|

7th June 1998 |

Front Page| |

Contents

|

||

|

IMF slams budget making processBy Mel GunasekeraThe IMF is calling for greater transparency in the implementation of budget documentation. The format and level of detail of the Estimate books is inappropriate to the principal purpose of the budget, which is to enable policy makers and the electorate to make informed, rational trade-offs in allocating scarce budgetary resources among competing policy priorities,IMF Resident Representative, Anton Op de Beke said. The budget should contain sufficient detail on the revenue and expenditure of lower levels of government, i.e. the provincial councils and municipalities, to allow a consolidated financial position for the general government to be presented. "This is not the case in Sri Lanka nor is it in the majority of the Fund's member countries. Especially in a country like Sri Lanka that is seriously considering further devolution of fiscal powers, this task ought to be taken up with urgency," he added. The core of the budget documentation consists of four volumes of 'Estimates of the Revenue and Expenditure of the Government of Sri Lanka'. In addition, the public investment programme and the staff schedule are introduced in parliament with the appropriations bill. The budget speech then introduces the government proposals for policy changes, while budget at a glance summarises the budget. The IMF code of Good Practices on Fiscal Transparency proposes that the budget document presents comparable information for the out-turns of the two preceding fiscal years (which is the case in Sri Lanka), together with forecasts of key budget aggregates for the two years following the budget, the IMF representative said. He was talking on 'Transparency in the Public Sector' at an event organised by the Institute of Chartered Accountants, Sri Lanka. The latter is not currently the case. The 1997 budget speech contained in summary form, a medium-term fiscal consolidation programme covering 1997-1999, but that is yet to become a standard feature. Multi-year budget projections are essential for judging the realism of medium-term fiscal consolidation programmes like the one the Sri Lankan government is engaged in, he said. The code also requires the budget documentation to specify fiscal policy objectives, the macroeconomic framework, and the policy basis for the budget and identifiable major fiscal risks. "In Sri Lanka, the budget speech contains a description of the macroeconomic framework but it is very succinct," he said. In practice, the government relies on the Central Bank for an analysis of the macroeconomic developments, which is published in the State of the Economy, and in its Annual Report. The Central Bank supplies the government not only with an analysis of past developments, but also with projections (for GDP growth, inflation, exports and imports growth, employment etc). These projections feed into the assumptions on which the budget projections are based. "The projections are not published, nor does the budget speech spell out how sensitive the expenditure and revenue projections are to changes in assumptions. This makes it impossible for anyone to form an independent judgement of the realism of the budget projection and the fiscal risks they entail". Budget estimates should also be classified and presented in a way that facilitates policy analysis and promotes accountability, he said. The infamous 2,400 page Estimates books contain enormous detail that is comprehensible only to a few insiders in the government. However, they fail to clearly identify the policy issues and set out their financial implications for policy makers and the scrutinising public. The information contained is relevant for budget execution at the administrative level but not for parliamentary consideration and approval. Another main problem is, the Estimates books group revenues and expenditures only by administrative headings. Policy makers are interested in grouping by government functions, like defence; education; police or social security. In addition, policy makers require a grouping of expenditures by economic criteria, like wages; subsidies; interest, or capital transfers. "As they stand, the Estimates play no role in facilitating policy analysis and promoting accountability," he said. To rectify this, the Treasury publishes the Budget at a Glance, which contains an economic and functional classification of expenditures, as does the Central Bank's Annual Report, but these cannot substitute for the actual budget documents. Sri Lanka is presently following a global trend on programme budgeting. Under this approach, the attention shifts from inputs, i.e. the number of staff, the money available for current expenditures, etc to outputs, defined as concrete programmes with which the government hopes to achieve its policy objectives. The budget preparation and documentation would then also be oriented around these programmes, he said. When contacted, Treasury officials agreed that the Estimate books were rather bulky. "Our main task is to reduce these volumes and at the same time give the information required. We are in the process of developing performance indicators to see how we can match the financial performance with the physical performance of each project. This is one area that we are considering re-doing when we revamp the budget format. We also hope to make the Budget at a Glance available to the general public from next year's budget onwards," they said.

