Foreign exchange reserves have exceeded US $ 4 billion which is indeed a very favourable development for the country.

The Central Bank has attributed several reasons for this favourable development. “The foreign exchange inflows have also responded favourably to the positive outlook brought about by the end to the three decades of conflict and approval of a Stand-by Arrangement (SBA) facility by the International Monetary Fund (IMF). Total net foreign inflows to the government T-bills and T-bonds since mid May 2009 to September 11 2009 amounted to US dollars 1,214 million.

In the meantime, the Central Bank of Sri Lanka (CBSL) is in the process of building up its official reserves to a more comfortable level by absorbing excess foreign exchange from the market.

Since end March 2009, up to September 9, it has absorbed US dollars 1,955.9 million from the market. In addition, with the approval of the new general and special allocations of Special Drawing Rights (SDR) by IMF on August 28 and September 9 2009, respectively, Sri Lanka has received SDR 324.6 million (approximately US dollars 508 million) and thereby the foreign reserves held by the CBSL have improved significantly. Accordingly, gross official reserves (without ACU) have been estimated to exceed US dollars 4 billion by September 10 2009.”

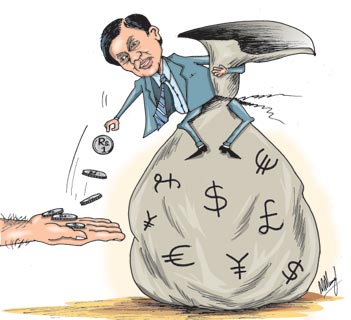

These reserves are undoubtedly a positive development and a sound foundation to launch a programme of rapid development. The large foreign exchange reserves provides an opportunity to expend these in a productive manner that would in turn enhance the balance of payments. There is however a danger if they are used imprudently. This is more so as most of the reserves are contingent liabilities and have increased the foreign debt. The use of these funds must be such as to improve the balance of payments rather than strain it.

In order to ensure that the foreign debt servicing costs are not excessively burdensome, the golden rule is to make certain that the returns from the use of these funds are more than their costs. This must be in terms of foreign exchange costs and returns. This must be a guiding principle in the use of most of the foreign reserves. Otherwise these reserves could lead to future economic difficulties especially in the balance of payments.

It is important not to be carried away by the large reserves of foreign exchange. Sri Lanka must not turn the positive development into a negative one and it must not catch the “Dutch Disease”. The “Dutch Disease” is an economic phenomenon where countries that have a windfall in foreign exchange reserves tend to be imprudent in their expenditure and get themselves into severe problems. It is an economic concept that tries to explain the apparent relationship between an increase in revenues from natural resources, a commodity boom or foreign aid that will work against a country’s export sector by raising the exchange rate, which makes the manufacturing sector less competitive. In addition a country may expend such reserves in an imprudent manner that causes a severe strain on its reserves later on.

The most dramatic example of this occurred when many countries got into a foreign debt trap a few decades ago. It was the oil producing countries in Asia, Africa and Latin America that got caught in a debt trap. This was owing to the imprudent expenditure of governments like Indonesia, Nigeria and some Latin American countries. As a result of the free flowing money from both their oil exports and international borrowing, they spent these funds in a manner that did not result in additional foreign exchange earnings. International banks were ready and willing to lend to these countries owing to their oil reserves. In the end they had spent their reserves imprudently and unproductively to end up unable to service their loans.

It is not likely that we would get into such a bind as wiser counsels are likely to prevail. Yet it is good to be forewarned of such possibilities. It is important to remember that a high proportion of the reserves are debts that have to be repaid. It is therefore very important that these funds are used for productive purposes that yield foreign exchange earnings or savings. Even some productive purposes though justified could be burdensome as they may have long gestation periods and not yield adequate foreign exchange earnings or save foreign exchange in time to service the debt. In expending these reserves it is important to keep an eye on the balance of payments implications of such expenditure.

There are several ways in which the increase in foreign exchange should be used. First and foremost it must not be frittered away in unproductive expenditure. Second, the increase in foreign reserves and strengthened external finances should not lead to an appreciation of the currency that would be a disadvantage to export industries. If the exchange rate appreciation makes export industries less competitive it would lead to lesser profitability of industries and even losses that would shrink export earnings, reduce investments and increase unemployment. This is especially important in the current context when industrial exports have declined by 18 percent and there is the imminent danger of the country losing GSP Plus status in the European market.

In any event it is important for the country to adopt a competitive exchange rate as we are an export dependent labour surplus economy. As much of the reserves are borrowings rather than earnings, it is prudent to invest such funds in enterprises that would either increase foreign exchange earnings or reduce import expenditure. There are many areas of sound investment that must be carefully considered as these though of advantage to the economy in the long run, their foreign servicing costs could be burdensome, if they do not lead to enhanced export earnings.

The large foreign exchange reserves are an advantage for the country’s development. They must be used to improve the country’s capacity to earn more through exports and strengthen the trade balance. A danger that lurks in large reserves is that there is a possibility of the exchange rate appreciating and making the country’s exports less competitive.

This is a serious concern for a labour surplus export dependent economy. The expenditure of these funds must ensure adequate foreign exchange earnings to meet the debt servicing costs. The prudent management of the large reserves could lead on to economic development. Their utilisation without consideration of economic consequences could lead to economic strains in the future. |