|

23rd May 1999 |

Front Page| |

TRC serves notice on Sri Lanka TelecomSri Lanka Telecom has been ordered to abide by the interconnection agreement unveiled by the telecom watchdog last November. The Telecommunication Regulatory Commission (TRC) issued a court order last week, giving SLT 30 days to appeal. The dominant carrier SLT alleged the interconnection agreement favoured the two wireless operators and took the regulators to court over the issue. TRC unveiled a new interconnection agreement last year that would replace the present controversial sender-keeps-all agreement and lead to revenue sharing among the operators. The new ruling was made in a bid to end a revenue row among the three fixed access telephone operators, which have substantial foreign investment. Under the agreement, which will be effective for 3 years, for the first time, the operators will have to share revenue from both incoming and outgoing international calls. While, revenue sharing on the lucrative international calls came into affect from December last year, revenue sharing on local calls is hanging in the balance with the three operators must first establish a common telephone directory and directory services. Since SLT has failed to agree to a common directory, the sender-keeps-all agreement is still in place for revenue sharing on local calls. Meanwhile, SLT's IPO is on hold pending court decision on the interconnection agreement. There are various moves behind the scenes to settle the matter amicably as the government hopes to list the shares within the next 12 months.

Mobitel launches digital networkMobitel, further reinforced its leadership position with the launch of a state-of-the-art digital network offering increased clarity of reception and a wider spectrum of value-added services, says a company release. These dual mode handsets give "Mobitel Digital" users the option of enjoying the services and wide coverage of both digital and analog networks through seamless transfer between systems. Hence the slogan "Best of Both Worlds". Customers can now enjoy the benefits of Mobitel's extensive islandwide coverage. A digital environment also means an extended battery life for handsets which is three times the talk and standby time of a normal analog phone. The network was officially launched on May 12 with special events held at Mobitel's Big M outlet at W.A.D. Ramanayake Mawatha which is also where its head office is. Deputy Minister of Posts, Telecommunications and the Media, Anura Priyadarshana Yapa was the chief guest at this function. Ms. Cathy Aston, CEO and Managing Director of Mobitel delivered the welcome address. This was followed by a speech by a Telecom Regulator from Sri Lanka Telecom and finally the deputy minister. Soon after, there was a viewing of the new Mobitel Digital TV commercial and the revelation of a "Digital City" Window Display - a miniature city lit with laser beams and high-tech lighting effects. The installation of Mobitels digital network has involved the upgrading of the main switching centre and radio base stations to facilitate better quality service. Digital coverage will gradually be extended to more and more areas. The TDMA system used by Mobitel has the leading edge in digital telecommunication technology in the world today and is enjoying a phenomenal growth rate in countries such as the USA, Latin America and Asia Pacific. It is gaining a foothold in Europe and Africa as well. Migration to digital technology opens the doors for a range of digital services which can be upgraded to third generation technology which will be widely used in the 21st century and accessible from any part of the globe.

Iridium says it won't meet bank deadlinesShares of Iridium LLC, which runs the first global satellite-telephone network, fell as much as 40% and its bonds tumbled after the company said it expects to default on US$ 800 mn in bank loans. Shares of Iridium fell 3 9/16 to 10 15/16 in midday trading after falling as low as 8 3/4 earlier. Iridium's 14% bonds due in 2005 fell 20 points, or US$ 200 per US$ 1,000 face value. At a price of 18 cents on the dollar, the notes are down 81% since February. Iridium failed to draw enough subscribers and meet the revenue requirements of the bank loans because of problems marketing and delivering its phones to customers. In the past two months, its chief executive quit in a dispute with the board and its financial chief and top marketing executive also left. Iridium's shares have fallen 80% in the past year. "Our model suggests it's heading for bankruptcy and we've thought that for several months," said Robert Kaimowitz, an ING Baring Furman Selz LLC analyst, who doesn't have a rating on the stock. "We just can't do the math where there is any positive equity value." The deadline for the bank-loan requirements is May 31. Iridium hired Donaldson, Lufkin & Jenrette Securities Corp. to restructure its debt, the Washington-based company said yesterday. Chase Manhattan Corp. and Barclays Plc are Iridium's lead bankers. Iridium's telephones allow callers to place or take calls from practically any spot on earth though a constellation of 66 low earth-orbit satellites and conventional cellular telephone networks. Some models of the phone have drawn criticism for their unwieldy size - almost as big as a brick - as well as their US$ 3,000 price tag.

