Central Bank’s Road Map 2014 versus underlying macroeconomic vulnerabilities

The Road Map 2014 presented by the Governor of the Central Bank early this month is the eighth consecutive policy announcement in the series commenced in 2007. The presentation is filled with more than 160 colourful slides illustrating impressive economic achievements. Almost everything in the economy is fine, and nothing has gone wrong, according to this policy declaration. The complacency of the Central Bank about the country’s economic achievements is displayed throughout the slideshow. Just to elucidate this point, the heading of one of the slides is “In summary, substantial progress was achieved in all macro-fundamentals …”.

According to the Road Map, economic growth rebounded to 7.2 per cent in 2013 while maintaining domestic investment over 30 per cent of GDP. The headline inflation declined to 4.7 per cent whereas the core inflation was as low as 2.1 per cent in December 2013. The unemployment rate remained low at 4.5 per cent. On the fiscal side, the budget deficit declined to 5.8 per cent and the public debt/GDP ratio was down to 78 per cent. On the external front, export earnings rose by 6.9 per cent in 2013 helping to reduce the trade deficit by 8.7 per cent during the year. Migrant remittances are estimated to reach $ 6.7 billion, and foreign direct investments (FDIs) are said to be over $1 billion for the third consecutive year. Further, the balance of payments recorded a surplus of $700 million while foreign reserves remained at a healthy level of $7.1 billion, adequate to finance 4½ months’ imports. The rupee remained stable despite the volatilities in the global markets. Domestic interest rates guided by the Central Bank’s policy rates continued to decline, thereby facilitating private sector credit disbursements. Thus, according to the Road Map 2014, the economy performed well in 2013  responding favourably to the economic stabilization package launched in 2012.

responding favourably to the economic stabilization package launched in 2012.

Need for independent economic assessment

While appreciating the initiatives taken by the authorities to attain economic growth and stability as claimed in the Road Map, we should not ignore the underlying vulnerabilities relating to macroeconomic fundamentals which are detrimental to achieve the very same economic goals. It is essential that the authorities disseminate accurate economic data and information to the stakeholders and to the general public for smooth functioning of the factor and commodity markets. Inaccurate economic signals lead to distort market activities and create uncertainty among consumers, savers and investors. Doubts have already been raised in various quarters recently regarding the accuracy of GDP data, and such scepticism obviously leads to a deterioration of public’s confidence in official data, and damages the country’s credibility and creditworthiness.

One may also expect an unbiased assessment of the economy from a country’s Central Bank. This was depicted well in the early Annual Reports of Sri Lanka’s or Ceylon’s Central Bank which were critical of the then government’s economic policies at times. This does not necessarily mean that the Central Bank should not be aligned with the prevailing government’s policy agenda, but it should have the autonomy and fearlessness to pinpoint any adverse repercussions arising from politically-dominated economic policies, and to guide the economy in an optimal path subject to any emerging constraints. Such critical assessment or objective guidance seems to be lacking in the current Road Map as well as in the previous years’ announcements in the series. Dilemma of ‘twin deficits’

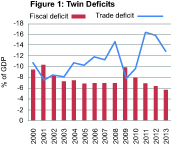

A major macroeconomic challenge faced by the country, which is not adequately addressed in the Road Map, is the deficits in the government budget and foreign trade account (Figure 1). Given the intimate relationship between these two deficits and their interactive influence on the entire economy, they are known as ‘twin deficits’ in economic literature. It is common knowledge that an excess of government’s expenditure over its revenue creates budget deficits. Although excess public spending is unavoidable often due to government’s commitments towards social and economic development as well as national security, maintenance of the budget deficit at manageable levels is critically important to avoid its adverse consequences on critical macroeconomic variables such as inflation, balance of payments, investment and savings. Persistence of the twin deficits over the years in Sri Lanka has not only constrained economic growth but also disturbed economic stability to a great extent.

A major macroeconomic challenge faced by the country, which is not adequately addressed in the Road Map, is the deficits in the government budget and foreign trade account (Figure 1). Given the intimate relationship between these two deficits and their interactive influence on the entire economy, they are known as ‘twin deficits’ in economic literature. It is common knowledge that an excess of government’s expenditure over its revenue creates budget deficits. Although excess public spending is unavoidable often due to government’s commitments towards social and economic development as well as national security, maintenance of the budget deficit at manageable levels is critically important to avoid its adverse consequences on critical macroeconomic variables such as inflation, balance of payments, investment and savings. Persistence of the twin deficits over the years in Sri Lanka has not only constrained economic growth but also disturbed economic stability to a great extent.

