|

18th April 1999 |

Front Page| |

Contents

|

||

|

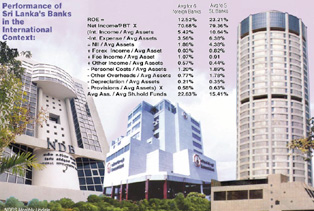

On the upside Sri Lanka's banking sector has a comparatively low gearing, it says. However a general tightening of banking regulation by Central Bank in 2000 or 2001 to be in line with international banking practices will show up more flaws in the sector. One such area will be tighter capital adequacy ratios. The Basle Standard requires 8% adequacy but the Central Bank has proposed to increase capital adequacy to 10%. Another is the tightening of provisioning requirements to be in line with international norms. Local banks still only provide for assets in arrears of six months and over as opposed to international norms of providing after three months. Therefore although local banks are operating on higher capital ratios (lower gearing) their actual level of outstanding capital is difficult to gauge. The brokerage also attacks the infamous margins enjoyed by the local banking sector. The general belief that the high margins are state bank lead, to cover up for inefficiency and high overheads may not be accurate if a closer look at the private sector banks is made, they say. See full report - Banking sector exposed

Mind your business –By Business BugNo, Not NowThe kidnapping drama may be over with the smart cops cracking the case inside of seven days and pledging that it will not happen again but that is not all. Several business big wigs or their families, at least think it is prudent to have themselves "covered" so that any ransom demands could be met without recourse to banks with hearts. But what most of them found out was that our insurance companies themselves were not prepared for such contingencies, so they were told to come again, a little later... Real AvuruduThe telecom giant may have offered free calls on the New Year holidays but others had to bear the consequences. Internet users, most of whom are on 'packages' where they pay only local call charges had a field day logging on with a vengeance. As a result at least one Internet service provider had its networks jammed, causing more than a few problems! A better wayThere has always been competition between local, small-time petrol-to-gas converters of vehicles and the established companies doing the same thing for a higher price. That is why the latter had to band themselves into an association representing five companies. But now, one of these companies at a suburb just south of Colombo is facing hard times due to the competition and may soon switch from conversions to operating a filling station...

FCBUs to go under domestic bankingBy Mel GunasekeraCentral Bank is laying the groundwork to include Foreign Currency Banking Unit (FCBU) assets under domestic banks assets, The Sunday Times Business learns. FCBU's liquid asset ratio would then have to rise from 10% to 20%, to bring it on par with domestic banking unit's (DBU) asset ratio of 20%. At present, FCBU assets do not come under DBU assets as they are off-shore operations and do not directly affect local money supply. However, the 1997 budget permitted FCBU's to lend to BOI companies. With non-BOI companies also permitted to borrow from FCBU's, our local money supply is affected indirectly, as most off shore assets are BOI companies (though they are technically Sri Lankan). With FCBU's increasingly lending to BOI and non-BOI companies they are now becoming part of bank assets and some of them form part of DBU liabilities. The proposed changes will affect DBU's capital adequacy ratios (CAR) and domestic bank's will see a decline in their Tier II capital. At present, all DBU's maintain CAR of 4 per cent (Tier I) and 8 per cent (Tier II). With the view to strengthening the capital base of Sri Lankan banks, Central Bank is to raise the CAR to 5 per cent (Tier I) and 10 per cent (Tier II) respectively by year 2000 or 2001. International banks operate at a higher gearing level since they carry a higher proportion of subordinate debt that qualifies as Tier II capital. Our local banks have begun to follow suit, but with a very small component of total capital and liabilities. Of the five listed commercial banks, Hatton National Bank, Commercial Bank and Seylan Bank came out with a series of debentures to prop up their Tier II capital. Sampath Bank's debenture is expected in the coming weeks. However, the proposed changes to include FCBU assets may put DBU's in a 'spot'. Most of the debentures issued last year were subscribed by state institutions like EPF, ETF, National Savings Bank and the Insurance Corporation. Meanwhile, Central Bank is in the process of framing necessary prudential rules for FCBU, a senior Central Bank official said. The proposed regulations would include defining liquidity ratios, capital adequacy and single borrowing limits. The Central Bank's Supervision Department monitors the FCBU operations of licensed commercial banks based on monthly statements of assets and liabilities and quarterly statements of income and expenses submitted to the department.

