|

14th March 1999 |

Front Page| |

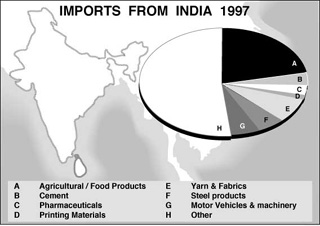

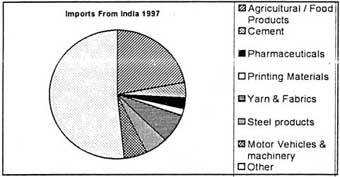

FTA: how will it affect listed companies?The recently signed Indo-Lanka free trade agreement can have both positive and negative consequences for listed companies.NDBS stockbrokers takes alook at some of the details of the agreement, some required clarifications, possible impact on the overall economy and effects on various sectors and their constituent companies. By Chanaka Wickramasuriya of NDBS StockbrokersIn 1996 India replaced Ja pan as Sri Lanka's single largest import source.

In 1997, total imports from Sri Lanka's exports to India on the other hand totalled a mere Rs. 2.5bn in 1997. Of this, the largest component at Rs. 403mn (or 16%), was waste steel. The second highest component at Rs. 384mn was accessories for machines. The trade imbalance from Jan-Nov. 1998 was US $482mn (Rs. 32bn). Salient features of the agreement Indian commitments: • Immediate duty free concessions on 1000 items to Sri Lankan exports; • 50% duty concession to Sri Lanka on 4100 items to become completely duty free in three years. Textile items would be given 25% duty concession throughout. Sri Lankan commitments: • Immediate duty free concessions to India on 300 items to Indian exports; • 50% duty concessions to India on 600 items to become completely duty free in three years; • For balance items not falling under the Sri Lankan negative list, phasing out to zero duty level in 8 years as follows: 35% of existing duty by the end of the 3rd year; 70% of existing duty by the end of the 6th year; 100% of existing duty by the end of the 8th year. Implementation: • Zero duty and negative lists to be exchanged by 1st March 99; • Duty concessions granted providing a 35% minimum value addition (Rules of Origin). In the event of a 10% sourcing from India, ROO to reduce to 25%; • ROO based on FOB value of the export product. Non- originating materials calculation will be based on the CIF value at the time of importation; • A ministerial joint committee to be set up, together with sub-committees and working groups, to annually review and ensure equitable benefits. The committee shall name one apex chamber of trade from each country to represent views of trade and industry. The committee is to also settle any disputes within 6 months; • Countries are free to apply domestic legislation with regard to dumping and where prices are influenced by subsidies under the same definitions as GATT/WTO agreements; Either nation facing a "Balance of Payments" difficulty is free to suspend provisionally the quantity and value of merchandise permitted to be imported (NB: BoP difficulty has not been defined). Some analysis A recent presentation made by the Indian High Commission to the Colombo diplomatic community and business and industry leaders presented some figures that intended to promote the benefits of the agreement. We will look at these both critically and positively. The Indian Negative list is expected to contain around 400 items and include at least the following: Garments, accessories, silk; Alcohol Spirits; Carpets; Plastic Articles; Coconut and Coconut Oil; Petrochemicals. The Sri Lankan negative list is expected to contain at least: All agricultural and fisheries products; Selected industrial products. 35% ROO requirement is lower than the 50% requirement under SAPTA. Concerns for India are the low ROO requirement which could be used to divert third country goods into India. Whether the ROO provides opportunities for foreign companies to set up shop in Sri Lanka to access the Indian market needs further analysis. According to the presentation, 67% of Sri Lanka's present exports qualify

