News

Online loan sharks devour people desperate for money

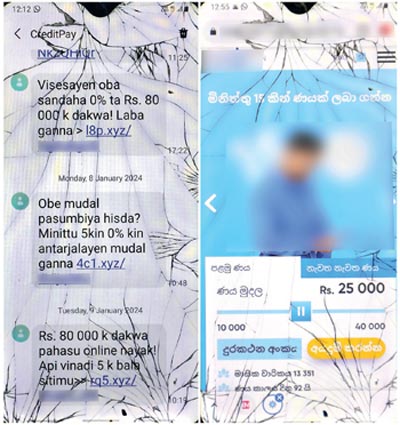

Beware of text messages sent to your phone from online loan scammers: Don't get caught and don't click the links in these messages and social media posts, police warn

The arrests this week of five Chinese nationals and a Sri Lankan for allegedly running an online loan scam in Dehiwala show how such scammers are increasingly using social media and messaging apps to target desperate and vulnerable Sri Lankans amid the country’s economic crisis.

Police said the scam had been in operation since at least 2021, when the business was registered with the Department of Registrar of Companies as an investment firm with an office in Dehiwala. The company, however, had not engaged in any investments and had instead set up various pages on social media advertising online loan schemes with attractive posts and slogans offering supposedly quick and easy loans for those in need of immediate cash.

Unsuspecting victims, who are in desperate need of a quick loan, were lured into the scam with promises of getting loans from Rs. 5,000 upwards within hours of applying online. Once the victims applied and had a loan approved, however, the scammers, it is alleged, would surreptitiously gain access to the clients’ phones and obtain their personal data, including the entire contact list and photographs stored in those phones. The victims had to pay back the loan at exorbitant interest rates amounting to as much as 30% per day within a maximum of 10 days. If they fail to make the payment on time, the scammers would threaten them over the phone and also set up WhatsApp groups with their contact lists, to which they would share photographs of the victim with posts claiming that the victim was not paying off loans he or she had obtained.

The Dehiwala scam was exposed after the Computer Crimes Investigation Division of the Criminal Investigation Department (CID) acted on a complaint made by a woman who had obtained loans from the group and had fallen behind on payments. She had complained that her photographs were being shared with her contacts on WhatsApp, along with defamatory posts.

After arresting the six suspects, the CID also seized eight desktop computers, 13 laptops, and 49 mobile phones. Investigators are yet to locate the server where the personal data obtained from victims are stored. It could be in Sri Lanka or overseas, the police said.

The CID’s Computer Crimes Investigation Division Director, Senior Superintendent Darshika Ranasinghe, said they had checked the agreements customers had entered into with the company when obtaining online loans and that at no point in the agreements was it stated that the customers’ contact lists would be obtained by the company when they took out a loan.

A group of locals were also employed by the Chinese nationals to carry out their operation. These persons, who included many female employees, were continuously harassed to meet “targets” in the form of forcing those who had fallen back on their loan repayments to pay back, Police Spokesman SSP Nihal Thalduwa told the Sunday Times.

He urged people not to fall victim to these scams and refrain from applying for online loans from such companies, warning that they might fall further into misery if they did so.

The scammers operated several social media pages under different names, all offering quick online loans. Yet there are many more such social media pages even now, offering online loans to the public, the Sunday Times found. Many do not even list an office address. Yet, their content is attractive to people looking for a quick loan without supporting documentation or having to fill out several forms, as applicants have to do at banks and financial institutions. All one needs, according to many of these pages, is the applicant’s National Identity Card number along with a WhatsApp number or a Facebook account. They state that the online application is reviewed within an hour, and the cash will be credited to the account immediately once approved. The companies further offer discounts on loan interest payments for those who meet several instalments on time.

Problems, however, start almost immediately if the person who obtained the loan falls behind on their payments. There are now pages and groups on Facebook devoted entirely to issues faced by those who have taken out loans and are now being harassed to pay them back with interest. The posts and questions raised by the victims denote a campaign of constant threats to and harassment of those who have fallen behind on their payments.

Many victims complain of receiving threatening phone calls, sometimes several within a single day. They have also shared screenshots of messages claiming that the companies have referred the cases to their “legal departments,” messages stating that police complaints will be lodged against them, and threats to send “company representatives” to the homes or offices of victims to collect payments. Several have also shared letters purporting to be from lawyers warning them that legal action will be filed against them in court for failing to settle their loan payments. Most victims have also complained that, given the massive interest rates and “late payments” charged for missing due dates, they are being forced to pay back several times the amount that they originally obtained as a loan.

The companies exploit a legal loophole to operate these scams, a Central Bank of Sri Lanka (CBSL) official said on condition of anonymity. “Under prevailing laws, only companies that accept deposits are required to register with the CBSL. This requirement does not apply to those who only provide loans; hence, these companies do not come under the regulatory authority of the CBSL,” the official explained.

Opposition Leader Sajith Premadasa raised the issue of online loan schemes in Parliament on January 12. He said most of the scams were being masterminded by foreigners and that these “loan sharks” were exploiting a legal loophole to operate. “They obtain photos of the person obtaining the loan. They obtain photos of their families, and if the person who obtained the loan is late on his payments, even for a day or two, they threaten the person and insult them. They try to break up families by alleging illicit affairs using doctored photos of those who fail to meet payments,” he said.