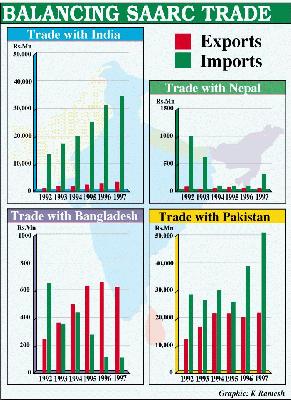

SAARC tariffs block Lanka's trade

After the Uruguay round of talks the Indian authorities reduced their tariffs, and the trade weighted tariff average came down to 32.4%. In Sri Lanka's case the tariffs on the same basis was 28.1% after the talks. India imposes a 35% tariff on consumer goods, plus 15% surcharge (since these are consumer goods), whereas the Sri Lankan authorities impose a 35% tariff on consumer goods. The argument here is that most Sri Lankan exports are consumer goods and less sophisticated manufactured goods and hence should be granted a concessionary rate. The tariffs imposed on machinery is much less than those levied on consumer goods.This does not help Sri Lankan exporters, as they are unable to serve such markets. Added to this, subsidies provided by the Indian authorities to agriculture mean that Sri Lankan exporters of similar produce are unable to compete in the Indian market in terms of price. Three other trading partners Bangladesh, Pakistan and Nepal practiced a more liberal trading policy, and this is probably the reason for easier access to such markets. It is only in the case of Nepal that difficulty in finding reliable and cost effective freight and transport still hampers trade. Given that the largest block of imports into Sri Lanka come from India (amounting to 11% of total imports at the end of 1996), it seems only reasonable that India grants further concessions in favour of Sri Lankan exporters. Since India is geographically much closer than any of our other major trading partners, and also given the size of its domestic market it makes sense for the Sri Lankan authorities to negotiate for further trade concessions with India.

TA Securities for sale?

Sources said the pull out could be a direct result of the East Asian crisis and a weak Malaysian economy. Some sources said the Malaysian partner was keen to dispose his non-performing overseas assets. The Malaysian partners, TA Enterprise Bhd, bought a 40 per cent stake in TA Securities a few years ago from the then owners the Serendib Group. However, the controlling stake remained with the Serendib Group. A spokesman for TA Securities told the Sunday Times Business that the Malaysian interest in the company had been looking for a buyer for the past nine months or so. If they get a good price they will be willing to sell. The local partners have also agreed to sell out at a good price, the spokesman said. The latest offer comes from a financial institution, which has previously bid unsuccessfully for a brokering licence from the Colombo Stock Exchange (CSE), market sources say. Buying into an existing brokering firm is like getting a seat on the CSE through the backdoor, some brokers said. The CSE recently called for applications for new brokers, but only two companies, DFCC and Union Bank applied. The CSE has given the greenlight to DFCC to proceed with their application for a licence. But the application of Union Bank is still in the balance, financial sources said. They said the CSE was looking for prospective brokers who are able to tap clients outside the Colombo area. Union Bank not having branches outside Colombo may be a factor that would go against them, sources said. In the midst of the bearish market, many brokers are complaining of a lack of business. With nearly 75 per cent of the market being controlled by four leading broking houses, the rest are struggling for a piece of the cake. Another old brokering firm is also on the lookout for a buyer for sometime. Financial sources say the company se tup operations when it was fashionable for most old established companies to have a brokering arm of their own. "However, most of these firms are not focussed properly and they are not venturing to tap the lucrative outstation market," sources said.