as 35% value added, but garments and petroleum products, which is on the

Indian negative list, account for 51% of the country's exports. Hence any

potential will be restricted to the remaining export categories, for most

The presentation also highlighted the fact that only 350-400 items will be on the Indian negative list and that these already constitute only 0.74% of India's total global import bill of around US $ 40mn. While these statistics are not disputed, the contention is that products that Sri Lanka can be competitive in, like garments and petrochemicals (via some multinationals based in SL), are not imported by India, and hence do not show up in India's present import bill. If these imports were to be liberalised, Sri Lanka could enjoy significant cost and quality benefits (in the case of garments) and freight cost benefits to the South Indian market (for petrochemicals). Hence, the restrictiveness of the negative list must not be looked at from the point of view of present trade characteristics but potential trade patterns. Indian customs regulations contain numerous auxiliary duties and local state level excise taxes, all of which must be taken account of in the agreement. Even though federal customs duties may be abolished, such auxiliary duties and taxes could amount to considerable barriers. Many Indian sectors also enjoy considerable state and federal subsidies in the form of direct subsidies, concessions on energy prices, special interest rates, transportation subsidies etc. These will have to be closely monitored and studied before preferential access is given. Of the 300-odd items to be given immediate duty free access by Sri Lanka, most come under the category of raw materials, which are already taxed at a concessionary rate of 5-7%. Hence the elimination of such tariffs should bode well for Sri Lanka industries and consumers using Indian raw materials, and have little impact on government revenue. The agreement, specially with its 25% ROO for products with a 10% Indian import content, has the potential to attract Indian corporations to set up joint venture operations here, taking advantage of some of Sri Lanka's relative advantages like a less restrictive bureaucracy, good port facilities and familiar legal structure. This, in particular, to serve the South Indian market to where freight and transport costs from factories in North India are higher than from Sri Lanka. Possible effect on some listed companies and sectors Even though negative lists have not yet been officially released by either country, we will attempt to ascertain any possible impact if tariff barriers are completely removed. Tea Companies affected: All plantation companies and their holding companies, processing and exporting companies like James Finlay and John Keells. India is expected to keep tea out of its negative list. It is hoped that this would increase demand for some of Sri Lanka's low end teas, that could be imported by India, and in turn exported to Russia under its present barter agreements. This would ease some of the pressure on low end tea prices and effectively re-open part of the lost CIS market. Indian tea manufacturers have been lobbying their government to include Ceylon Tea in its negative lists even though the tea industry there enjoys larger fertiliser subsidies. Ironically, local tea producers are also averse to opening up our markets for Indian imports, both in the areas of CTCs and low growns, while tea blenders and exporters have been clamouring for liberalisation and the creation of Colombo as a global tea centre. At present only speciality teas like Darjeeling's are permitted to be imported, with quota restrictions on CTCs (10% of annual production) for fear of falling prices for local producers. Present tariffs on Indian teas are in the range of 20% and Sri Lanka is likely to stick to the status quo in this regard. Soft Drinks Companies affected: Ceylon Cold Stores, Pure Beverages. There exists the possibility of an influx of cheaper Indian soft drinks which will in turn have an impact on overall prices. Companies like Pure Beverages have the potential to import from sister companies in India to compensate for capacity constraints faced locally. Processed Meat and other products Companies affected: Ceylon Cold Stores, Keells Food Products. Potential for Sri Lankan exports exists in the upper end of the Indian market and tourism/hotel sector, since local products are of generally higher quality and have good brand and packaging image. Import potential is low given quality concerns. Grains/Animal Feed/Chicken etc. Companies affected: Ceylon Grain Elevators, Three acre farms, Bairaha Farms The above companies are lobbying the government to restrict the importation of Day Old Chicks (DOCs) on the grounds of introduction of possible disease, the likes of which occurred in 1994, and difficulties faced in the quarantine procedures. In the case of Animal Feed, companies like CGE are confident of their position with regard to quality and reputation in the market. Imported processed meats are unlikely to find a market here in the light of quality concerns and costs incurred with regard to freight and storage. Export possibilities exist for both animal feed as well as processed meats. Pharmaceuticals and Consumables Companies affected: Reckitt and Colman, CIC, Nestles Even with prevailing tariffs in the range of 15-20%, most Indian products remain cheaper and of higher quality than locally manufactured items. Companies like Reckitts are expected to gradually phase out 90% of their local manufacturing and resort to imports from sister companies in India. Others, like Nestle, already import most of their product range like chocolates, some milk products and noodles from factories across the straits. Basically all consumer item manufacturers with links to manufacturing bases in India will benefit, while local companies like Swadeshi will find it increasingly harder to compete. Petroleum Products Company affected: Lanka Lubricants. This is an area where the above company has much potential, but India is expected to retain petrochemicals in its negative list. At present, tariff rates into India on such items is a massive 50% even though there was some discussion and speculation of reducing duties on 20 litre cans. Tariff rates on imports of such items into Sri Lanka are also expected to be maintained. Cables Companies affected: ACL Cables, Kelani Cables Present tariff rates on imports stand at 30% and elimination will have a downward effect on prices. Export possibilities are also minimal given capacity constraints. Industry officials are of the opinion that Indian products are of a poor standard given the absence of Indian companies in the international tender arena. Electrical Items Companies affected: Associated Electricals, Singer Industries. Presently, tariff rates on Indian items like fridge's stand at 25.2%, and in spite of this local manufacturers have failed to compete. Companies like AEC have virtually shut down their manufacturing operations and resort to import and assemble which is more lucrative. Manufacturers like Singer will find it even harder to compete and have already tied up with Indian companies like Whirlpool to import and assemble. Tyres Companies affected: Kelani Tyres, Associated CEAT. With the recent Kelani-CEAT tie-up, almost the entire local manufacturing base is now controlled by Indian interests, and hence all indications so far are that India is likely to allow preferential access to Sri Lankan manufactured tyres. Since it is cheaper to service the South Indian market from Sri Lanka rather than from factories in North India, CEAT/Kelani have immense potential to reap the benefits of a market that is 4-5 times the size of that of Sri Lanka. Motor Vehicles Companies affected: Associated Motorways, Dimo. The Sri Lankan government is keen to reduce duty on Indian vehicles with the intention of reducing prices in the overall market, where importers of second hand/reconditioned vehicles from Japan maintain very high margins offshore. Since these tariffs will be phased out over a few years, the initial impact will be relatively negligible though in time companies like AMW and DIMO stand to benefit. Plastic Products Companies affected: Associated Plastics, Richard Pieris.If the existing import tariff rate of 30% is phased out Sri Lankan manufacturers will face price competition even though local products compete well in quality. Large scale items like water tanks (Richard Pieris) remain relatively protected due to high freight costs incurred in importing, while other industrial plastics are likely to face stiff competition. Rubber Products Company affected: Richard Pieris. Products like foam and polyurethane mattresses also remain protected due to the high level of transportation cost involved. On other smaller products like hose pipes, mats etc., India enjoys considerable cost advantages and can lead to price pressure. Ceramic Products Companies affected: Lanka Tiles, Royal Ceramics, Lanka Walltile, Lanka Ceramics. The phasing out of existing tariff rates of 35% will have considerable price effects. Most Indian products compete at the lower end of the market that is already dominated by such imports. Potential for exports to compete with other imported tiles into India, and possibilities of importing cheaper feldspar, also exist. Cement Company affected: Tokyo Cement. Existing tariff rates are 7.5% on bulk and 10% on bagged cement. Elimination will have some price effect, though less of an effect than global and regional supply and demand conditions have had in the recent past. Glass Products Company affected: Lanka Glass. Even with the existing 30% tariff barrier, Sri Lankan companies are struggling to compete. Preferential access to cheaper Indian products can benefit Breweries and Soft Drink companies. Courtesy NDBS Monthly Update