Industry worries over South African tea dutyBy Shafraz FarookThe recent introduction of a US 64 cents per kg duty on tea in South Africa has the local tea industry worried. Expectations are that the duty will affect the export of high priced teas to that country. Despite the low quantities exported to South Africa, the FOB prices of tea was around Rs. 200 per kg, well above the average price of Rs. 184.97, Forbes and Walkers officials said. Sri Lanka exported 1.8mn to 1.9mn kg of tea to South Africa in 1998. Shippers around the world have been asked by the South African authorities to hold onto their supplies, Forbes and Walkers said. Meanwhile government sources had revealed attempts to negotiate with Pakistan trade officials to allow Sri Lankan tea imports at zero duty or at least concesionary terms in an attempt to prop up sagging prices, a Forbes ABN Amro report said. This aims to capture 15 percent of the Pakistani market. Overall tea export at the end of February 1999 has dropped 22 percent to 37.1 million kg over the same period last year, an Asia Siyaka report said. The approximate FOB value per kg has declined 10 percent to Rs. 166.07 from Rs. 184.97, resulting in a decline in rupee earnings to Rs. 6.7 billion in 1998, the report said. The report raised concern over the volume of value added exports, which have dropped to 41 percent. Exports in this form peaked at 53.5 percent in 1996 and has been dropping since. Statistics upto the end of February 1999 reveal CIS as the largest importer of Sri Lankan tea. Sri Lanka exported a total of 6.9 million kgs of tea, a decline of 1.7 million kg (19.8 percent) against the same period last year, a Forbes and Walkers Report Said.

CSE changes front-end systemThe Colombo Stock Exchange (CSE) has changed the front-end system of the automatic trading system to make it more 'user friendly'. The automatic trading systems' front end is used to access daily market information like historical background, orders placed, days trading and to look at the depth of the order book. The CSE's surveillance department will now have access to market information with a 'touch of a button', without having to go through the hassles of accessing the central depository system, as it used to be done earlier, Lalin Paranavithana, CSE AGM IT said. The CSE will also be able to monitor limits imposed on brokers, he said. A few new things have been added at the stockbrokers end. For instance, a manager can control the limits set on his traders. Stockbrokers commented that the new additions were good, but it needed a lot of refinement. For instance, checking client orders takes time under the new changes. However, brokers were pleased that information like turnover, foreign buying/selling on particular stocks can be accessed at anytime. The new system was developed on Microsoft Visual C++ with the assistance of Millennium Information Systems. There have been a few 'minor hiccups' since it was introduced a fortnight ago, but nothing major yet, Mr. Paranavithana said.

US regulator finds some shipping lines guiltyBy Dinali GoonewardeneA US regulator has found a cartel of shipping lines guilty of malpractice including price fixing and authorised action, an exporters' association official said. Chairman Sri Lanka Shippers Council, Rohan de S Wijeyeratne, told The Sunday Times Business that US shipping regulator the Federal Maritime Commission was apprised of this situation by the Federation of ASEAN Shippers Council which complained that certain shipping lines under the umbrella of the Transpacific Stabilisation Agreement (TSA), a grouping of 13 shipping lines, have formed a cartel and are fixing freight rates. The economic crisis in ASEAN economies and a strong US dollar caused an unusually strong demand for the carriage of goods from the ASEAN region. As demand exceeded capacity, shipping lines operating this route experienced vessel space shortages and exploited this situation to increase revenue. Local shippers too were affected as freight rates in Sri Lanka increased by $1000 per 40 foot container from Colombo to the US. A further increase has been proposed for May this year. Members of the TSA include shipping lines SeaLand and APLNOL. The summary report released by the commission details instances of space discrimination against NVOCC cargo and arbitrary rate increases imposed on service contracts commencing in May 98. Documentation evidencing carriers refusals to carry cargo under existing contracts has been unearthed by the commission. Other possible malpractices in the report include the use of volume incentive programs which do not appear in the filed service contract, misrating of service contract bills of lading, coordination of the implementation of charges among carriers without a filed agreement, demand for payment (bribes?) for obtaining space which are not reflected in applicable bills of lading and 'creative pricing pending the effectiveness of rate increases. The report details carrier documents which indicate an auction like atmosphere including one which actually says 'box goes to the highest bidder'. The report concludes that evidence gathered in the investigation indicated that the carrier's ability to demand significantly higher rates was dependent on a comprehensive communication network under the TSA whereby any member proposing to change a rate will notify other members of the TSA through the secretariat with suggestions to members to 'follow suit:" Consequent enforcement action by the FMC involves practices prohibited by section 10 of the Shipping Act of 1984. Meanwhile the Exporters Association of Sri Lanka contacted the secretary to the president Mr Balapatabendi last week, expressing shock and disappointment that shipping lines only granted a freeze on the Terminal Handling Charge (THC) for one year as at 31, March '98, thus incorporating the rate increases in January, said Mr Wijeyeratne who is also a member of the Exporters Association of Sri Lanka. 'This enables shipping lines which did not increase their rates in January to do so and then freeze rates' he said. The Fair Trading Commission has already ruled that the payment of THC is an anti competitive practice which should be stopped. This has been interpreted by shipping lines as not being a mandatory charge but one which can be levied by carriers in a free market economyî said the head of the Sri Lanka Vessel Operators Association Jeremy Haycock. The Fair Trading Commission's decision has been appealed by shipping lines. The appeal is pending since April '98 and this is to the advantage of shipping lines which are levying the THC in the meantime' said Mr. De S Wijeyeratne. However Mr. Haycock claimed the port levies a tariff of which only 60% is borne as THC by shippers. 'In Sri Lanka the port tariff cannot be negotiated by individual shipping lines but the same tariff is levied from all shipping lines and the THC is therefore more transparent and justifiable in comparison to other parts of the worldî Mr Haycock said. The Fair Trading Commission has already ruled that the payment of THC is an anti- competitive practice which should be stopped. 'This has been interpreted by shipping lines as not being a mandatory charge but one which can be levied by carriers in a free market economy' said the head of the Sri Lanka Vessel Operators Association, Jeremy Haycock. The Fair Trading Commission's decision has been appealed by shipping lines. The appeal is pending since April '98 and this is to the advantage of shipping lines which are levying the THC in the meantime' said Mr. Wijeyeratne. However Mr. Haycock claimed the port levies a tariff of which only 60% is borne as THC by shippers. 'In Sri Lanka the port tariff cannot be negotiated by individual shipping lines but the same tariff is levied from all shipping lines and the THC is therefore more transparent and justifiable in comparison to other parts of the world, Mr Haycock said.