Celltel's Cellcard competitionCelltel Lanka Ltd., Sri Lanka's leading cellular operator, has introduced two new pre-payment cards and organised a competition to create awareness about the new value CellCARDs. The two new CellCARDs are in denominations of Rs. 450 and Rs. 750 and the competition will provide users an opportunity to win upto six CellCARDs a day for 6 weeks starting the first week of May. Explaining how the competition works, Celltel's Commercial Director Steve Torode said that when the PIN numbers of CellCARDs of the two new denominations are keyed into the phones, their users will automatically be entered for the draw which will take place the very next day. Celltel has tied up with Yes FM and Sirasa FM for the promotion and will draw the winners on air every day. The winners will be contacted by the radio stations and spoken to on air. Each station will conduct three draws a day, and each winner will receive a CellCARD value of the one he or she purchased to enter the competition, Mr. Torode added.

UML progress after privatisationUnited Motors Lanka Limited celebrated 10 years since privatisation on May 9. Over the past decade, the company progressed recording achievements. United Motors has expanded over the years to become one of the largest automobile companies in Sri Lanka, with five subsidiary companies - Orient Motor Co. Ltd, UML Property Developments Ltd., Motor Trade Ltd., Associated United Motors Ltd and AUML Autogas Ltd., a company which promotes the conversion of petrol vehicles to LP gas operation, a strategic alliance with Associated Motorways Ltd. These five subsidiaries cater to every aspect of automobile engineering and service. Since 1992 , UML has won awards for the Best Corporate Report and Accounts at the annual competition conducted by the Institute of Chartered Accountants, Sri Lanka. This achievement reinforces the company's commitment to quality in every aspect of its business. United Motors Boad of Directors: M.J.C. Amarasuriya (Chairman), G.A.Hedelaratchi (MD/CEO), I.S.Jayasinghe, Prof. J.W.Wickremasinghe, J.S.Mather, C.Wijenaike, K. Balendra, V. Lintotawela and A. Surahashi.

Lanka Internet ushers new eraLanka Internet Services Ltd. has carried out a major infrastructure expansion project at a cost of over Rs. 36 million, aimed at expanding their current business lines as well as to launch a host of new services, says a company release. Lanka Internet - a US-Sri Lanka joint venture with BOI status and a licensed operator, pioneered Internet services in Sri Lanka four years ago, and has remained the leading Internet Service Provider for the business sector as well as to individuals. This expansion project will enable Lanka Internet to provide cost effective, speedy and reliable Internet, E-mail, Fax and Customized Data Communication solutions including International Private Leased Circuits [IPLC], Video Conferencing Facilities, Frame Relay Services, Real Time Faxing, as well as a host of other services. Under the expansion programme, a fully redundant Satellite Internet Earth Station obtained from IDB Systems of USA, [the 4th largest Satellite Earth Station lntegrator in the world] was commissiond by Dr. Arthur C. Clarke who is respected the world over as the Father of satellite communication, in Colombo on May 13. Lanka Internet is no longer just an Internet Service Provider, but a Total Communication Solutions Provider for the Corporate sector, State Institutional sector, as well as the Retail sector, adds the news relase.

John Keells tops the listJohn Keells headed the list of corporate giants who received awards

at the Top ceremony held by Lankan stones to ItalyEight exporters of free sized and calibrated stones will leave for Italy next week in a bid to get direct access to the Italian market. Italy is a major manufacturer supplying nearly 62% of the worldwide jewellery demand. Italian jewellery manufacturers are familiar with the wide variety of Sri Lankan stones and use them extensively, but we had no direct contacts with the Italian manufacturers. They purchase Sri Lankan gems through Thailand and Hong Kong.

Chamber signs MOU with SingaporeA 10 member trade and investment mission from Singapore, co-ordinatd by the Singapore Trade Development Board in association with the Sri Lanka-Singapore Business Council, which functions under the aegis of the Ceylon Chamber of Commerce, visited Sri Lanka last week. The Ceylon Chamber of Commerce signed a Memorandum of Understanding with the Singapore Indian Chamber of Commerce & Industry on May 11. The MOU's main objective is to: Co-operate and assist in promoting trade, investment and economic co-operation between Singapore and Sri Lanka. Regularly exchange information and views on expansion of trade and investment between the two countries. Organise investment missions.