Rs. 500 mn could be drained from garmentsBy Shafraz FarookTighter GST rules may result in an estimated Rs.500mn loss to the garment industry, the Apparel Exporters' Association head said last week. A Teasury decision to reduce the GST payment deferment period from 60 - 45 days, is adding pressure on their cash flow and increasing cost of business, he said. The immediate effect of this decision may result in the closure of some smaller factories. "Our estimates show that around Rs.500mn will be drained out of the industry permanently. The annual interest on this sum to the industry will be nealy. Rs. 75mn to 100 mn," Mr. Mahesh Amalean said at the association's AGM last week. The association also alleged that the industry is being continuously used as a 'vehicle to create quick employment opportunities' by past and present governments. Mr.Amalean said that the government has helped the growth of the industry and given employment opportunities to the rural sector. "However, these programmes are pushed through too rapidly without giving adequate consideration to the qualitative growth of the trade, thus creating instability in the industry," he said. While requesting the authorities to encourage structured qualitative development of the apparel industry, Mr. Amalean appealed to the authorities to look at other industries as avenues for crating job opportunities in the country.The ongoing fraudulent misuse of the quota system is another problem hampering the smooth operation of the industry. The industry experienced a crisis situation in two quota categories, i.e. 334/634 and 340/640 during the latter half of last year. Fraudulent visas, which have been used by unscrupulous persons to benefit from an already difficult position, have aggravated the situation further, Mr. Amalean said. Mr. Amalean said that the service of the Criminal Investigation Bureau and the US Customs would be needed to stop such acts. Michael Owen, Counselor for Economic and Commercial Affairs USA Embassy suggested that the Sri Lankan government could use an electronic visa issuing system (more commonly known as the ELVIS system) presently used in the USA. The apparel industry grew by 17.2 percent in 1998 compared to a 29 percent growth recorded in 1997, mainly due to the reduced margins charged to retain their customers and protect their business. The effects of global competition began to be felt by the Industries after the currency melt-down crisis that began in July 1997 in South East Asia. A large share of the US market passed into the hands of Mexico and the Caribbean countries. These countries benefited owing to the advantages conferred by NAFTA on Mexico and the special treatment Caribbean countries receive from USA. Chief Guest, Industrial Development Minister C. V. Gooneratne said world trade was valued at about US$ 133 billion and is growing fast. Sri Lanka's share of exports was however less than 1 percent, although Sri Lanka is reckoned as a player in the International market for apparel wear.Amidst all these problems the association has launched a programme for voluntary evaluation of members' factories. This programme will issue certificates of conformity to accepted international standards. Mr. Amaleen said that eight factories are currently being evaluated on a trial basis. This comprehensive evaluation and certification of the factory, is not only a very useful exercise, but also becoming increasingly an eligibility to manufacture for the moderate and better customers, he