Cautious approach to structural changesThe structural changes in the economy in the las two decades have been both beneficial and costly. Agriculture, which was the predominant sector till the 1970s, became relatively less important in the 1980s and 1990s. Today agriculture contributes only about 18 per cent of the country's national product, while industry accounts for about 23 per cent. While this change in relative importance may be looked at as a sign of a transformation of the economy into a more developed one, it has also been owing to deficiencies in the economy's performance. A change in the relative importance of agriculture and industry owing to a rapid growth in the latter is a sign of dynamism and development. Yet part of the change in relative importance has been owing to the weak performance in agriculture and in some agricultural sub-sectors even a negative growth. Regrettably the new emphasis on industrial growth led to a neglect of our food crop cultivation. The mismanagement of the estates led to poor production on tea lands, in particular. The robust tea industry became a liability to the government. While in the case of tea, the privatization of the estates and the dynamic growth of small holdings led to significant gains in the last few years, no such improvements are seen in paddy cultivation. The cost-price squeeze in paddy cultivation is leading to lower production. Paddy cultivation is fast becoming economically non-viable and is being sustained by it becoming a part-time occupation. Paddy cultivation is also being continued owing to the compulsion arising out of not having alternate avenues of full employment for farmers. There is neither a clear-cut policy for the development of paddy and other food crops nor adequate support systems of credit, extension and marketing. The infrastructure for agriculture is exceedingly weak. Such a situation in food crops is further aggravated by uncertainties in trade policies and in particular the impending implementation of the Indo-Lanka Trade Agreement, SAPTA and SAFTA. The fundamental error is to think that the development of a sector implies the neglect of another. Agriculture requires to remain the backbone of our economy for the first few decades of the 21st century. This does not mean that we should not diversify our economy and expand our industrialization. In fact rapid industrialization is a must to increase our income levels and provide employment opportunities. But rapid industrialization does not mean a need to neglect agriculture. The country's economy would be more resilient and robust if it has a productive agriculture. While the agricultural output increases its relative importance could decline owing to an even more rapid growth in industry. Agriculture can still be a significant growth centre and source of employment generation. The need to diversify our industrial structure has been self-evident. The excessive dependence on garments could be precarious for several reasons. The international trading situation is changing and when the multi-fibre agreement lapses we may find ourselves in a weaker position in garment exports despite a notable diversification into non-quota items. The basic nature of the garment industry implies that other countries could enter the competition with advantages of lower costs, especially of labour. In fact this has been happening and the need is for us to be ready to shift our industrial enterprises to other more sophisticated industry. Such a transition in industrial structure is not a matter of wishful thinking. We have to develop a capacity to undertake such industry. Skill development at various levels of sophistication, management capabilities and economic infrastructure are pre-requisites to developing such a capacity. It is true that some of these skills are learnt by doing and the establishment of industry itself contributes to such development. Yet the development of the scientific and technological infrastructure is a much needed requirement. A fast track approach would be to induce Sri Lankan scientists and technologists abroad to return. But the overall social and economic conditions do not appear to be conducive to this. In fact the reverse is true, that scientifically qualified personnel are leaving the country for greener pastures abroad. The Brain Drain continues at tremendous cost to the country. While we must make every effort to transform our economy into one which produces much higher value added commodities, we must take the precaution of ensuring that we do not lose our competitive edge in those sections we currently have an advantage. It would be suicidal if our efforts to make the country a service hub leads us to a situation of neglect of what we presently produce and export. As we mentioned last week competitiveness in services require considerable improvements in skills and efficiency. We must recognize this and do the hard ground work to produce these capabilities. Meanwhile let us not neglect either our agriculture or export industry.

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|