Hayleys sell over 6,000 TV setsHayleys Electronics Limited, sole agents in Sri Lanka for Philips, Daytron, Usha and Daewoo consumer electronics, ended the 1998 -99 financial year selling over 6000 television sets in March, says a company release. Announcing this achievement at the company's annual convention, Hayleys Electronics' Managing Director Sujiva Dewaraja said the company also emerged as Sri Lanka's market leader in TV sales for the year with their three brands - Philips, Daewoo and Daytron, and was making substantial in-roads into the refrigerator market. Hayleys Electronics' Deputy General Manager Keshini Ediriwira said the company's staff had grown ten fold since its inception; the company had the largest dealer network in the electronics sector, and has maintained a strong presence in the marketplace for 15 years. During this period it had stayed ahead of the many changes in the marketplace and penetrated many sectors, including most recently, mobile phones, she said.

MMBL will advise US TeledesicMercantile Merchant Bank Ltd. (MMBL) has signed a consultancy agreement with Teledesic, a leading US Telecommunications company. By virtue of this agreement Mercantile Merchant Bank will be responsible for advising Teledesic, in Sri Lanka, in relation to their efforts to establish a global telecommunication network, says a news release. Teledesic is building a global, broad band Internet-in -the Sky. Using a constellation of low-earth-orbit satellites, Teledesic and its international partners are creating the world's first network to provide affordable, worldwide "fiber-like" access to telecommunications services such as computer networking, broadened Internet access, high-quality voice and other digital data needs. On Day One of service, Teledesic will provide guaranteed end-to- end quality of service to meet the broadband needs of enterprises, businesses, schools and individuals around the world.

AppointmentsBAs New General Manager South AsiaSimon J. Ratcliffe has been appointed British Airways General Manager South Asia, based at the airline's Global Business Unit in Gurgaon, says an airline press release. In this role he is responsible for British Airways' presence and operations in the region, which comprises India, Pakistan, Bangladesh, Sri Lanka, Nepal, Bhutan and the Maldives. Earlier, he was General Manager Asia Pacific at British Airways' headquarters in London - involved in the commercial profitability of the airline's Asia Pacific route network as well as the Joint Service Agreement with Qantas. From 1994 to November 1998, as Head of Supply Chain, he introduced and led a major change in logistic strategy to improve the airline's business performance in this area. He joined British Airways in 1985 on a young professionals programme and later held various management positions with operational as well as commercial responsibilities. Simon, 36, hails from Bolton in England. He is married to Debbie. They have two children Bethany, 3 and Adam l. Simon replaces Kevin Steele who has moved to British Airways' headquarters in London as Senior Manager Quality Revenue Development. Tissera takes over as director CMSChandana Tissera has been appointed to the Board of Directors of Carsons Management Services (Pvt) Ltd., from April 1. Carsons Management Services (Pvt) Ltd., is the management services provider to companies of the Carsons Group, says a company release. Mr. Tissera is the General Manager Finance of Carsons Management Services (Pvt.) Ltd., which is the management services arm of Carson Cumberbatch & Co. Ltd., and is also the Director of Rubber Investment Trust Ltd., Weniwella Investment Ltd., and Mylands Investments Ltd., which are companies within the Carson Cumberbatch umbrella. Mrs. Neela de Silva has relinquished her nomination as a Director of Carsons Management Services (Pvt) Ltd., with effect from March 31 on her retirement. CF directorsThe Board of Directors of Central Finance has appointed the following as directors of its subsidiary companies from April 1. U. B. Illangasinghe: Central Concrete Industries Ltd., and Central Mineral Industries Ltd. Mrs. Chandramali Korale: Central Homes (Pvt) Ltd. Ravi Rambukwelle: CF Insurance Brokers (Pvt) Ltd.