CB deposits rise 25% without 'gimmicks'Commercial Bank has recorded an impressive 25 per cent deposit growth for the year ending December 1998, higher than the industry's average growth of 12.3 per cent, Commercial Bank Chairman said. Total deposits which stood at Rs. 20 bn in December 1997, rose to Rs. 25.2 bn in 1998. "We have been able to increase our deposit mobilisation without any reward schemes or gimmicks," Chairman Mahendra Amarasuriya said. Despite a downturn in the economy, the Bank's pre-tax profit rose to Rs. 769 mn in 1998 from Rs. 652 mn in 1997, a growth of 17.8 per cent. The Bank ended the year with a 12.9 per cent growth in gross advances which reached Rs. 22 bn while the export and import turnovers grew by 15.5 per cent and 12.6 per cent respectively despite adverse economic conditions, he said. Although the Bank's pre-tax profits grew by 17.8 per cent over the previous year, post tax profit growth was 8.9 per cent due to a new tax law which curtailed the capital allowances the Bank could claim on leasing operations, he said. At present, the Bank is pursuing a very ambitious branch expansion programme in a bid to strengthen its retail banking business while maintaining the vigour and vitality in its traditionally strong area of international trade finance. Commercial Bank Managing Director, Amitha Gooneratne attributed the impressive growth in deposits to the well spread branch network of the Bank, its advances computer system, attractive deposits products and marketing efforts. "With 61 of our 62 branches linked through the ComNet system we are the most technologically advanced indigenous bank in Sri Lanka," Mr. Gooneratne said. Commercial Bank continues to maintain the highest Capital Adequacy Ratios among the four listed local banks at 15.53 per cent and 18.45 per cent for Tier I and Tier II respectively. On the key profitability ratio of ROA, the Bank recorded 2.46 per cent (before tax), which is expected to be above the average rate of 1.65 per cent (before tax) estimated for the peer banks for 1998. The cost/income ratio (which measures the operational efficiency) remained at 56 per cent in 1998 (55% in1997) which too was very acceptable, judging by the average of over 60 per cent estimated for the private sector indigenous banks for 1998. The annual report released to shareholders last week published the non-performing advances and the full maturity analysis of the Bank's assets and liabilities. "This is the first instance our Bank disclosed such information, which is not a mandatory requirement but is an indication of the greater degree of transparency of the institution," Deputy General Manager Finance and Planning, Ranjith Samaranayake said.

HNB records high turnoverHatton National Bank recorded a turnover of Rs. 6.7 mn for the year ending December 1998, the highest turnover among the four listed commercial banks. The Bank's rival Commercial Bank reported a turnover of Rs. 3.8 bn, while the unaudited figures of Seylan Bank and Sampath Bank reported a turnover Rs. 4.9 mn and Rs. 2.6 mn respectively, HNB Chairman, Rienzie T Wijetillake said.HNB's pre tax profit recorded a growth of 18.4 per cent to reach Rs. 858 mn for the year under review, the post tax profit grew 23.5 per cent to reach Rs. 683 mn. The Bank's total asset base increased to Rs. 64 mn from Rs. 52 mn over the previous year, a 23 per cent. Deposits increased by 17 per cent to reach Rs. 46 mn. The advances portfolio, inclusive of leasing, recorded an increase of 19 per cent to reach Rs. 36 mn. Despite marginal increase in the gross income the net interest income of the Bank recorded an increase of almost 30 per cent mainly due to efficient asset liability management resulting an increase in the spread by 50 basis points. "These record growth levels reflect the fundamental strength of HNB," Mr. Wijetillake said. Income from the Bank's Foreign Currency Banking Units (FCBU) increased from Rs. 266 mn in 1997 to Rs. 361 mn in 1998, despite economic downturn experienced in the country. HNB issued Rs. 1 bn worth of debentures in July 1998, to finance the housing loan portfolio and to supplement the tier two Capital Adequacy requirements. As a result, the tier two capital increased from 0.72 per cent in December 1997 to 3.15 per cent in December 1998. Consequently, the Bank's total capital adequacy has increased form 8.4 per cent in 1997 to 11.4 per cent in 1998.

