Columns

Foreign debt repayment manageable, reserves adequate and economic recovery likely

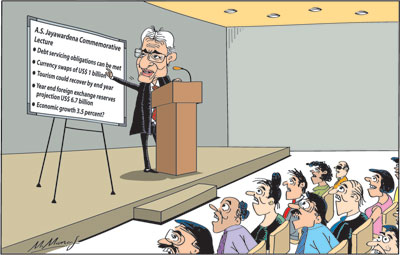

View(s): Delivering the A.S. Jayewardena Inaugural Commemorative lecture on May 24, the Central Bank’s Governor, Dr. Indrajit Coomaraswamy, explained that the country would be able to meet its foreign debt obligations this year and maintain the nation’s unblemished record of meeting debt repayment.

Delivering the A.S. Jayewardena Inaugural Commemorative lecture on May 24, the Central Bank’s Governor, Dr. Indrajit Coomaraswamy, explained that the country would be able to meet its foreign debt obligations this year and maintain the nation’s unblemished record of meeting debt repayment.

Currency swaps, international assistance and International Sovereign Bonds (ISBs), he said, would strengthen the reserves. In spite of lesser tourist earnings, lower foreign direct investment and some capital outflows, foreign reserves are projected to be US$ 6.7 billion at year’s end.

Confident

The Governor was confident that the economy could recover in spite of the April 21 terror attacks and their aftermath, as the production capacity of the country is intact. However, achieving the targeted 3.5 percent growth remains a challenging task.

Governor Jayawardena

The lecture was held at the auditorium of the Central Bank’s Centre for Banking Studies (CBS).

Dr. Coomaraswamy said Governor A.S. Jayawardena, the 10th Governor of the Central Bank, played a pivotal role in the development of the Central Bank, monetary policy and in many facets of the country’s economic development. Governor Jayawardena, he said, had an unpatrolled career in banking and economic affairs of the country.

Macroeconomic fundamentals

Dr. Coomaraswamy gave a detailed analysis of the evolution of the country’s economic problems and focused on the current state of external finances. He explained how the twin deficits—the fiscal and trade deficits—evolved over time.

The persistent fiscal deficits over the years had resulted in debt servicing absorbing above 90 percent of revenue in most years. In 2018, it absorbed as much as 108 percent of government revenue. This fundamental macroeconomic weakness has retarded the country’s economic development. The Governor outlined some of the policy measures that are being contemplated to ensure fiscal consolidation.

Trade deficit

Trade deficit

Dr. Coomaraswamy explained how trade deficits had widened owing to adverse terms of trade in the past and inadequate exports. Exports that were around 20 percent of GDP had declined to 12.5 percent of GDP. Imports, on the other hand, had increased. The continuous large trade deficits had eroded the foreign reserves and increased foreign debt.

Debt repayment

Even before the Easter Sunday bomb blasts on April 21st, there was some anxiety about the country’s capacity to meet its debt obligations. This was due to it being as much as US$ 5 billion, the low reserves and an inadequate balance of payments surplus to replenish the foreign reserves.

Dr. Coomaraswamy explained in detail how the country would be able to meet its debt obligations this year and maintain the nation’s unblemished record of meeting its debt obligations.

Current status

Governor Coomaraswamy gave a detailed analysis of the country’s current position of the external finances. He explained that this year’s foreign debt obligations had been reduced from US$ 5 billion to US$ 3 billion. Foreign reserves have also been strengthened by international Sovereign Bonds, capital inflows and three currency swap arrangements with India, China and Qatar that together amounted to about US$ 1 billion.

He said that there are other accommodations by the World Bank and friendly countries that would strengthen the reserves and assured that the government could meet its large foreign debt obligations this year and have a comfortable, though not a “wonderful”, foreign reserve of US$ 6.7 billion at the end of the year.

Economic growth

Turning to the country’s economic performance this year, Dr. Coomaraswamy said, the economy could recover during this year, provided there were no further setbacks. He said only one or two industrial establishments have been affected and the production capacity of the economy was largely unaffected.

Tourism

Dr. Coomaraswamy said the April bomb blasts and the subsequent violence were a setback to the economy. Undoubtedly, the most serious impact was on the booming tourism that was expected to earn US$ 5 billion and strengthen the balance of payments. This target, Dr. Coomaraswamy admitted is not likely to be achieved. However, if there is a restoration of normalcy, tourism may recover to some extent at the next tourist season starting in November.

Nevertheless, he pointed out, that the net loss from tourism was much less, as tourist expenditure had a high import content of about 30 percent. However the drop in tourism is affecting the employment and incomes of many linked to tourism.

Tourism and those activities linked to tourism could recover by the end of the year when the next tourist season begins. By then foreign country travel advisories could be lifted and the country would be considered safe provided there are no new occurrences of violence. Tourist earnings of about US$ 3.5 billion may be possible.

Financial market

Dr. Coomaraswamy said that unlike last year’s global financial developments that led to serious difficulties, the terrorist attacks did not result in significant capital outflows or an appreciable increase in international interest rates. The decline in fuel prices is also a benefit to the balance of payments.

Expectations

All things considered, Dr. Coomaraswamy expects the country’s foreign reserves to be around US$ 7.2 billion at the end of the year. While this, he said, was not a wonderful position, it is a comfortable one. The IMF and the Central Bank are not changing their growth forecast of 3.5 and 4 percent, respectively. The return to normalcy is vital to achieve these targets.

Concluding reflection

Dr. Coomaraswamy was reassuring and convincing as they were data based and rational expectations. As he said, much of the remaining month’s economic performance depends on the return to normalcy and there being no communal backlashes. This year being an election year is not conducive to the adoption of sound economic policies for economic stability, growth and development.

Although the country may be able to meet its debt obligations this year, the external finances are a serious weakness. The foreign debt at around US$ 53 billion is over 50 percent of GDP. This is much above the threshold of external debt for an economy of Sri Lanka’s size. Furthermore, foreign debt repayment absorbs nearly a third of the country’s merchandise exports and the country is continuing to borrow to repay debt and foreign debt liability is increasing. The only way the country could come out of this predicament is to generate a larger balance of payments surplus by increasing exports, reducing non-essential imports and increasing earnings from tourism, ICT and other services.

Is the country resolved to ensure that the economy recovers or will we continue to be preoccupied with party politics and communal issues?

Leave a Reply

Post Comment