YA TV targets South AfricaYoung Asia Television Programmes which are now watched by over 40 million Asians, will soon be on South African Television. Worldview Global Media Ltd. (WGML). The producers of YA TV Programmes has finalised a joint venture agreement with "Future Africa Technology Holdings" in South Africa to produce "Young Africa Television" in Johannesburg, says a media release. The international marketing division of YA TV identified South Africa as a lucrative market of the new millennium for TV programmes. Today, YA TV programmes produced in Colombo are broadcast regularly on National TV stations in Thailand, Vietnam, Cambodia, India, Nepal, Pakistan and Sri Lanka. In Vietnam alone, over 15 million watch YA TV four times a week. In Sri Lanka, YA TV is broadcast daily on TNL TV with a viewership of one million. South Africa's Deputy President Thabo Mbeki's African Renaissance concept envisages to disseminate information and educate the youth of Africa, on global and national issues. Television has been identified as one of the primary media for this ambitious programme. YA TV specialising in documentary and magazine type educational TV programme productions, have quickly moved in to dominate opportunities available in this market of 55 million people with an average per capita GDP of US $ 3000. During a business visit to Colombo last week, the South African High Commissioner for India, Sri Lanka and Maldives, Jerry Matsila reviewed the progress of this joint venture with Mrs. Margot Wallstrom, the newly appointed Vice President of WGML and the initiator of the South Africa/YA TV joint venture Ananda Rajapakse, the International Marketing Director of WGML.

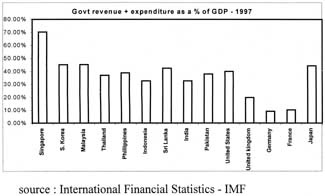

Government fiscal operations under NDB microscopeThe government's fiscal deficit has been one of the primary factors

governing the overall health and future prospects for the economy. While

government participation in the economy ( measured as total revenue &

expenditure as a % of GDP ) is much higher than that of developed nations,

it is more or Nevertheless, over the years the deficit has raced passed government capital expenditure, as defence related expenses have eaten into government revenues. Hence government borrowing has crowded out more and more public and private sector investment. Since heavy defence expenditure has its own governing factors and the government has little flexibility in this regard, we will take a closer look at recent trends in state revenues and other expenditures, against actual as well as budgeted figures, to better ascertain the failings of recent government fiscal policy. The first observation is that total government revenue has failed to grow in proportion to GDP, falling from 20.4% in 1995 to 17.3% in 1998. Almost half of the decrease has taken place in the GST/ TT category, with most of it incurred in 1998 as the introduction of GST at 12.5% has not been revenue neutral. The total fall in revenue in 1998 has been responsible for around 40% of the variation of the deficit from budgeted figures. Tax revenues have fallen in all categories including manufacturing, non-manufacturing and imports, with a steeper variance in the last category due to falling import prices ( intermediate and consumer goods) and volumes ( capital goods ). Import duty levels have also fallen due to the above as well as various concessions given to industries and services. In fact, falling import related taxes ( duty and import TT/GST ) have accounted for over 60% of the fall in total revenue levels over the last four years, and almost 70% of the fall over 1998. It is interesting that over 80% of the variance in revenue over budgeted figures for 1998 also arises from import and import related taxes, indicative of the unforeseen sensitivity of government revenue to import prices and volumes. Given the backdrop of the factors governing revenue collection in 1998,

the government's budgetary targets for 1999 seem extremely unrealistic.