Mind your Businessby Business BugsHopes lostThe statistics may show that tourist arrivals are on the up this year,but that is not the whole story. Despite this increase which is only modest by any standards,the trade is still struggling to make ends meet. And that is why one leading city hotel has postponed a previously planned refurbishment programme that would have been a renaissance of sorts to the industry. For ductorsStories of professional negligence are hitting the headlines ever so regularly now and many such complaints are being aired against the medical profession. One insurance company, a relatively new entrant to the competitive insurance sector, has therefore decided to cash in. This company will soon market a range of very attractive insurance policies for the medical profession after a market survey revealed a great demand for this type of cover. The loserNow the much awaited polls will not be held on April Fools 'Day but' much later to appease all sections of the public -but excepting those at the Stock Market. Brokers say most commitments of institutional investors were put on hold, awaiting the outcome of the elections. But now,with the polls postponed some institutions have withdrawn those funds in favour of other regional markets and Colombo is the loser, they said.

InnovationsRobots turn angry and emotionalTHE first robot that can sense and show emotions is being developed as the ultimate interactive toy. The machine has been christened Kismet by its creator Cynthia Breazeal (both are pictured above right). She claims it will lead to toys that grow up and develop at the same time as children, giving them a mechanical best friend. The robot uses two high-resolution cameras and a sound sensor to interact with a "care giver". It has eyes, eyelids, a mouth and ears to allow it to show expressions. Emotions such as fear, anger and sadness have been programmed into the machine, and it can display these if it detects the correct conditions. Breazeal says the emotions are easily discernible by users, as they are based on the way human faces show emotions. "One of the aims of this project is to find a way for robots to interact with us in a more natural way. Using a face similar to our own is obviously an easy way of achieving that. Users don't need to learn anything new," she says. Kismet is an attempt to model the learning processes of a baby, particularly the development of a proto-language, the babbling that is produced by an infant before it can manage real words. According to Breazeal, a robot that can actually learn a language in the same way as a baby is still many years off, but she hopes Kismet may develop its own proto-language. "One of the things that happens in a baby's development is that these babbles become a form of communication between the baby and mother. It's not a language as such, but the mother learns what the baby wants. We hope to do the same with Kismet." Researchers are still not sure how babies develop a sense of language. However, Breazeal hopes the software being developed for Kismet will shed light on the process because the robot should learn in the same way as a baby. Although much of the artificial intelligence software that drives Kismet is still being developed, the robot already has some basic emotions. "The driving force behind the software for Kismet is the idea that the robot has to be contented, so it has a kind of happiness quota built in. It is designed to act just like a baby, which means the user doesn't always know how to react. For instance, if a baby cries you don't always know what is wrong, and it's exactly the same with Kismet. If it appears unhappy, it may want you to talk to it, play with it or even leave it alone so that it can go to sleep. "If Kismet doesn't get enough sleep, then it starts to get crotchety. If it still can't sleep it can get angry with the user - a kind of robot tantrum, I guess," says Breazeal. "Every Kismet will be different, and take on some of its owner's personality - it has to learn everything it knows from its owner. Obviously, the trend now is for high-tech toys and virtual pets, so Kismet may be used in that way." However, Breazeal hopes Kismet may also affect the way everybody interacts with robots in the future. "We want to get Kismet to learn from its owner. The way that babies learn is by associating certain actions with events. For instance, if they cry a certain way they know they will be fed. If we can get a robot to use the same learning process, they will be easier to interact with." Within a year Breazeal believes she will have finished developing the software that allows Kismet to learn a whole range of emotions from its owner, rather than rely on pre-programmed emotions.