Mr. Premadasa alleged that such a company was also operating out of a four-storey building in Kotte, not far from Parliament. He pointed out that CBSL Governor Nandalal Weerasinghe had already discussed this with representatives of those who had fallen victim to these loan schemes.

The government has already directed attention to the issue raised by the opposition leader, Finance State Minister Shehan Semasinghe said in reply. The Microfinance and Credit Regulatory Authority Bill, which was presented for its first reading earlier that week, would go some way towards addressing the issue, though it would not provide blanket cover, he added. “Many of those involved in this scam are foreign nationals based here temporarily. They stay here for a year or a year and a half to carry out this scam,” the state minister said.

While the new Act will not provide full protection from such scams, State Minister Semasinghe pledged that the government would introduce new laws soon to fully address this issue.

The CBSL cannot simply wash its hands off the problem by saying online loan schemes do not fall under its regulatory authority, insisted Attorney-at-Law Udul Premaratne. He noted that, as per the Finance Business Act No. 42 of 2011, it is an offence for any institution to engage in a financial business without a valid licence. These provisions should be applied to such online loan companies too to compel them to register, he opined.

The CBSL cannot simply wash its hands off the problem by saying online loan schemes do not fall under its regulatory authority, insisted Attorney-at-Law Udul Premaratne. He noted that, as per the Finance Business Act No. 42 of 2011, it is an offence for any institution to engage in a financial business without a valid licence. These provisions should be applied to such online loan companies too to compel them to register, he opined.

Mr. Premaratne, who has campaigned against online loan scams, said it shouldn’t be hard for the CBSL, which keeps a close watch on bank accounts, to notice large amounts of cash coming in and going out from the accounts of these companies, which do business with several hundred clients each day.

“If they are proactive, they will be able to identify and take action against these elements. We saw how slow the CBSL was to act against cryptocurrency pyramid schemes. They shouldn’t use the same excuse to delay action against this online loan threat,” he noted.

| Repay your debt now or risk private photos being leaked | |

| A Galle resident who had a close call with an online loan scheme explained how the loan providers lured him into obtaining more and more loans at higher interest and threatened him when he fell behind on payments.He said he obtained a Rs 30,000 loan as he urgently wanted the money to repair his motorcycle and pay his mobile phone bill. “They just asked for a copy of my National Identity Card (NIC) and a selfie with the NIC in hand. Afterward, they asked me to register using my mobile phone number and fill out applications. I had the money deposited in my account after that,” he said.He added that when he took out a loan previously, the loan providers increased the amount he could obtain, claiming that his loan records were good. “However, when I took out a loan for the third time, I found it difficult to pay it back along with the 49 percent interest within one month. That was when I started receiving calls.” He explained that on the due date and the day after, he received reminder calls from the company saying that the loan payment was due. On the third day, he started receiving calls from different unknown numbers from people who threatened him to pay the loan. “We have your phone details and pictures of the people on your phone. Think about what would happen if those pictures were to leak. Make the payment or else there will be trouble,” he said, detailing one such call he received. |

| CCID seeks AGs advice regarding Lankans who worked for online loan companies | |

| The Police Computer Crimes Investigation Division (CCID) has said that they are planning to seek the Attorney General’s advice when taking action against the 80 Sri Lankan employees working for Chinese nationals who are allegedly involved in an online loan scam.The CCID Director, Senior Superintendent Darshika Ranasinghe, told the Sunday Timesthat they had arrested five Chinese nationals, including the owner and manager of a company operating from Dehiwala. Also arrested was a Sri Lankan.She said investigations had revealed that the company owner ran two more online loan companies. The online loan scam is carried out by hacking into the phones of the loan recipients when they click links, fill out the online documents, and agree to the terms and conditions stipulated by the scammers. “After we received a complaint on January 9 with substantial evidence, we tracked the Chinese-run company,” she said. SSP Ranasinghe added that 80 Sri Lankan employees were working as recoverers for the Chinese. They were provided with contact lists and photos obtained by hacking the phones of clients. They were instructed to use the information to threaten the clients who failed to honour repayment and set up WhatsApp groups using the contact lists to share photographs of the client, with posts claiming that he or she was not paying off loans. “This action is a violation of Computer Crime Act Sections 3, 4, and 5, which clearly say securing unauthorised access, taking any action to secure unauthorised access to commit an offence, and causing a computer to perform a function without lawful authority are offences,” she added. The SSP explained that the employees who worked as loan recoverers had not even been given appointment letters and did not enjoy labour rights. Their job is to recover money for the company by exerting pressure on loan receivers. She added that the employees were both victims, as they were pressured by the company, and offenders, as they were using malicious intimidation. Therefore, they would seek the AG’s advice on taking action against them. SSP Ranasinghe said their initial investigations had revealed that the stolen data of the victims were stored in China. Further investigations are ongoing as to what types of phone data have been collected. She urged people not to get caught in easy online loan schemes that are unregistered by the Central Bank or any government authority. She also advised them not to click on links and share their mobile numbers and one-time passwords with anyone. |

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!