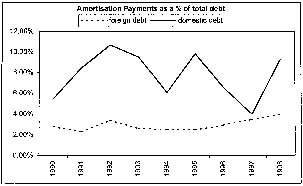

With little likelihood of a GST re-rating given that the next Since 1994 the government has curtailed overall expenditure which has been largely responsible for the trends in the falling deficit. Though there have been some cuts in capital expenditure, from 5.3% of GDP in 1994 to 5.0% in 1997, 1998 saw an increase to 5.4%. Hence state policy has been to attempt to hold or cut recurrent expenditure while maintaining capital outlays. This trend reversed in 1998 with the government unable to curtail recurrent expenditure, even in the face of falling revenue levels. Expenditure overruns in 1998 accounted for 60% of the variance from the targeted deficit, but was responsible for only a negligible portion of the variance over 1997 figures, once again highlighting the inadequacy in revenue collection in curtailing the overall deficit. Defence expenditure has been second largest component of total expense, following interest expenses on domestic and foreign debt, and has accounted for around 60% of the deficit over the last 5 years. Capital expenditure has also accounted for a similar proportion over the same period. While it is well known that defense expenses have borne a heavy proportion of the deficit, state expenses on goods and services in 1998 accounted for 40% of the variation of the deficit from targeted figures, and 22% of the variation over 1997 actuals, indicating the inability of line ministries and local and provincial governing bodies to control their non-salary related costs. Also note that the inefficiencies and losses of public corporations are "lost" in the above accounting format as revenues and expenses from and to these institutions take the form of dividends, special levies and transfer payments. Hence, proportionately large salary bills and overheads of institutions like the Ceylon Petroleum Corporation and the Sri Lanka Port Authority, and their relative inefficiencies, are not detectable. On the positive side the government has been able to cut down on subsidies ( most of which are targeted to the entire populace as opposed to the real needy ) and interest payments, the latter due to retirement of some public debt in 1997 and the relatively low interest rate structure over 1997 & 98. The 1999 budget once again looks to bring down overall expenditure in line with the 1998 budget, with most of it coming from a reduction in defense expenditure. While a 1% of GDP reduction in defence related capital expenditure is envisaged, a theoretically possible but extremely unlikely scenario, we are at a loss as to how the government proposes to bring down defence related salaries by 5%, specially given the fact that salary increases were effected only in 1998 and the military has a dire need for new recruits. We believe that most of the reduction will again come through in capital expenditure, while subsidies and transfers will be at least held at current levels given forthcoming elections. Even our estimates thus only bring down overall expenditure from 26.5% of GDP in 1998 to 25.8% for 1999, giving whatever budgetary estimates as much credence as we can. This in turn gives us a deficit of 8.4% of GDP, down from the 9.2% incurred in 1998 but much higher than the budgeted 6.0%. Note that another contributing factor has been interest payments, which we maintain at current levels. Given the estimated 8.4% deficit, we calculate the domestic debt component to grow by at least 12-13%, leaving the interest expense levels more or less unchanged over 1998, in turn also contributing toward higher than budgeted shortfall. As shown, domestic borrowings financed over 75% of last year's deficit. Most of which was drawn down from non-banking sources like the EPF, ETF and NSB. Given the drying up of multilateral and bilateral concessional lending, through which financing of the deficit has been steadily declining, our estimated deficit for 1999 is also likely to be financed largely by domestic borrowings. Note that while we have allocated some of this debt to commercial banks, the government will attempt to borrow as much as possible from the above mentioned non-banking sources, where the expansionary effect on domestic money supply is minimal. Monetary Authority Financing will be difficult to tap into given the fact that the government is likely to have already utilized its interest free overdraft at the Central bank ( which is fixed at 10% of the previous year's revenues ). Note that this is one of the primary factors that help maintain low interest rates over the first half of the year. The saving grace toward the latter half of the year will be the expected sale of part of the state's remaining stake in Sri Lanka Telecom. The budgetary estimates of 0.7% of GDP for privatization proceeds roughly translates to the rumored sale of USD 100mn worth of SLT shares. The failure to execute this sale will only result in further domestic borrowings, crowding out more public and private investment and higher interest rates. Since maturity profiles of Sri Lanka's domestic and foreign debt are not publicly available, it is difficult to predict any future government financing programme and its impact on a number of variables including domestic interest rates, the exchange rate and inflation. If amortisation payments on exiting debt are any indication, steadily increasing foreign debt repayments could point to shortening maturity profiles. Given the concesionary nature of such debt ( ie : 1-2% in dollar terms ) and future replacements being drawn down at higher rates, a persistent deficit will only have a negative impact on the above variables, making stable monetary policy by the Central Bank even more difficult.

