Road to a “developed country” in 2048

View(s):

Garments, one of the key drivers of the economy, is a great way to grow foreign exchange earnings.

The vision for a “new economy” as envisaged in the Budget 2023 entails an export-oriented, competitive economy led by the private sector. It expects Sri Lanka to be a “developed country” by the year 2048, which marks 100 years of independence; therefore, we have 25 years to go.

A developed country means a high-income country which has per capita income more than US$12,695; by that time, the high-income threshold must be higher than this. However, Sri Lanka must increase its present income level by about four-times, after allowing for a big contraction of the economy this year.

Today, I thought of explaining this journey in simple language without using economic jargon and building complex relationships. While I try to deal with it, I may have to refute some dogmatic views based on either ideological grounds or personal interests or any other reasons.

Cut down imports!

As the Budget spells it out, the government expects to begin the journey in 2023. The road to a developed country status is clear, as many countries in our neighbourhood have journeyed there: Building an export-oriented, competitive economy which can sustain 7 – 8 per cent annual rate of real GDP growth, not once in a while as we did during the past 75 years, but continuously over a period of 25 years.

Some would argue that it could be done with import controls; if it is the case, here we have import controls and foreign exchange restrictions for more than two years now. It’s an ideal test ground to confirm how domestic industries could flourish and expand behind import protection. In fact, the results have been the opposite; our production contracted reporting a negative growth of the economy. As a result, businesses collapsed and people lost their jobs and incomes, while prices skyrocketed with hyper-inflation.

Some would argue that it could be done with import controls; if it is the case, here we have import controls and foreign exchange restrictions for more than two years now. It’s an ideal test ground to confirm how domestic industries could flourish and expand behind import protection. In fact, the results have been the opposite; our production contracted reporting a negative growth of the economy. As a result, businesses collapsed and people lost their jobs and incomes, while prices skyrocketed with hyper-inflation.

At the same time, we heard how some businesses made their fortune by exploiting the consumers with undue advantage of domestic price hikes. While our total import bill is $20 billion, we cannot ban capital goods, which require about $4.5 billion.

Intermediate and consumer imports

Among the intermediate category too, we cannot cut down fuel imports which require nearly $4 billion and, textile inputs for the apparel sector which amount to $3 billion. We cannot limit any other intermediate inputs which are needed for sustaining production such as chemicals, plastics, paper, metal, and wheat flour!

What about the imports of consumer goods? We have already cut down the importation of personal vehicles plus some of the household appliances, and thereby saved about $2 billion. Let’s be careful – the same household appliances or any other consumer item could be for business purposes, if they are imported for a company.

We cannot ban food, beverages and pharmaceuticals, although we tried to save a couple of dollars by banning turmeric and some other spices. In fact, if we expect to welcome a high-spending tourist turnover, we must also import some of the so-called luxury items such as mineral water from France, beef cuts from Australia, salmon fish from Norway, dairy products from New Zealand and many others.

It is clear that cutting down imports may not save more than $2 – 3 billion to the economy, whereas we expect to earn 100s and billions of dollars from exports. In fact, as the economy begins to grow and exports begin to rise, we must be prepared to import even more.

Massive leap forward

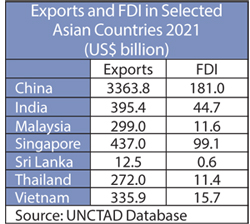

The budget envisaged an increase in $3 billion exports every year and, an increase in $3 billion foreign direct investment (FDI) every year. Exports are needed to sustain a higher rate of economic growth, while FDI is needed to sustain a higher rate of export growth. While Sri Lanka achieved $12.5 billion exports in 2021, many of the country’s high-performing neighbours report about $300 – 400 billion in exports; China is an exception in Asia for its achievement of over $3.3 trillion in exports.

Similarly, while Sri Lanka reports less than one billion-dollar FDI inflows in 2021, our neighbouring countries, China, Singapore and India, became the world’s top-3 FDI-recipient countries. While China has attracted $181 billion FDI, Singapore and India received $99 billion and $45 billion, respectively.

Similarly, while Sri Lanka reports less than one billion-dollar FDI inflows in 2021, our neighbouring countries, China, Singapore and India, became the world’s top-3 FDI-recipient countries. While China has attracted $181 billion FDI, Singapore and India received $99 billion and $45 billion, respectively.

Since there is no shortage of world capital for investment, in all of the high-performing countries in Asia, the underlying FDI-driver has been the continuity in policy reforms for export growth and FDI growth. This is exactly what Sri Lanka has abandoned after the initial two rounds of reforms in 1977 and in 1989.

For instance, the post-war “high growth spurt” of Sri Lanka has been driven by a few “non-tradable” sectors such as construction, transport, domestic trade, banking, insurance and real estate. And, more importantly, a significant portion of this growth has originated from “public investment” with credit-financing.

Beyond the IMF programme

Sri Lanka needs to make a U-turn by shifting growth from a non-tradable sector towards a tradable sector with export growth, and from public investment towards private investment, including FDI. This is obviously a medium-term programme which would run beyond the boundaries of an annual budget of the government. Neither are they limited to those agreed upon with the IMF. The budget categorically identifies that the IMF programme is for economic stabilisation, while export growth requires reforms beyond the IMF programme.

The budget has proposed setting up a “single agency” for trade and investment, replacing a number of existing ones including the BOI, the EDB, SLECIC and NEDA. We anticipate that this institutional reform would save money and time costs of the investors making their business processes more efficient and effective.

The second proposal is to set up New Economic Zones in the Western Province, North-Western Province, Hambantota, and Trincomalee with a view to attracting FDI. The budget does not specify the type of economic zones; however, the experience of the region suggests that either government-owned or even private-owned Special Economic Zones (SEZs) would provide a “bypass strategy” in order to avoid lengthy and complex regulatory frameworks.

The only SEZ that Sri Lanka is just initiating is in the Colombo Port City which would have an entirely different regulatory framework and an administrative mechanism enabling export-oriented multi-services business operations. While replicating the Port City SEZ model in other appropriate locations of the country, it is of utmost importance to narrow down the regulatory gap between such an SEZ and the local economy by undertaking overall reforms as well.

The third important budgetary proposal for export growth is the enhancing access to global markets through both bilateral and multilateral Free Trade Area (FTA) agreements, including the Association of Southeast Asian Nations (ASEAN) and the Regional Comprehensive Economic Partnership (RCEP).

While FTAs are important too, what is much more fundamental to export growth as well as to enter into the FTAs is the “unilateral reform” process. Without having Sri Lanka’s own reform programme at home, it would be more painful and more distortionary for Sri Lanka to integrate with countries and regions which have been adopting their own policy reforms over a long period of time.

Crisis, we nurtured

Apart from the above specific proposals, the budget also indicates the need for the general reform process, institutional arrangements and regulatory changes in order to establish a business-friendly enabling environment in Sri Lanka. Even though there is no dispute over the validity of all these proposals, we, Sri Lankans are not used to reforms for over two-and-half decades.

Besides, regular elections are round the corner at which many political parties and their affiliated semi-political groupings are getting ready with their typical democratic weapons for battle. We should not forget the “crisis” for which we have contributed in the past in order to nurture it to its present level.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!