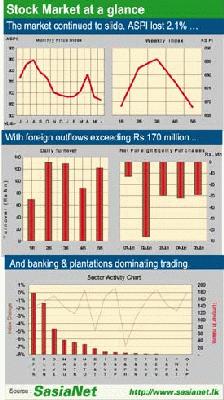

South Asia's mounting economic concernsThe adverse economic consequences of nuclear tests could be even more serious than the initial expectations we discussed last week. With both India and Pakistan having exploded nuclear devices and facing economic sanctions, the entire South Asian region could be over shadowed by grim economic prospects. The adverse economic consequences stem from the possibility of increased defence expenditures by the two countries, the impact of economic sanctions by major donor countries and the withholding of essential short-term and long-term financial facilities by multilateral agencies. Although the Indian government has stated that defence expenditures would not rise, this can hardly be expected in a new climate of hostilities and higher levels of dangers. Already India expends about 2.5 per cent of her GDP on defence. Pakistan being a smaller country has to spend considerably more to match India's might. Pakistan probably spends more than twice the proportion of GDP which India spends on defence. This indeed is a tragic situation for two of the poorest countries in the world. In fact, South Asia as a whole is the second poorest region only better than Sub Saharan Africa. The likely increased expenditures on defence of these two countries would no doubt retard their investments for long run economic growth. Foreign investments, aid flows and lending by multilateral agencies are all likely to fall. This would no doubt lead to a decline in the rate of economic growth of both countries. India, which was getting poised for higher rates of economic growth, will no doubt face a setback. Already predictions are that India's economic growth would dip from 7 per cent to less than 5 per cent. Given the political instability of both countries and considerable lawlessness in Pakistan the environment is hardly conducive to the required foreign investments. Already portfolio investments have declined. Multinational companies are likely to consider the region as inappropriate for long-term, high tech investments. In an international economic environment where the East Asian and South East Asian economic crises are retarding world economic growth, the latest development in South Asia adds a further blow to India's and Pakistan's economic growth. In these emerging conditions some commentators have suggested that Sri Lanka may be a beneficiary. The rationale for such an expectation is that Sri Lanka provides more stable conditions than her neighbours do. This is both optimistic and unrealistic. Sri Lanka is too small a country to expect investors to consider as an alternative, is not large enough for the kind of investments for which the two larger countries were attractive. Besides this, we are ourselves not free from problems within our country. The continuing security situation has been the main stumbling block for larger foreign investments and even domestic investments. This factor will continue to be a detractor for investment despite the relative stability of Sri Lanka and the lack of economic sanctions. However it is possible that some small investments may flow into the country, mainly from investors who are searching for low cost production locations. To expect a large siphoning off of investments from India and Pakistan into Sri Lanka is unrealistic. This is particularly so, because, as we pointed out last week, investors would view the prospects of a region as a whole rather than particular countries. In fact the first adverse impacts may have already been seen in the Colombo Stock Market where an outflow of foreign investments have occurred. The tumbling share prices in Colombo have no relation whatsoever to company performances. They are the result of international investors moving out of the region or of local investors expecting such an outflow. The economic developments of the South Asian region would impact on the Sri Lankan economy. We may have no control of these forces but our response must at least mitigate their adverse impacts and where possible, even benefit from any new opportunities. It is essential to continuously review the developments and fashion our economic policies to cope with the external shocks that are affecting us. These developments once again pose the question whether Sri Lanka should rely too heavily on SAARC economic co-operation. Should we carve out our economic future in relation to the rest of the world?

More Business * Farms and farmers neglected, so agrarian sector fails * Breakaways make headway * 'Aitken Spence' looking abroad for investment * Container terminal tariffs: ACTDO replies

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

Exporters'

lobbies have put forward many reasons for the imbalance in our trade with

India ranging from high tariffs to unfair trade practices.

Exporters'

lobbies have put forward many reasons for the imbalance in our trade with

India ranging from high tariffs to unfair trade practices. A

leading private bank has made an offer to buy TA Securities Lanka Ltd.

according to market sources. The Malaysian partners of the brokering firm

are rumoured to be pulling out of the Sri Lankan operation.

A

leading private bank has made an offer to buy TA Securities Lanka Ltd.

according to market sources. The Malaysian partners of the brokering firm

are rumoured to be pulling out of the Sri Lankan operation.