Sluggish tourism hampers real estate growthAttractive BOI tax incentives have encouraged more foreign and local investments in real estate. But selling office and residential space has not been easy due to a gamut of social economic and legal reasons, developers say. The real estate sector witnessed a significant expansion during the last few years, says the recently released Central Bank Annual Report for 1998. This was in response to rising demand for low and middle- income category and generous fiscal incentives offered to property development activities, it adds. The Cenral Bank says its survey examined 33 developers in Colombo and suburbs with the special attention to the rate of occupancy and financial viability of the projects. The main selection criterion was the construction cost, including projects exceeding Rs.200mn, based on information obtained from the BOI and a few banks. The 33 projects consisted of 14 residential projects, 11 office buildings, three commercial buildings and a combination of residential, commercial, and/or office projects. The surveyed projects were 73% owned by locals while foreign investors and joint venture companies owned the rest. All companies except two had the BOI status. Of the 33 projects only 23 projects were in full operation, with the occupancy rate for the office/commercial area 70 percent and the residential units 64 percent. Of the total establishments, 50% of the buildings were occupied, whereas 25 were underoccupied. Though agreements had already been made with the clients for eight establishments, 17 are still under negotiation for the sale, rent or lease. The low rate of occupancy was due to the general security situation and slow growth in demand due to economic slow downturn, the annual report said. The real estate developers also experienced some immediate constraints such as high cost of building materials, slow recovery of tourist arrivals; as a few of them rent-out apartments on their visits. A few legal barriers were also an impediment because the Condominium Act restricts the lease/sale of apartments below the 6th floor to foreigners. The property developers also expressed concern regarding the high interest rates. They indicated that the property development projects were not viable at the present interest rates, unless at least 75 % of the project cost was raised by way of equity. This complicated administration procedures and red tape has caused unnecessary delays regarding the high cost of constructions. Indicators such as the sources of funds, repayment capacity, outstanding loan amounts and loan rescheduling were considered in order to examine the financial viability. The main sources of capital funds were share capital, own capital and long-term loans. The total long-term loans taken by all companies are estimated Rs. 7.54mn, of which Rs.6mn was outstanding at the time of the survey. Of the outstanding loan amount, 56% was due from the residential property developers, while 21% was from commercial cum office property developers. About 25% of the property developers have applied for loan rescheduling, while 45% stated that they had no difficulty in repaying the loan. Prospective homeowners also face the difficulty to obtain bank loans, as banks are reluctant to grant loans on mortgage of apartments. There are also environmental and socio-economic concerns as many Colombo residences have been converted into commercial and office premises. Some of the construction companies have reduced their rental charges which lead to further reduction in income, and several companies have housed their offices in under -utilised buildings to minimize the loss. Unless the occupancy rate improves further, the financial position of the real estate sector would be weak. Despite all this drawbacks, several property developers have said that they would engage in new investments once the economy recovers from the current depressed situation.

CEB plans for energy efficiencyCeylon Electricity Board plans to introduce energy efficient building codes for commercial buildings in Sri Lanka, says a company release. This was revealed at the inaugural stakeholders meeting held last Friday at Taj Samudra Hotel in Colombo. Chairman of CEB, Arjun Deraniyagala said that the board has taken necessary steps to diversify power generating capacity away from hydropower by adding several blocks of thermal power to the national grid. This has been achieved using CEB resources as well as by tapping into private sector investment into thermal power generation. He also pointed out that presently for every 100 units of electricity generated, only 82 units could be delivered for consumption by the end user. These losses were high compared to what's achieved in developed countries. He also noted that as part of the strategy for efficient intilization of electricity the board proposed to invest heavily into increasing the efficiency of our system of transmission lines from the generation centres to the consumers, and thereby reduce losses from the current 18 percent to around 12-15 percent within the next ten years. Mr. Deraniyagala added that funds have been made available by the World Bank to the CEB to implement a lot of research programs. M.S. Jayalath - Deputy General Manager, Demand Side Management branch of CEB, said that CEB and the Urban Development Authority have been appointed as the joint implementing agencies with the CEB being responsible for the development of the code. The steering committee after having revised the codes being used in Singapore, Hong Kong, Malaysia, the Philipines and Jamaica identified the Malaysian, code as the most relevant to the conditions in Sri Lanka. First draft will he submitted for public comments in January 2000, and the code will be adopted immediately after the public review process is completed. A presentation about the topic by Dessau-Soprin Inc. of Canada was also held.

Browns agent for Wilson generatorsBrown & Co., was recently appointed as authorized agents for F.G. Wilson brand of generators from the UK, says a company release. Romesh Ilangakoon, Director Business Development. Browns said that following the national power crisis in '96, the company undertook the sales and services of generators from F.G. Wilson of UK. "Since then, Browns has emerged as the market leader in Sri Lanka in the sales of generators in the 6 - 2000 Kva. range" said Mr. Ilangakoon. In the financial year 98/99 alone Browns have sold over 170 generators to achieve dominance and market leadership in this area. Recently the Power Systems Division of Browns that handles the sale and service of F. G. Wilson generators, shifted to a modern sales facility at their Head Office and have also invested in a new fully equipped workshop dedicated solely to Generator repairs.

