Columns

Strikes pose threat to economic recovery and growth

View(s):The prospect of an improvement in external finances led to an expectation of an economic revival and recovery this year. This could have been the take-off to economic growth and development in the fullness of time.

However, if the general strike launched on Wednesday continues, and political protests and social upheavals are widespread and prolonged, there will be uncertainty in achieving economic recovery, economic growth, and economic development in the fullness of time.

External finances

Weak external finances have been a root cause of the economy’s poor performance in the past few years. Improvement in the balance of payments and the expected increase in the external reserves could be a forerunner to an economic recovery and economic revival by the end of the year. However, there is uncertainty in achieving this goal owing to the current strikes, political protests and social upheavals.

Strike

The general strike launched by several trade unions on the Ides of March could prove to be a serious setback to the expected economic revival and recovery.

It is in the national interest to reach a measure of compromise to achieve industrial peace. The Government which claims it is aware of the people’s economic difficulties must be responsive to the demands of workers and be willing to arrive at some degree of compromise on the taxation of incomes.

On the other hand, workers must realise that taxation is imperative and, therefore, only a more equitable system is possible.

It is to the credit of several trade unions that they have admitted the need for taxation. What they are demanding is a more equitable tax regime.

Threshold

A particular demand of unions is that the threshold for taxation should be increased from the current Rs. 100,000 a month to a higher threshold. They appear to be agreeable to the threshold being increased to Rs. 200,000 at a tax rate of 6 percent.

Whether the taxation of incomes at Rs 100,000 a month at 6 percent is inequitable is controversial. One could argue that the tax of Rs 6,000 from an income of Rs. 100,000 that leaves a disposal income of Rs 94,000 is not too heavy a burden.

On the other hand, trade unions argue that in today’s high costs of living and further increases in costs of basics such as electricity, water and medicine, such an erosion of incomes is unbearable.’

This argument is surely not tenable for professionals earning Rs 450,000 a month who would probably have to pay about Rs 100,000. If those earning such an income were to pay much less, how can the Government obtain adequate income for its expenditure?

Discussion

The Government and the trade unions must discuss this issue in a reasonable manner. The unions must approach the issue of taxation from a realistic economic and financial perspective, while the Government must be sensitive to the difficulties of wage earners. Both should be mindful of the economic consequences of their actions.

Tax evasion

The foregoing discussion leads us to a pertinent issue in the taxation policy: Tax avoidance and evasion.

One of the principal reasons for the country having a low tax-to-GDP ratio of 8 percent is the avoidance and evasion of taxes. It is too well known that lawyers, doctors, tuition teachers, business people, technicians, and traders pay little or no taxes. The large informal sector in the country makes it near impossible to gather taxes through the current tax system and administration.

Attempting to rake in taxes from tax evaders in the normal manner will not be effective. What is needed is a fresh pragmatic approach.

Expenditure taxes

In several previous columns, we have argued that the way forward for gathering revenue from rich tax evaders is through a system of expenditure taxes. Taxes should be imposed on what economists call “conspicuous consumption”.

For instance, high taxes should be imposed on high-powered cars, property, air travel and other items of luxury expenditure of the rich. It is difficult to understand why the governments have not moved in this direction. Apart from the gains in revenue such taxes would make the taxation of employment incomes less controversial.

Conclusion

If the spate of strikes is prolonged, the productive capacity of the economy would be severely eroded. This is especially so as the improvement in the country’s external finances should be utilised for ensuring a revival and recovery of the economy and an upsurge in economic growth and development.

Final reflections

The nation’s post-Independence history is punctuated by a series of missed economic opportunities, economic blunders, and political opportunism. Are we on the verge of missing another opportunity for economic recovery and development?

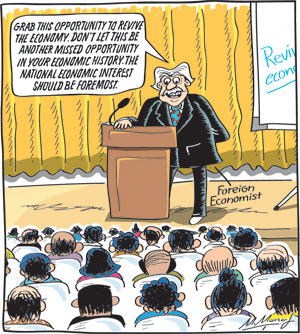

We must grab this opportunity to revive the economy. We can’t let this be another missed opportunity in our economic history. The national economic interest should be foremost.

The Government, the trade unions and the people have a responsibility to ensure that the economic gains are not frittered away owing to political motives. Their own economic conditions are at stake.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment