZFS's perspective as well, it may not wish to tarnish its exclusive financial services with the globally censored substance of nicotine. CTCE commenced business 11 years ago, and has a gross written premium of Rs. 1.6 bn as at 1998. To reflect the change in ownership structure, CTCE will change its name to Eagle Insurance Co. Ltd. The logo of the company too will be changed. Eagle NDB Fund Management Company, the existing joint venture between NDB and Eagle, will also become a member of the ZFS. Hence, Sri Lanka's largest fund manager with Rs. 6 bn funds under management will be able to benefit from the technical expertise of the group and provide even better solutions to their clients. "This is a landmark deal where the fourth largest insurance company in the world, Zurich Financial Services, has invested in Sri Lanka. In line with BAT's global re-structuring we were mandated as financial advisors for their re-structuring in Sri Lanka," Jardine Fleming HNB Capital CEO, Anura Wickremasinghe said. The ZFS Group is a global leader in the financial services industry, providing its customers with products and solutions in the area of financial protection and asset accumulation. The Group concentrates its activities in four-core business: non-life and life insurance, re-insurance and asset management. Companies within the Group include Zurich Insurance, Zurich Re, Allied Dunbar.

Putting the economy on correct pathDip in growth endangers long term development Forecasts that the economy would grow by less than 5 per cent this year is bad news. Given the global downturn and the lower rates of economic growth in many other countries, a 4.5 per cent growth or even a 4 per cent growth appears quite acceptable. Yet it is bad news as the long term expectations that the country would achieve a much higher rate of growth needed to solve the country's economic and social problems appear to be diminishing. Economists have for some time pointed out that the country requires to grow at around 8 per cent a year for about a decade to make a serious dent in the country's problems, particularly the problem of unemployment. It is also an 8 per cent growth over a decade that would ensure a doubling of per capita income during the next ten years . Such a rate of growth would be needed to sustain social welfare expenditures and reduce poverty to acceptable levels. While we have been speaking of these kinds of growth rates, we have in fact achieved only a little above one half of the required rate. One can even be fatalistic and say that the country can in fact achieve only an average of around 5 per cent growth. But that is another way of saying that we would not be able to solve our problems. Since we cannot take such a fatalistic view we must look to the reasons why we have been unable to grow faster. One easy answer is to blame the war. No doubt the war is an important factor inhibiting a faster rate of growth. It affects the economy in very many ways, both directly and indirectly. But we must look beyond the debilitating factors of the war to take remedial action. If the war ends tomorrow to expect the economy to automatically generate an 8 per cent growth sustained over a long period is a pipe dream. There are a number of other conditions which must be fulfilled to achieve the kind of rapid economic growth which the East Asian countries achieved. These include governmental actions besides, good policies, as well as a response by civil society to back up economic growth. But people's responses can only come in a situation where the government takes a leadership and makes it clear that it is seriously interested in policies and actions which are growth oriented. The government must play a pro-active role. Recent governments have failed to play this role as there has been a lack of priority for the pursuance of economic policies. Instead government's prior concern has been to pursue policies which would bring short term political gains. Political concerns have dominated the country's scene not economic programs. Frequent elections have made this obsession with politics greater. The economy has had to grow with very little positive actions by the government. It is true that the government has put in place a good framework of policies, but that alone would not do in an underdeveloped country like ours where the government must play a more supportive role for economic growth. When the country faces unfavourable global conditions, it is precisely the time when there must be support to those sectors which are facing problems. Besides this there have to be efforts to find alternate strategies to ensure growth. There is an urgent need to take the fall in economic growth seriously and find ways and means by which we can grow faster. The expected fall in growth must be a challenge to policy makers to find ways and means of putting the economy on a path of higher growth.

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

CAN

I HAVE MORE? No, not more funds... Mr. Hideki Kamitsuma, head of Nippon

Telecom who owns 35%and manages Sri Lanka Telecom is probably asking HNB's

MD, Mr. Rienzie Wijetilleke to pass the sugar, at a dinner he hosted for

his foreign clientele last week. On Mr. Wijetilleke's right is Food and

Commerce Minister, Kingsley Wickramaratne, who in his address to foreign

investors said that Sri Lanka is still an unsaturated market where there

is scope for a telephone in the toilet and the pantry. Take note Mr. Kamitsuma..

HNB's dinner to its foreign clients was a pioneering event to promote a

better relationship with them. In his address to them Mr. Wijetilleke is

just behind the market leader Bank of Ceylon in foreign currency deposit

base with US$ 175 deposit base inclusive of NRFC accounts. HNB's FCBU manages

an asset base of USS155mn, Mr. Wijetilleke said. The bank's exposure is

in the areas of textiles, tents, and soft toys, garments, leather and Maldives

holiday resorts.

CAN

I HAVE MORE? No, not more funds... Mr. Hideki Kamitsuma, head of Nippon

Telecom who owns 35%and manages Sri Lanka Telecom is probably asking HNB's

MD, Mr. Rienzie Wijetilleke to pass the sugar, at a dinner he hosted for

his foreign clientele last week. On Mr. Wijetilleke's right is Food and

Commerce Minister, Kingsley Wickramaratne, who in his address to foreign

investors said that Sri Lanka is still an unsaturated market where there

is scope for a telephone in the toilet and the pantry. Take note Mr. Kamitsuma..

HNB's dinner to its foreign clients was a pioneering event to promote a

better relationship with them. In his address to them Mr. Wijetilleke is

just behind the market leader Bank of Ceylon in foreign currency deposit

base with US$ 175 deposit base inclusive of NRFC accounts. HNB's FCBU manages

an asset base of USS155mn, Mr. Wijetilleke said. The bank's exposure is

in the areas of textiles, tents, and soft toys, garments, leather and Maldives

holiday resorts.