Targets for Japan trade talksThe Twelfth Joint Meeting between Sri Lanka - Japan Business Co-operation Committee (SLJBCC) and the Japan - Sri Lanka Business Co-operation Committee (JSLBCC) will take place in Tokyo from September 6 - 9 at the Japan Chamber of Commerce & Industry, (JCCI). Sri Lanka's Economy, trade and investment climate will be highlighted at this meeting to attract Japanese investment to Sri Lanka. This meeting will be followed by the One to One Business meetings organised by the JCI. In addition meetings will be organised with associations of medium and small scale enterprises, says a press release. The following agenda will be targeted at this meeting. Review of Political and Economic situations of both countries Investment Policy including infrastructure, industrial parks |

||

|

Return to the Bussiness Contents

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

Business

Today magazine on May 13 at the BMICH. John Keells was, followed by the

National Development Bank, Hayleys, Hatton National Bank, DFCC, Commercial

Bank, Ceylon Tobacco Company, Maskeliya Plantations, Central Finance and

Colombo Dockyard. The ratings were based on criteria such as sales turnover,

profitability, earnings per share, profit per employee and social responsibility.

John Keells with a turnover at Rs 8 billion came out first with 7.22 points.

Chairman of John Keells Ken Balendra accepted the award on behalf of the

company from Minister of Justice and Constitutional Affairs Prof. G.L.Peiris.

Pic by Sajeewa Chintaka

Business

Today magazine on May 13 at the BMICH. John Keells was, followed by the

National Development Bank, Hayleys, Hatton National Bank, DFCC, Commercial

Bank, Ceylon Tobacco Company, Maskeliya Plantations, Central Finance and

Colombo Dockyard. The ratings were based on criteria such as sales turnover,

profitability, earnings per share, profit per employee and social responsibility.

John Keells with a turnover at Rs 8 billion came out first with 7.22 points.

Chairman of John Keells Ken Balendra accepted the award on behalf of the

company from Minister of Justice and Constitutional Affairs Prof. G.L.Peiris.

Pic by Sajeewa Chintaka

less

in line with other Asian countries, a characteristic that has both cultural

and socio-economic roots.

less

in line with other Asian countries, a characteristic that has both cultural

and socio-economic roots.  two

years will be election years, and that 5 months for the year have already

passed, revenue levels for 1999 are only likely to follow 1998 trends.

The budget estimates GST revenue levels to increase from 3.9% of GDP in

1998 to 5.0% in 1999. This would require an overall growth of around 45%

in nominal terms (assuming a nominal GDP growth of around 13% or 4% real

), an extremely unlikely scenario given the government's commitment not

to raise GST rates. Budgeted figures for corporate and personal income

taxes also look unrealistic given the required 19% growth under a declining

corporate earnings scenario. Even our estimates at 1.9% of GDP require

a 7% growth. Budgeted figures for import GST collection also require a

massive 52% growth in nominal terms, and even though import commodity prices

are expected to move up over 1999 ( ex: petroleum ), it is unlikely to

yield the desired increases. Our estimates take into consideration a 10%

depreciation for the rupee as well as a price and volume increases. Hence

even on somewhat of an optimistic scenario, our estimates for government

revenue at best stands at 1998 levels of around 17.3% of GDP.

two

years will be election years, and that 5 months for the year have already

passed, revenue levels for 1999 are only likely to follow 1998 trends.

The budget estimates GST revenue levels to increase from 3.9% of GDP in

1998 to 5.0% in 1999. This would require an overall growth of around 45%

in nominal terms (assuming a nominal GDP growth of around 13% or 4% real

), an extremely unlikely scenario given the government's commitment not

to raise GST rates. Budgeted figures for corporate and personal income

taxes also look unrealistic given the required 19% growth under a declining

corporate earnings scenario. Even our estimates at 1.9% of GDP require

a 7% growth. Budgeted figures for import GST collection also require a

massive 52% growth in nominal terms, and even though import commodity prices

are expected to move up over 1999 ( ex: petroleum ), it is unlikely to

yield the desired increases. Our estimates take into consideration a 10%

depreciation for the rupee as well as a price and volume increases. Hence

even on somewhat of an optimistic scenario, our estimates for government

revenue at best stands at 1998 levels of around 17.3% of GDP.