Thinner, Sexier Palm PilotsThe first smash hit personal digital assistant gained two new relatives as 3Com's Palm Computing launched the Palm V and IIIx. The machines boast a thinner form factor, a rechargeable battery, and for the Palm V, a new attachable 3Com modem. "We're advancing the standard for functionality and form factor in the handheld industry, while remaining true to the ease-of-use and simplicity that made the Palm Computing platform the world leader," said Palm Computing president Robin Abrams in a statement. Both models sport a new liquid crystal display screen that improves contrast and clarity, Palm said. The US$449 Palm V is the high-end addition to the line, targeted at mobile professionals and "design-conscious" consumers. The slim device is half the height of the Palm III and the new Palm IIIx and weighs only four ounces. The Palm V snazzes up the Palm image with a new anodized aluminum finish, recessed buttons, and rounded edges. It runs on a single rechargeable lithium ion battery, replacing the AAA batteries that power the Palm III and IIIx. The company designed expandability into the Palm IIIx to give the device storage room for multiple add-on applications and the reams of data that spew from corporate applications such as PeopleSoft and Oracle. A new internal expansion slot allows for the addition of peripherals like add-on memory modules or pager cards. Like its predecessors, the Palm IIIx organizer runs on two AAA batteries. The company says current PalmPilot users have typically been content with 1 MB of standard memory. Going on that premise, it considered 2 MB sufficient for the Palm V audience. Looking cool is more critical to them than large amounts of memory, the company believes. By contrast, the Palm IIIx's 4 MB overhead is designed to let it function as a corporate workhorse, leaving room for additional workplace applications that require extra memory space. The new Palm V modem snaps on a 33.6-Kbps modem to the Palm V serial port, fitting snugly onto the back of the product, the company said. The PalmPilot faces a battery of competing handheld devices from Microsoft Windows CE-based devices such as the Philips Nino — the subject of an aggressive marketing campaign.

Accelerated drug screeningEver wonder why you feel groggy after taking an antihistamine but your friend doesn't? Or why some women respond to breast cancer drugs while others don't? Orchid Biocomputer has developed chip technology to help scientists collect data to understand how genetic makeup affects an individual's response to drug treatments. Doctors could ultimately use this knowledge to prescribe appropriate treatments. Individual human gene mutations are the result of single nucleotide polymorphism (SNP) — and researchers are discovering them by the tens of thousands. Measuring, interpreting, and understanding which SNPs cause what problems is an expensive and time-consuming process. Princeton, New Jersey-based Orchid has developed SNPstream, a new "core chip" that allows microprocessors to rapidly perform tests of a DNA sample on a chip, then screen it against a gene mutation and disease pathway simultaneously. "SNPstream can screen 30,000 genotypes a day with the chip technology in a microfluidic processor, which is similar to a Pentium processor, but we're moving fluids around instead," said Russell Granzow, senior director of business development for genomics and diagnostics at Orchid. "SNPstream will correlate genetic diversity with the disease and the drug to treat it. It will help us understand the role genetic diversity plays in individual drug effectiveness against some diseases," Granzow said. Finding these correlations, he said, can produce viable leads that could warrant clinical trials. Orchid plans to release SNPstream as an individual product by the end of the year. Granzow foresees doctors and clinicians using SNPstream to identify patients' genetic variations to determine which drugs they will respond to, or what diseases a patient has a predisposition for. "Scientists can use the same biochemistry on an automated platform," Granzow said, "and this will provide different treatment choices. You can tailor the drug treatment to meet your genetic diversity." Two years ago, a drug called Seldane killed six people who had a gene mutation — an enzyme in their liver that caused them to break the drug down into a toxic compound. Seldane was subsequently taken off the market. The Journal of the American Medical Association reported last year that adverse drug interaction is the fourth leading cause of death in the United States and sends more than 100,000 people to the hospital every year. If doctors could tailor their prescriptions to their patients' genetic variations, some of these complications might be avoided. |

||

|

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

India

stood at Rs. 33bn, or 10% of total import expenditure, while imports from

Japan totalled Rs. 28.2bn. While 29 different items constituted 49.3% of

total imports from India, 3859 items made up the remaining 50.7%. This

probably included miscellaneous items such as plastic and glass products,

small machinery and equipment, processed food items etc.

India

stood at Rs. 33bn, or 10% of total import expenditure, while imports from

Japan totalled Rs. 28.2bn. While 29 different items constituted 49.3% of

total imports from India, 3859 items made up the remaining 50.7%. This

probably included miscellaneous items such as plastic and glass products,

small machinery and equipment, processed food items etc. of

which india already enjoys considerable economies of scale and cost benefits.

of

which india already enjoys considerable economies of scale and cost benefits.