News

Budget 2013: Sops for middle and working classes; farmers, fishermen get little relief

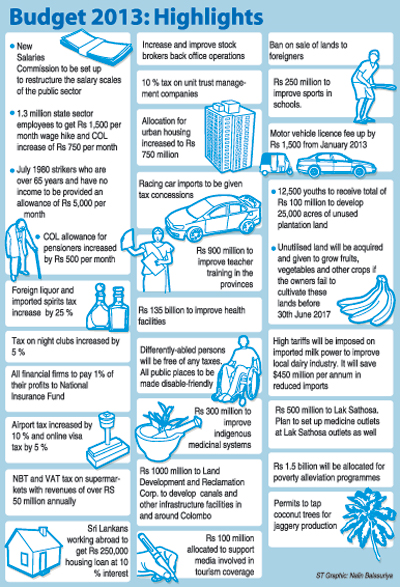

If it was good news for flashy racing car drivers and bare footed children who trudge to school through rocky roads, last Thursday’s budget was bad news for most others.

President Mahinda Rajapaksa announced that racing cars will be allowed into the country without duty and school children in rural areas will receive free footwear. However, a cross section of the public was livid there was very little for them to reduce the burden of high living costs.

“Even before the budget, there were price increases with the latest of them the bread price”, said Mr. M. Sudarshana Silva. According to the budget, public servants will be entitled to a monthly allowance of Rs.1, 500 which includes a CoL allowance of Rs.750.

“A majority find it hard to make the ends with the increasing CoL, so a monthly allowance of Rs.1, 500 for every public servant which including a CoL allowance of Rs.750 is not enough,” said Chandana Ratnayake from Alawwa who works in a State institution in Colombo. Anura Wickremasekera, a private sector employee attached to a financial institution in Colombo said the working class is not benefited by this budget and the Government has done little to control the price increase of essential commodities through the budget.

Anura Wickremasekera |

Chandana Ratnayake |

N A Siriyawathi |

F.Fazeem |

Among the products to which the cess will be increased or imposed will be imported dairy products, edible products of animal origin, cut flowers and flower buds, foliage, fresh preserved and dried vegetables and fruits, edible oils, margarine, sausages and preserved meat products, honey and jaggery, confectioneries, bakery products, food preservatives, taxi meters, tyres for cars and light trucks, aluminum ware and radiators and parts.

To encourage local industries the Special Commodity Levy on chillies, canned fish, black gram, Maldive fish, grapes, coriander, turmeric, groundnut, mustard seeds, cumin seed and palm oil will also be revised.

The tax on imported liquor prices will be increased by 25 percent. Accordingly, prices of beer made from malt will be increased by Rs.150 per litre. Spirits prices will be increased by Rs.250 per litre while prices of wine, whiskies, rum, gin, vodka and other liquor will be increased by Rs.1250 per litre.

The present airport tax will be increased to US $25 and the online visa fee will be increased by US $ 5.

N.Siriyawathie (61) a widow from Ganemulla said she had to work to support her two married daughters and their families.

“The tax on milk powder will impact on our family as we have small children,” she said.F.Fazeem, a mother of two said expenses are increasing and therefore the public should be benefited by bringing down the cost of living.

“There are good development-oriented proposals but the public is struggling to manage with the salaries they get as the prices of goods and services are increasing,” she said.

According to the budget proposals, a special allowance of Rs. 750 per month will be granted to those public servants who retired before 2004, and Rs. 500 per month to those who retired between 2005 and 2006. Fifty percent of this increase will be granted in January 2013 and the balance from July 2013. There will also be an increase in the Cost of Living allowance to all pensioners, by Rs.500 per month from January.

“It is a relief to the pensioners, especially those who retired before 2004.

But with the present increase in the prices of medicinal drugs, food items and house rents it is unbearable for a retiree to survive with a mere increase. As there is no war, the Government should provide more relief to the ageing population like in many developed countries,” said W. Gunesekera, a pensioner.

In his budget speech, President Mahinda Rajapaksa proposed to allocate Rs. 300 million annually to grant a monthly living allowance of Rs.5,000 to the July 1980 strikers who complete 65 years on January 1, 2013.

“Those who struck work in July 1980 risked losing their jobs hoping for a better future. However since the Rs.5,000 allowance is given only to those who are over 65, around 500 strikers who are below this age limit still remain. What we request the Government is to bring down the age limit to 60,” said July Strikers Association President P. Ameradivakera.

Despite many protests by trade unions demanding a six percent of GDP be allocated for the education sector, this budget allocated 4.1 percent (Rs.306 billion) for the education sector.