External imbalance

A country’s external balance is usually measured in terms of the current account of the balance of payments, which captures exports and imports of goods and services and transfers. In the case of Sri Lanka, inward remittances received year after year from migrant workers, mainly who are in the Middle East, have helped to contain the current account deficit to a large extent. In 2012, the current account deficit would have been nearly $10 billion (16.7 per cent of GDP) in the absence of migrant remittances, in contrast to the current account deficit including remittances that stood at $3.9 billion (6.6 per cent of GDP). This illustrates the extent of vulnerability in the external payments situation. A similar dependence on foreign remittances is projected for 2014 and beyond in the Road Map, thus anticipating a reduction in the foreign exchange burden. Worker remittances are projected to rise from $6.6 billion (9.9 per cent of GDP) in 2013 to $9 billion (8.9 per cent of GDP) by 2016. The improvement in the current account, as projected in the Road Map, from a deficit of 3.9 per cent of GDP in 2013 to a surplus of 1 per cent of GDP by 2016 relies heavily on the projected remittance growth. While a steady growth in remittances certainly leaves some breathing space for policy makers, overdependence on worker remittances raises doubts with regard to the sustainability of external deficits. Continuation of remittance inflows largely depends on the politico-economic conditions in the host countries such as their political ideologies, economic growth, employment policies and attitude towards foreign workers. Besides, the difficulties faced by Sri Lankan female workers abroad and their children left behind are matters of concern from a social welfare perspective.

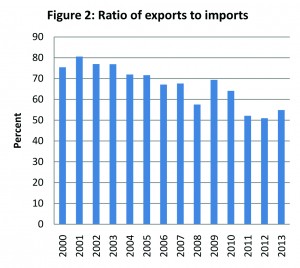

Dependence on remittances has become imperative due to the widening gap between exports and imports. The ratio of exports to imports declined from 75 per cent in 2000 to 64 per cent in 2010 and to 55 per cent by 2013 (Figure 2). In other words, exports are sufficient to finance only 55 per cent of import payments now whereas they financed as much as 75 per cent of imports in 2000 and 64 per cent in 2010. This underscores the gravity of the foreign exchange problem faced by the country. Despite the export-led growth strategies adopted over the last three and a half decades, the export sector has experienced setbacks over the years partly due to weaknesses in macroeconomic fundamentals. These weaknesses need to be addressed timely to resuscitate the export sector, and to foster export-led growth. In the background of slow export growth and limited FDI inflows, a shift towards commercial borrowing to finance the balance of payments deficits is evident in recent years. Given the high interest rates and short grace periods, accumulation of commercial loans poses debt servicing problems in the short run.

Fiscal deficit

A gradual improvement of fiscal performance in relation to GDP is evident since 2010. The ratio of budget deficit to GDP is down to 5.8 per cent in 2013 from 9.9 per cent in 2009. Undoubtedly, this is a reflection of the progress made towards fiscal consolidation. However, there are still concerns with regard to insufficient revenue generation to meet current expenditure commitments. Almost the entire government revenue is absorbed by three major current expenditure items – salaries and wages, interest payments on public debt and welfare transfers. As a result, government borrowings, particularly in the form of foreign commercial loans, have increased substantially in the recent past in the backdrop of a fall in revenue in relation to GDP. Borrowings from the domestic market, on the other hand, have preempted resources from the private sector and widened the gap between domestic savings and investment.Therefore, further fiscal consolidation is imperative to ease the debt servicing pressures and thereby to restore fiscal stability.

Policy options

Guided by the Central Bank’s policy rate corridor, the country is now experiencing a low interest rate regime. This accommodative monetary policy stance, of course, helps to reduce the lending costs thus, favouring borrowers. It also reduces the interest cost of the government’s domestic borrowings. However, savers may get frustrated with low rates of return for safer financial instruments, and therefore, they may shift their funds to physical assets boosting asset prices. Given the low borrowing costs, there is also a tendency to increase demand for consumer goods, particularly for imported goods. Increasing consumer demand will augment inflation, in addition to a rise in imports.

Substantial inflows of worker remittances coupled with foreign borrowings have helped to build up international reserves, and thereby prevented any drastic depreciation of the rupee. But the mounting import demand pressures backed by low interest rates will necessitate a depreciation of the exchange rate to restore the eroding export competitiveness of the country. Hence, maintaining a stable exchange rate in a low interest rate regime is a remote possibility. In this context, either a significant depreciation of the currency or an upward movement of interest rates sooner or later is inevitable in the absence of tangible growth in the export sector.

Preparation of policy frameworks without taking into account these macroeconomic vulnerabilities would be a futile exercise.

(The writer is a former central banker and university academic)