Columns

Hard times and emerging challenges

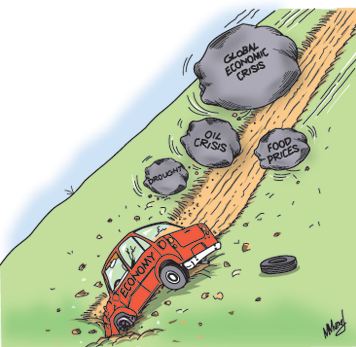

View(s):This year has been one of the toughest for the economy. Global conditions have affected the economy at a time when nature has been unkind too.

At such times of external and internal shocks the country has to either depend on using its reserves or get into foreign debt.

Unfortunately the country has to face these shocks at a time when the country’s economy does not have the strength to face adversity. Consequently economic fundamentals are being weakened and the country is getting into further debt.

Balance of payments difficulties

Despite the economic growth of 8.3 estimated by the Department of Census and Statistics, for 2011, last year was one when the country faced a severe balance of payments crisis. The depreciation of the currency, the tightening of credit and increasing import tariffs prevented a further worsening. Even with all these measures the country is heading towards a huge trade deficit of similar magnitude as last year’s almost US$ 10 billion.

While imports continue to be high, though somewhat reduced from that of last year, it is about double the export earnings. Export earnings have been reducing owing to the slow growth of Western countries and the turmoil in the Middle East that has affected especially the country’s main agricultural export tea. In the first seven months export earnings fell. Both agricultural and industrial exports declined. In the first seven months the trade deficit was as much as US$ 4.7 billion, nearly 12 percent more than that of last year.

Although part of this deficit will be offset by workers’ remittances, tourist earnings and net capital inflows, it is likely that there would be a balance of payments deficit of about US$ 2 to 3 billion that would have to be met by drawing down of the reserves. It is because of this that there are efforts to obtain further foreign loans. Foreign borrowing has reached a level when its servicing costs could be a severe strain on the economy.

Foreign debt

The foreign debt of the country has increased considerably in the first seven months of this year from Rs. 2.33 trillion at the end of last year to nearly Rs. 3 trillion.

The proposed borrowing will increase it further. The danger of further borrowing is that the debt servicing costs of the foreign debt could itself be a severe strain on the balance of payments.

The foreign debt servicing costs (repayment of capital and interest payments) is itself a factor in increasing foreign borrowing. The country is moving towards a dangerous situation of a foreign debt trap when further foreign borrowing is needed to meet debt obligations.

The core cause for this situation is the large trade deficit.

Although the depreciation of the rupee early this year, restrictions on credit and a higher interest rate regime has curtailed consumer imports, the continued increase in intermediate and capital imports and the reduction in export earnings have led to a trade deficit of a massive amount, as was the case last year.

Manufactured exports have fallen 3.7 per cent in the first seven months of the year. This drop has been significant in not only decreasing export earnings but also in reducing industrial output and employment. Agricultural export earnings have fallen by nearly 6 per cent.

Drought

Conditions in the country have aggravated the problems caused by the global conditions. Drought conditions have reduced agricultural output. Paddy and other food crops have been adversely affected, especially in dry zone areas.

The reduction in output of food crops may not have affected GDP growth by much, but it could impact on import expenditure that is likely to increase with higher food imports. Besides the severe hardships to the livelihoods of farmers, government expenditure on relief measures is an added expenditure at a time when there is a shortfall in revenue.

The drought has affected the tea crop and tea production is likely to fall by about 8 per cent this year. Again this will not have much effect on GDP, but the loss of export revenue is not minimal. Compared to last year’s earnings from tea in the first seven months, this year’s tea export earnings during the same period have dipped by 4.2 per cent. This reduction in export earnings is also due to the impact of the Middle Eastern turmoil that has affected especially Sri Lankan tea exports to Iran, one of the main markets for our tea.

Fiscal difficulties

Not unrelated to these adverse external trade developments has been the widening of the fiscal deficit. During the first seven months of his year government revenue increased by only seven per cent compared to the same period last year. While this is much less than was expected, expenditure has increased by much more than budgeted for. Consequently the fiscal deficit increased to Rs. 417 billion or 5.56 per cent of GDP. It is therefore highly unlikely that the target of a fiscal deficit of 6.2 per cent of GDP could be achieved. Since achieving the target of a 6.2 per cent fiscal deficit is important to satisfying the IMF, it is likely that some creative accounting practices are used to bring the deficit to somewhere near the target.

Fundamental problems

With the trade deficit being massive and the balance of payments creating a severe problem; the fiscal deficit being larger than targeted; and foreign borrowing increasing, the economy is in severe difficulties. It is important to recognise that the economic fundamentals are weak and strong reform measures are needed.

It is a time to reflect on fundamental changes and reforms that are needed to restore the economy to a healthy and robust one. Ideological blinkers, political constraints and a poor understanding of economics that have prevented the adoption of economic policies and reforms conducive to growth in the recent past are likely to be severe constraints to achieving the country’s economic potential. We should take a leaf from the recent bold economic reforms adopted by India to revive the economy.

Follow @timesonlinelk

comments powered by Disqus