“Our demands were that the six percent should be from the Government. But this 4.1 percent includes contributions from both the private sector and parents,” said University Teacher’s Association President Dr. Nirmal Dewasiri. Ceylon Teachers Union President Joseph Stalin said that salary issues in the education sector are yet to be addressed by the Government.

“Among the 1.3 million Government sector workers 225,000 are teachers and despite requesting the Government to give an increment of Rs.10,000 only an increment of Rs.750 was received,” he said adding that education sector workers find it hard to cope with the current cost of living.

Dr Chandika Epitakaduwa, spokesman of the Government Medical Officers’ Association said the association is presently studying the budget proposals and will be formulating an opinion by the end of this month. He said the exemption from tax of the profits and income earned by the College of General Practitioners and the allocation for research are good moves in the budget.

“But there are issues faced by medical officers and problems in the health sector that needs to be addressed. Our union will be forwarding these issues in the coming weeks,” he said.

Farmers, who have seen promises made in the past broken, expressed doubts on the budget proposals.

All Ceylon Farmers Association President Namal Karunaratne said despite the President reading out proposals enumerating a number of benefits for the farmers and those in the agricultural sector, there are many such proposals that have been ignored with time.

“During the provincial election campaign several months ago, President Mahinda Rajapaksa met the drought stricken farmers and assured them the instalments on loans they obtained from State banks will not have to be paid till the next harvest. But many farmers have got red notices from banks demanding they pay the loan installments,” he said.

“We were told by bank managers that there was no written document stating that the payment should be paid after the next harvest,” he said. According to him, only selected farmers were given free seed paddy last time thereby creating disharmony between the farmers.

“Drought-stricken farmers were given Rs. 5,000 for each family, but this was given after 10 days of manual work, including cleaning of drains and building of roads. These monies were released by the Government to the Samurdhi Bank. The bank deducted loan installments from the farmers who have obtained loans from the bank,” he said.

S.Thavaratnam, President of the Northern Province Fishermen’s Alliance said the Government has allocated funds for resources for fishermen but no action has been taken against thousands of fishing boats that enter Lankan waters from Tamil Nadu.

The Joint Plantation Trade Union President S. Ramanathan said his union is displeased with the budget as the Government has failed to provide any relief to plantation sector workers and they have not even been mentioned in the budget speech.

“We have submitted proposals to the Government before the budget. The proposals included housing facilities for the plantation workers,” he said. Mr. Ramananthan said plantation workers are not paid during a natural disaster or illnesses.

“We requested they be paid even during the days they are unable to attend work due to such reasons,” he said. Bakery Owners Association President N.K.Jayawardena said the bakery owners did not benefit from the budget.

“There is no relief at all. This industry is collapsing. There is a tax imposed on bakery products and confectioneries. We expected the Nation Building Tax and VAT on bakery products to be reduced. Now with the increase of wheat flour prices the situation will become more difficult for bakery owners,” he said.

Another proposal is that individuals returning from foreign employment investing his or her savings to commence new businesses will be exempt from all taxes payable on turnover and on the profits and income from all such new businesses for a period of five years. This budget will also see an increase in the motor vehicle revenue licence fee from 2013.

Adjustments to certain provisions of the Inland Revenue Act, Value Added Tax Act, Nation Building Tax Act, Economic Service Charge Act, Finance (Amendment Act) and Telecommunication Levy Act will be made to rectify certain ambiguities and unintended effects.

Changes to Income Tax and the Economic Service Charge will be effected from April 1, 2013, while Value Added Tax (VAT), Telecommunication Levy, Betting and Gaming Levy, Airport Departure Tax, Stamp Duty and changes to fees and charges will be effected from January 1, 2013.

Cess, Ports and Airports Development Levy, Excise (Special) Duty, Customs Duty and Special Commodity Levy will be effective immediately.

Go karts, racing cars instead of circuses to please the plebs

From this budget several relief measures have been given to the sports sector. In the budget speech the President said the foreign income from sports activities in Sri Lanka is estimated to be around US $ 50 million and he proposed to increase the earnings to about US $ 500 million by 2016.

The import of goods for any international sports event approved by the Minister of Finance will be exempted from Nation Building Tax (NBT) while go karts and racing cars will be exempted from excise taxes.

The supply of hotel accommodation to any sportsman, organiser of any sports event or sponsor arriving in Sri Lanka for participating in any sporting event or activity connected with sport will be exempted from Value Added Tax (VAT).

According to the proposal present restrictions on the deduction of advertisement expenses (25 percent) will be removed for specific sponsorship for international sports events approved by the Minister of Sports (with effect from August 1, 2012).

An additional Rs. 300 million will be allocated to the National Youth Services Council to make preparations for the Asian Youth Conference to be held here in 2014.

Follow @timesonlinelk

comments powered by Disqus